Cornerstone Capital Inc. lowered its stake in shares of Shake Shack Inc. (NYSE:SHAK - Free Report) by 19.5% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 188,627 shares of the company's stock after selling 45,835 shares during the quarter. Shake Shack comprises approximately 1.8% of Cornerstone Capital Inc.'s holdings, making the stock its 24th largest holding. Cornerstone Capital Inc. owned 0.45% of Shake Shack worth $19,468,000 as of its most recent SEC filing.

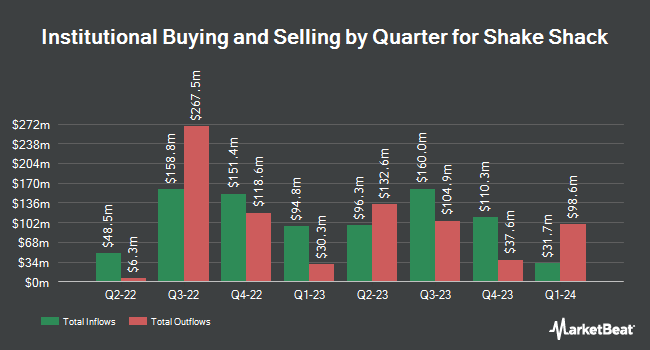

Several other large investors have also recently bought and sold shares of SHAK. Allspring Global Investments Holdings LLC acquired a new stake in shares of Shake Shack during the 1st quarter worth approximately $25,000. Commonwealth Equity Services LLC increased its holdings in Shake Shack by 71.1% in the 1st quarter. Commonwealth Equity Services LLC now owns 7,973 shares of the company's stock valued at $829,000 after buying an additional 3,313 shares during the period. BNP Paribas Financial Markets increased its holdings in Shake Shack by 7.8% in the 1st quarter. BNP Paribas Financial Markets now owns 41,487 shares of the company's stock valued at $4,316,000 after buying an additional 2,996 shares during the period. Janney Montgomery Scott LLC bought a new position in shares of Shake Shack during the 1st quarter worth about $853,000. Finally, Jennison Associates LLC bought a new position in shares of Shake Shack during the 1st quarter worth about $16,365,000. 86.07% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In related news, Director Daniel Harris Meyer sold 22,691 shares of the firm's stock in a transaction dated Wednesday, October 30th. The shares were sold at an average price of $124.47, for a total value of $2,824,348.77. Following the completion of the sale, the director now directly owns 437,646 shares in the company, valued at approximately $54,473,797.62. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. In other news, CFO Katherine Irene Fogertey sold 321 shares of the business's stock in a transaction dated Wednesday, September 4th. The shares were sold at an average price of $98.57, for a total value of $31,640.97. Following the completion of the sale, the chief financial officer now owns 36,822 shares of the company's stock, valued at approximately $3,629,544.54. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Daniel Harris Meyer sold 22,691 shares of the firm's stock in a transaction dated Wednesday, October 30th. The stock was sold at an average price of $124.47, for a total transaction of $2,824,348.77. Following the transaction, the director now directly owns 437,646 shares in the company, valued at approximately $54,473,797.62. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders sold 43,433 shares of company stock valued at $5,103,556. 9.73% of the stock is owned by insiders.

Shake Shack Stock Up 2.6 %

NYSE SHAK traded up $3.26 on Tuesday, reaching $126.82. The company had a trading volume of 899,222 shares, compared to its average volume of 943,579. The company's fifty day moving average is $106.49 and its 200-day moving average is $99.08. The firm has a market capitalization of $5.39 billion, a price-to-earnings ratio of 744.47, a price-to-earnings-growth ratio of 3.35 and a beta of 1.81. The company has a debt-to-equity ratio of 0.51, a quick ratio of 1.98 and a current ratio of 2.01. Shake Shack Inc. has a 1-year low of $54.06 and a 1-year high of $130.20.

Shake Shack (NYSE:SHAK - Get Free Report) last issued its quarterly earnings results on Wednesday, October 30th. The company reported $0.25 earnings per share for the quarter, topping the consensus estimate of $0.20 by $0.05. The company had revenue of $316.92 million during the quarter, compared to analysts' expectations of $316.03 million. Shake Shack had a net margin of 0.68% and a return on equity of 6.28%. The business's quarterly revenue was up 14.7% on a year-over-year basis. During the same period last year, the business earned $0.17 EPS. On average, research analysts forecast that Shake Shack Inc. will post 0.8 earnings per share for the current fiscal year.

Analysts Set New Price Targets

SHAK has been the topic of a number of analyst reports. Barclays upped their price target on Shake Shack from $115.00 to $125.00 and gave the company an "equal weight" rating in a research report on Thursday, October 31st. Truist Financial increased their target price on shares of Shake Shack from $127.00 to $144.00 and gave the stock a "buy" rating in a research report on Friday. Bank of America boosted their price target on shares of Shake Shack from $104.00 to $116.00 and gave the company a "neutral" rating in a research report on Monday, August 19th. Morgan Stanley dropped their price objective on shares of Shake Shack from $108.00 to $100.00 and set an "equal weight" rating for the company in a report on Tuesday, July 16th. Finally, Oppenheimer increased their price target on Shake Shack from $122.00 to $135.00 and gave the stock an "outperform" rating in a research report on Monday, October 28th. Two equities research analysts have rated the stock with a sell rating, ten have issued a hold rating, six have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Hold" and a consensus target price of $110.00.

Check Out Our Latest Report on Shake Shack

Shake Shack Company Profile

(

Free Report)

Shake Shack Inc owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally. Its Shacks offers hamburgers, chicken, hot dogs, crinkle cut fries, shakes, frozen custard, beer, wine, and other products. The company was founded in 2001 and is headquartered in New York, New York.

See Also

Before you consider Shake Shack, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shake Shack wasn't on the list.

While Shake Shack currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.