Claro Advisors LLC bought a new position in shares of The Boston Beer Company, Inc. (NYSE:SAM - Free Report) during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 6,095 shares of the company's stock, valued at approximately $1,762,000. Claro Advisors LLC owned 0.05% of Boston Beer as of its most recent filing with the Securities and Exchange Commission (SEC).

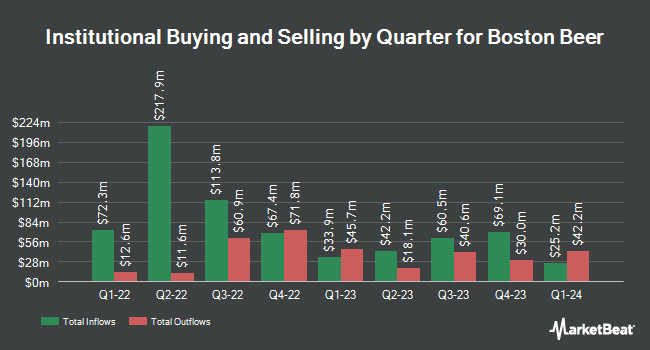

Other hedge funds have also recently added to or reduced their stakes in the company. LRI Investments LLC purchased a new stake in Boston Beer during the 1st quarter worth about $28,000. Seven Eight Capital LP boosted its holdings in Boston Beer by 160.0% in the first quarter. Seven Eight Capital LP now owns 4,940 shares of the company's stock valued at $1,504,000 after purchasing an additional 3,040 shares in the last quarter. Natixis purchased a new position in Boston Beer in the first quarter valued at approximately $3,044,000. Gamco Investors INC. ET AL raised its holdings in Boston Beer by 16.9% during the first quarter. Gamco Investors INC. ET AL now owns 13,333 shares of the company's stock worth $4,059,000 after purchasing an additional 1,925 shares in the last quarter. Finally, Vanguard Group Inc. lifted its position in shares of Boston Beer by 2.3% during the 4th quarter. Vanguard Group Inc. now owns 918,502 shares of the company's stock worth $317,425,000 after buying an additional 21,060 shares during the last quarter. Institutional investors and hedge funds own 81.13% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have issued reports on the stock. Deutsche Bank Aktiengesellschaft upped their price objective on shares of Boston Beer from $273.00 to $283.00 and gave the company a "hold" rating in a research note on Wednesday, July 17th. Piper Sandler dropped their price target on Boston Beer from $344.00 to $325.00 and set an "overweight" rating on the stock in a research note on Friday, July 26th. Royal Bank of Canada cut their price target on Boston Beer from $332.00 to $318.00 and set a "sector perform" rating on the stock in a research report on Friday, July 26th. Finally, Roth Mkm decreased their price objective on Boston Beer from $395.00 to $389.00 and set a "buy" rating for the company in a report on Friday, July 26th. One research analyst has rated the stock with a sell rating, nine have assigned a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $326.92.

Read Our Latest Research Report on SAM

Boston Beer Trading Up 1.7 %

Shares of NYSE:SAM traded up $4.91 during midday trading on Friday, hitting $298.81. The stock had a trading volume of 188,328 shares, compared to its average volume of 159,581. The company has a market capitalization of $3.57 billion, a PE ratio of 37.49, a P/E/G ratio of 1.12 and a beta of 1.06. The Boston Beer Company, Inc. has a 1 year low of $254.40 and a 1 year high of $378.08. The stock has a 50 day moving average price of $277.42 and a two-hundred day moving average price of $282.14.

Boston Beer (NYSE:SAM - Get Free Report) last released its earnings results on Thursday, July 25th. The company reported $4.39 earnings per share (EPS) for the quarter, missing the consensus estimate of $4.99 by ($0.60). The business had revenue of $579.10 million for the quarter, compared to analyst estimates of $597.33 million. Boston Beer had a return on equity of 9.69% and a net margin of 4.39%. The business's revenue for the quarter was down 4.0% on a year-over-year basis. During the same quarter in the previous year, the firm posted $4.72 EPS. As a group, equities analysts expect that The Boston Beer Company, Inc. will post 9.65 EPS for the current year.

Boston Beer Profile

(

Free Report)

The Boston Beer Company, Inc produces and sells alcohol beverages primarily in the United States. The company's flagship beer is Samuel Adams Boston Lager. It offers various beers, hard ciders, flavored malt beverages, and hard seltzers under the Samuel Adams, Twisted Tea, Truly, Angry Orchard, Dogfish Head, Angel City, and Coney Island brand names.

Recommended Stories

Before you consider Boston Beer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Beer wasn't on the list.

While Boston Beer currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.