Zweig DiMenna Associates LLC purchased a new stake in shares of SentinelOne, Inc. (NYSE:S - Free Report) in the third quarter, according to its most recent disclosure with the SEC. The firm purchased 160,000 shares of the company's stock, valued at approximately $3,827,000. Zweig DiMenna Associates LLC owned approximately 0.05% of SentinelOne at the end of the most recent quarter.

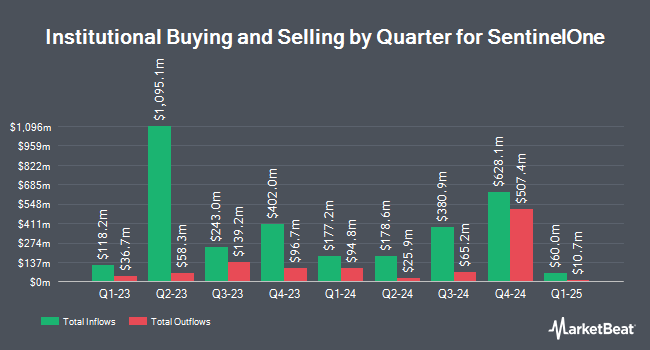

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Waldron Private Wealth LLC acquired a new stake in shares of SentinelOne in the 3rd quarter valued at about $26,000. Blue Trust Inc. bought a new position in SentinelOne during the 2nd quarter worth approximately $27,000. Allspring Global Investments Holdings LLC grew its position in shares of SentinelOne by 49.1% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 1,318 shares of the company's stock worth $28,000 after acquiring an additional 434 shares in the last quarter. Sugarloaf Wealth Management LLC increased its holdings in shares of SentinelOne by 56.0% in the 2nd quarter. Sugarloaf Wealth Management LLC now owns 1,950 shares of the company's stock valued at $41,000 after acquiring an additional 700 shares during the last quarter. Finally, Unique Wealth Strategies LLC acquired a new stake in shares of SentinelOne during the 2nd quarter valued at approximately $49,000. Hedge funds and other institutional investors own 90.87% of the company's stock.

Insider Buying and Selling

In related news, CEO Tomer Weingarten sold 60,864 shares of the company's stock in a transaction on Wednesday, October 9th. The shares were sold at an average price of $25.30, for a total transaction of $1,539,859.20. Following the completion of the sale, the chief executive officer now directly owns 1,039,497 shares of the company's stock, valued at approximately $26,299,274.10. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In related news, CEO Tomer Weingarten sold 60,864 shares of the stock in a transaction that occurred on Wednesday, October 9th. The stock was sold at an average price of $25.30, for a total transaction of $1,539,859.20. Following the completion of the sale, the chief executive officer now owns 1,039,497 shares in the company, valued at $26,299,274.10. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CAO Robin Tomasello sold 5,022 shares of SentinelOne stock in a transaction that occurred on Friday, September 6th. The stock was sold at an average price of $22.80, for a total value of $114,501.60. Following the completion of the transaction, the chief accounting officer now directly owns 193,542 shares in the company, valued at approximately $4,412,757.60. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 475,267 shares of company stock worth $10,691,681. 5.60% of the stock is currently owned by insiders.

SentinelOne Stock Up 1.2 %

Shares of SentinelOne stock traded up $0.30 on Friday, hitting $26.27. 3,108,288 shares of the company traded hands, compared to its average volume of 5,332,551. SentinelOne, Inc. has a 12-month low of $14.33 and a 12-month high of $30.76. The company has a 50-day moving average price of $24.21 and a 200 day moving average price of $21.95. The company has a market cap of $8.33 billion, a PE ratio of -27.92 and a beta of 0.67.

SentinelOne (NYSE:S - Get Free Report) last released its quarterly earnings data on Tuesday, August 27th. The company reported $0.01 EPS for the quarter. The firm had revenue of $198.94 million for the quarter, compared to the consensus estimate of $197.32 million. SentinelOne had a negative return on equity of 15.42% and a negative net margin of 38.91%. The firm's revenue was up 33.1% on a year-over-year basis. During the same quarter in the prior year, the company posted ($0.26) earnings per share. Equities research analysts anticipate that SentinelOne, Inc. will post -0.73 EPS for the current year.

Wall Street Analysts Forecast Growth

S has been the topic of a number of recent research reports. Citigroup raised their target price on shares of SentinelOne from $20.00 to $25.00 and gave the stock a "neutral" rating in a report on Wednesday, August 28th. Scotiabank boosted their price target on shares of SentinelOne from $18.00 to $25.00 and gave the company a "sector perform" rating in a report on Wednesday, August 28th. JMP Securities restated a "market outperform" rating and issued a $33.00 price target on shares of SentinelOne in a research note on Wednesday, August 28th. Robert W. Baird boosted their price target on SentinelOne from $29.00 to $30.00 and gave the stock an "outperform" rating in a research report on Friday, October 18th. Finally, Sanford C. Bernstein lowered their price target on SentinelOne from $37.00 to $32.00 and set an "outperform" rating on the stock in a report on Wednesday, August 28th. One analyst has rated the stock with a sell rating, five have assigned a hold rating, eighteen have assigned a buy rating and three have issued a strong buy rating to the company's stock. According to MarketBeat.com, SentinelOne has an average rating of "Moderate Buy" and a consensus target price of $28.60.

Check Out Our Latest Report on S

SentinelOne Profile

(

Free Report)

SentinelOne, Inc operates as a cybersecurity provider in the United States and internationally. Its Singularity Platform delivers an artificial intelligence-powered autonomous threat prevention, detection, and response capabilities across an organization's endpoints, cloud workloads, and identify credentials, which enables seamless and autonomous protection against a spectrum of cyber threats.

Recommended Stories

Before you consider SentinelOne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SentinelOne wasn't on the list.

While SentinelOne currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.