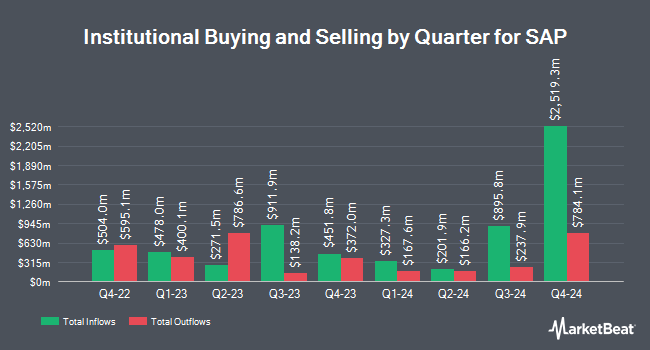

China Universal Asset Management Co. Ltd. purchased a new stake in shares of SAP SE (NYSE:SAP - Free Report) during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund purchased 16,500 shares of the software maker's stock, valued at approximately $3,780,000.

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Westfield Capital Management Co. LP purchased a new stake in SAP during the 1st quarter valued at about $58,936,000. International Assets Investment Management LLC purchased a new stake in shares of SAP during the third quarter valued at approximately $40,573,000. Marshall Wace LLP bought a new stake in shares of SAP during the second quarter valued at approximately $21,479,000. Hantz Financial Services Inc. purchased a new position in SAP in the 2nd quarter worth approximately $20,532,000. Finally, GQG Partners LLC bought a new position in SAP in the 1st quarter valued at approximately $14,940,000.

SAP Price Performance

Shares of SAP stock traded up $1.93 during trading on Tuesday, reaching $242.21. 801,815 shares of the stock traded hands, compared to its average volume of 796,889. The company has a market capitalization of $297.55 billion, a price-to-earnings ratio of 96.13, a P/E/G ratio of 4.54 and a beta of 1.25. SAP SE has a 52-week low of $132.33 and a 52-week high of $243.01. The business has a fifty day simple moving average of $224.04 and a two-hundred day simple moving average of $205.47. The company has a debt-to-equity ratio of 0.17, a current ratio of 1.10 and a quick ratio of 1.10.

SAP (NYSE:SAP - Get Free Report) last released its quarterly earnings results on Monday, October 21st. The software maker reported $1.23 EPS for the quarter, missing analysts' consensus estimates of $1.31 by ($0.08). The firm had revenue of $8.47 billion for the quarter, compared to analysts' expectations of $9.25 billion. SAP had a return on equity of 11.44% and a net margin of 8.15%. SAP's revenue for the quarter was up 9.4% on a year-over-year basis. During the same period in the prior year, the firm posted $1.20 earnings per share. Sell-side analysts expect that SAP SE will post 4.9 EPS for the current year.

Wall Street Analyst Weigh In

Several research analysts have recently weighed in on the company. Argus upgraded SAP from a "hold" rating to a "buy" rating in a research note on Wednesday, July 31st. TD Cowen boosted their target price on SAP from $234.00 to $240.00 and gave the stock a "hold" rating in a research report on Tuesday, October 22nd. JMP Securities upped their target price on shares of SAP from $245.00 to $300.00 and gave the company a "market outperform" rating in a research note on Tuesday, October 22nd. BMO Capital Markets boosted their target price on shares of SAP from $248.00 to $265.00 and gave the company an "outperform" rating in a research note on Tuesday, October 22nd. Finally, Barclays increased their price objective on shares of SAP from $252.00 to $275.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 23rd. One analyst has rated the stock with a hold rating and nine have given a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $252.33.

Get Our Latest Stock Report on SAP

SAP Company Profile

(

Free Report)

SAP SE, together with its subsidiaries, provides applications, technology, and services worldwide. It offers SAP S/4HANA that provides software capabilities for finance, risk and project management, procurement, manufacturing, supply chain and asset management, and research and development; SAP SuccessFactors solutions for human resources, including HR and payroll, talent and employee experience management, and people and workforce analytics; and spend management solutions that covers direct and indirect spend, travel and expense, and external workforce management.

Featured Stories

Before you consider SAP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SAP wasn't on the list.

While SAP currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.