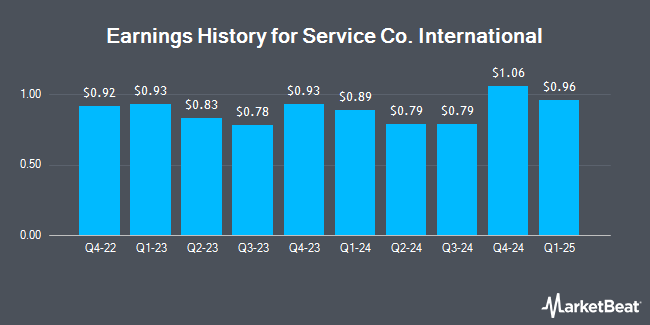

Service Co. International (NYSE:SCI - Get Free Report) will announce its earnings results after the market closes on Wednesday, October 30th. Analysts expect Service Co. International to post earnings of $0.79 per share for the quarter. Service Co. International has set its FY24 guidance at $3.50-3.80 EPS and its FY 2024 guidance at 3.500-3.500 EPS.Parties interested in participating in the company's conference call can do so using this link.

Service Co. International (NYSE:SCI - Get Free Report) last announced its earnings results on Wednesday, July 31st. The company reported $0.79 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.86 by ($0.07). Service Co. International had a net margin of 12.32% and a return on equity of 32.07%. The business had revenue of $1.03 billion for the quarter, compared to analysts' expectations of $1.03 billion. During the same quarter in the prior year, the company posted $0.83 earnings per share. The firm's quarterly revenue was up 2.0% compared to the same quarter last year. On average, analysts expect Service Co. International to post $4 EPS for the current fiscal year and $4 EPS for the next fiscal year.

Service Co. International Trading Up 1.1 %

NYSE SCI traded up $0.82 during trading hours on Wednesday, hitting $76.76. 679,180 shares of the company were exchanged, compared to its average volume of 898,380. Service Co. International has a 52 week low of $52.89 and a 52 week high of $81.32. The company has a quick ratio of 0.51, a current ratio of 0.55 and a debt-to-equity ratio of 3.05. The stock has a 50-day moving average price of $77.44 and a 200 day moving average price of $73.80. The stock has a market cap of $11.08 billion, a PE ratio of 22.38, a price-to-earnings-growth ratio of 2.18 and a beta of 0.84.

Service Co. International Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Monday, September 30th. Investors of record on Friday, September 13th were issued a dividend of $0.30 per share. The ex-dividend date was Friday, September 13th. This represents a $1.20 annualized dividend and a yield of 1.56%. Service Co. International's payout ratio is presently 34.99%.

Insider Activity

In related news, CEO Thomas L. Ryan sold 80,638 shares of Service Co. International stock in a transaction dated Wednesday, August 7th. The shares were sold at an average price of $73.97, for a total transaction of $5,964,792.86. Following the completion of the sale, the chief executive officer now owns 988,365 shares in the company, valued at $73,109,359.05. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. In other Service Co. International news, CEO Thomas L. Ryan sold 80,638 shares of Service Co. International stock in a transaction on Wednesday, August 7th. The stock was sold at an average price of $73.97, for a total transaction of $5,964,792.86. Following the completion of the sale, the chief executive officer now directly owns 988,365 shares of the company's stock, valued at $73,109,359.05. The trade was a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Ellen Ochoa sold 2,642 shares of the company's stock in a transaction on Thursday, August 22nd. The stock was sold at an average price of $76.41, for a total value of $201,875.22. The disclosure for this sale can be found here. Insiders own 5.10% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, StockNews.com downgraded shares of Service Co. International from a "hold" rating to a "sell" rating in a research note on Thursday, August 1st.

Read Our Latest Analysis on SCI

Service Co. International Company Profile

(

Get Free Report)

Service Corporation International provides deathcare products and services in the United States and Canada. Its funeral service and cemetery operations comprise funeral service locations, cemeteries, funeral service/cemetery combination locations, crematoria, and other businesses. The company also provides professional services related to funerals and cremations, including the use of funeral home facilities and motor vehicles; arranging and directing services; and removal, preparation, embalming, cremation, memorialization, and travel protection, as well as catering services.

Featured Articles

Before you consider Service Co. International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Service Co. International wasn't on the list.

While Service Co. International currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.