Pallas Capital Advisors LLC grew its position in The Boston Beer Company, Inc. (NYSE:SAM - Free Report) by 323.5% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 3,261 shares of the company's stock after buying an additional 2,491 shares during the quarter. Pallas Capital Advisors LLC's holdings in Boston Beer were worth $984,000 at the end of the most recent quarter.

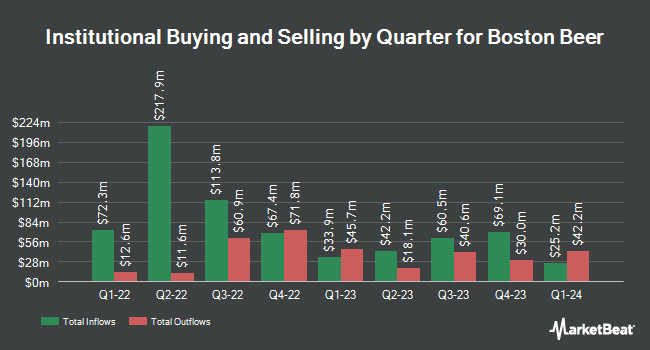

A number of other hedge funds have also made changes to their positions in SAM. Wealth Enhancement Advisory Services LLC increased its position in Boston Beer by 389.2% during the 3rd quarter. Wealth Enhancement Advisory Services LLC now owns 5,714 shares of the company's stock worth $1,652,000 after purchasing an additional 4,546 shares in the last quarter. International Assets Investment Management LLC purchased a new stake in Boston Beer in the 3rd quarter valued at about $45,150,000. Aaron Wealth Advisors LLC purchased a new stake in Boston Beer in the 3rd quarter valued at about $329,000. Claro Advisors LLC acquired a new position in shares of Boston Beer in the 3rd quarter valued at about $1,762,000. Finally, Cardinal Capital Management lifted its stake in shares of Boston Beer by 17.5% in the 3rd quarter. Cardinal Capital Management now owns 5,719 shares of the company's stock valued at $1,654,000 after purchasing an additional 850 shares in the last quarter. Hedge funds and other institutional investors own 81.13% of the company's stock.

Boston Beer Stock Up 0.2 %

SAM traded up $0.74 during trading on Wednesday, reaching $299.52. 104,467 shares of the company were exchanged, compared to its average volume of 159,533. The Boston Beer Company, Inc. has a 12-month low of $254.40 and a 12-month high of $371.65. The company has a market cap of $3.51 billion, a price-to-earnings ratio of 44.05, a P/E/G ratio of 1.24 and a beta of 1.06. The company's 50-day moving average is $280.91 and its two-hundred day moving average is $282.49.

Wall Street Analysts Forecast Growth

Several equities analysts recently commented on the company. Royal Bank of Canada reissued a "sector perform" rating and set a $318.00 price target on shares of Boston Beer in a research report on Friday, October 25th. Piper Sandler boosted their price target on Boston Beer from $325.00 to $330.00 and gave the company an "overweight" rating in a report on Friday, October 25th. Jefferies Financial Group downgraded Boston Beer from a "buy" rating to a "hold" rating and lowered their price objective for the stock from $355.00 to $325.00 in a research note on Friday, October 25th. Roth Mkm restated a "buy" rating and set a $389.00 price objective on shares of Boston Beer in a research note on Wednesday, October 23rd. Finally, Deutsche Bank Aktiengesellschaft reduced their price target on Boston Beer from $281.00 to $277.00 and set a "hold" rating for the company in a research report on Thursday, October 24th. One analyst has rated the stock with a sell rating, nine have assigned a hold rating and two have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus price target of $314.82.

Read Our Latest Stock Report on Boston Beer

Boston Beer Profile

(

Free Report)

The Boston Beer Company, Inc produces and sells alcohol beverages primarily in the United States. The company's flagship beer is Samuel Adams Boston Lager. It offers various beers, hard ciders, flavored malt beverages, and hard seltzers under the Samuel Adams, Twisted Tea, Truly, Angry Orchard, Dogfish Head, Angel City, and Coney Island brand names.

Read More

Before you consider Boston Beer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Beer wasn't on the list.

While Boston Beer currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.