IFM Investors Pty Ltd lifted its holdings in shares of Southern Copper Co. (NYSE:SCCO - Free Report) by 100.4% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 11,468 shares of the basic materials company's stock after buying an additional 5,746 shares during the quarter. IFM Investors Pty Ltd's holdings in Southern Copper were worth $1,327,000 as of its most recent SEC filing.

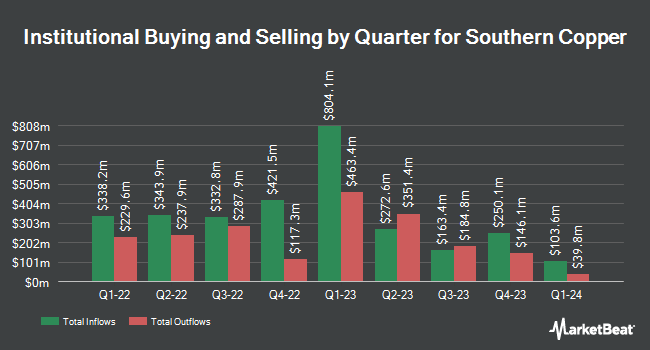

A number of other hedge funds and other institutional investors have also recently made changes to their positions in the business. Capital World Investors purchased a new stake in Southern Copper during the 1st quarter worth approximately $340,373,000. Price T Rowe Associates Inc. MD raised its stake in Southern Copper by 18.1% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 7,771,332 shares of the basic materials company's stock valued at $827,804,000 after purchasing an additional 1,192,111 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. lifted its holdings in Southern Copper by 54.6% in the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,541,396 shares of the basic materials company's stock valued at $164,190,000 after purchasing an additional 544,312 shares in the last quarter. Los Angeles Capital Management LLC boosted its stake in Southern Copper by 1,300.4% during the 2nd quarter. Los Angeles Capital Management LLC now owns 443,285 shares of the basic materials company's stock worth $47,760,000 after purchasing an additional 411,630 shares during the last quarter. Finally, Lord Abbett & CO. LLC purchased a new stake in shares of Southern Copper during the first quarter worth $27,163,000. Hedge funds and other institutional investors own 7.94% of the company's stock.

Southern Copper Stock Down 0.6 %

Shares of NYSE:SCCO traded down $0.64 on Monday, hitting $114.77. 768,855 shares of the company's stock were exchanged, compared to its average volume of 1,162,364. The company has a debt-to-equity ratio of 0.67, a quick ratio of 2.27 and a current ratio of 2.81. Southern Copper Co. has a 1-year low of $68.93 and a 1-year high of $129.79. The company has a market capitalization of $89.65 billion, a PE ratio of 29.53, a P/E/G ratio of 1.18 and a beta of 1.18. The firm's 50-day moving average is $107.62 and its 200 day moving average is $110.11.

Southern Copper Announces Dividend

The company also recently disclosed a -- dividend, which will be paid on Thursday, November 21st. Stockholders of record on Wednesday, November 6th will be issued a $0.62 dividend. This represents a dividend yield of 2.1%. The ex-dividend date of this dividend is Wednesday, November 6th. Southern Copper's payout ratio is currently 61.79%.

Wall Street Analysts Forecast Growth

SCCO has been the subject of a number of analyst reports. Morgan Stanley upped their price target on Southern Copper from $97.00 to $100.00 and gave the company an "underweight" rating in a research report on Thursday, September 19th. Scotiabank dropped their target price on Southern Copper from $54.00 to $52.00 and set a "sector underperform" rating for the company in a report on Tuesday, October 15th. Citigroup lifted their price target on Southern Copper from $99.44 to $100.00 and gave the stock a "sell" rating in a report on Wednesday, October 2nd. Finally, UBS Group began coverage on shares of Southern Copper in a report on Friday, July 12th. They issued a "neutral" rating and a $120.00 price objective for the company. Six equities research analysts have rated the stock with a sell rating, one has assigned a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat.com, Southern Copper currently has a consensus rating of "Hold" and an average price target of $90.63.

Get Our Latest Report on SCCO

Southern Copper Profile

(

Free Report)

Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile. The company is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates; smelting of copper concentrates to produce blister and anode copper; refining of anode copper to produce copper cathodes; production of molybdenum concentrate and sulfuric acid; production of refined silver, gold, and other materials; and mining and processing of zinc, copper, molybdenum, silver, gold, and lead.

Read More

Before you consider Southern Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southern Copper wasn't on the list.

While Southern Copper currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.