Boston Beer (NYSE:SAM - Get Free Report)'s stock had its "buy" rating restated by equities researchers at Roth Mkm in a research note issued on Wednesday, Benzinga reports. They currently have a $389.00 target price on the stock. Roth Mkm's price target indicates a potential upside of 29.03% from the company's current price.

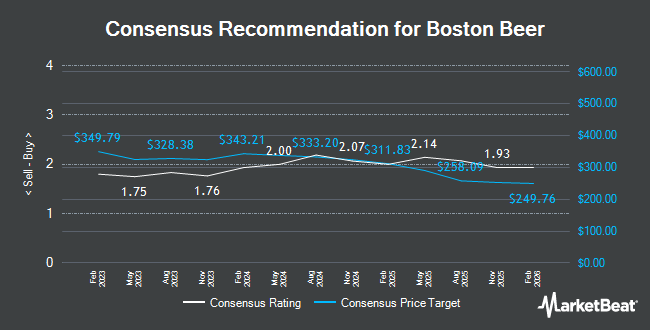

SAM has been the subject of a number of other research reports. Deutsche Bank Aktiengesellschaft boosted their price target on Boston Beer from $273.00 to $283.00 and gave the company a "hold" rating in a research report on Wednesday, July 17th. Piper Sandler lowered their price target on Boston Beer from $344.00 to $325.00 and set an "overweight" rating for the company in a research report on Friday, July 26th. Finally, Royal Bank of Canada lowered their price target on Boston Beer from $332.00 to $318.00 and set a "sector perform" rating for the company in a research report on Friday, July 26th. One analyst has rated the stock with a sell rating, nine have assigned a hold rating and three have given a buy rating to the company. According to MarketBeat, Boston Beer presently has a consensus rating of "Hold" and a consensus target price of $326.92.

Get Our Latest Stock Report on SAM

Boston Beer Stock Up 2.0 %

Shares of NYSE:SAM traded up $5.86 during midday trading on Wednesday, reaching $301.47. The company's stock had a trading volume of 114,649 shares, compared to its average volume of 158,969. The firm has a market cap of $3.60 billion, a price-to-earnings ratio of 37.34, a price-to-earnings-growth ratio of 1.22 and a beta of 1.06. Boston Beer has a 1 year low of $254.40 and a 1 year high of $378.08. The business has a 50 day moving average price of $278.44 and a 200 day moving average price of $282.03.

Boston Beer (NYSE:SAM - Get Free Report) last announced its quarterly earnings data on Thursday, July 25th. The company reported $4.39 EPS for the quarter, missing analysts' consensus estimates of $4.99 by ($0.60). The business had revenue of $579.10 million during the quarter, compared to analysts' expectations of $597.33 million. Boston Beer had a net margin of 4.39% and a return on equity of 9.69%. Boston Beer's revenue for the quarter was down 4.0% on a year-over-year basis. During the same period in the prior year, the firm earned $4.72 EPS. Sell-side analysts anticipate that Boston Beer will post 9.63 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Institutional investors have recently modified their holdings of the business. Los Angeles Capital Management LLC raised its stake in Boston Beer by 0.5% during the second quarter. Los Angeles Capital Management LLC now owns 14,729 shares of the company's stock valued at $4,493,000 after buying an additional 74 shares in the last quarter. Gagnon Securities LLC raised its stake in Boston Beer by 0.5% during the first quarter. Gagnon Securities LLC now owns 16,893 shares of the company's stock valued at $5,143,000 after buying an additional 80 shares in the last quarter. QV Investors Inc. raised its stake in Boston Beer by 0.4% during the third quarter. QV Investors Inc. now owns 20,650 shares of the company's stock valued at $5,971,000 after buying an additional 80 shares in the last quarter. DekaBank Deutsche Girozentrale raised its stake in Boston Beer by 61.3% during the second quarter. DekaBank Deutsche Girozentrale now owns 250 shares of the company's stock valued at $75,000 after buying an additional 95 shares in the last quarter. Finally, LRI Investments LLC acquired a new stake in Boston Beer during the first quarter valued at approximately $28,000. Institutional investors and hedge funds own 81.13% of the company's stock.

About Boston Beer

(

Get Free Report)

The Boston Beer Company, Inc produces and sells alcohol beverages primarily in the United States. The company's flagship beer is Samuel Adams Boston Lager. It offers various beers, hard ciders, flavored malt beverages, and hard seltzers under the Samuel Adams, Twisted Tea, Truly, Angry Orchard, Dogfish Head, Angel City, and Coney Island brand names.

Further Reading

Before you consider Boston Beer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Beer wasn't on the list.

While Boston Beer currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.