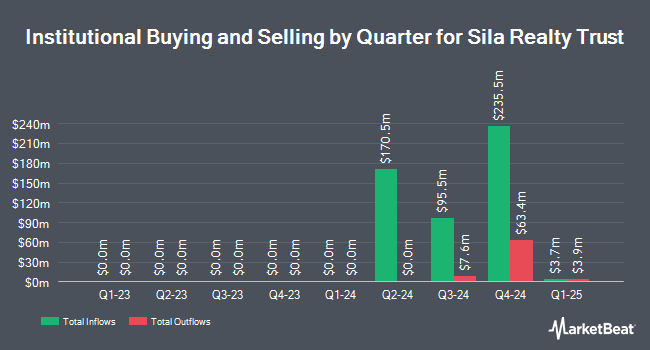

Graham Capital Wealth Management LLC bought a new stake in Sila Realty Trust, Inc. (NYSE:SILA - Free Report) during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm bought 170,190 shares of the company's stock, valued at approximately $4,304,000. Sila Realty Trust makes up about 4.4% of Graham Capital Wealth Management LLC's investment portfolio, making the stock its 5th biggest position. Graham Capital Wealth Management LLC owned about 0.31% of Sila Realty Trust as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other hedge funds have also bought and sold shares of SILA. Long Pond Capital LP bought a new position in shares of Sila Realty Trust during the 2nd quarter valued at about $49,981,000. Millennium Management LLC purchased a new stake in Sila Realty Trust in the second quarter worth approximately $16,010,000. Cambridge Investment Research Advisors Inc. bought a new position in Sila Realty Trust during the second quarter valued at approximately $15,534,000. Cetera Investment Advisers purchased a new position in shares of Sila Realty Trust during the second quarter worth approximately $7,547,000. Finally, Madrona Financial Services LLC bought a new stake in shares of Sila Realty Trust in the 2nd quarter worth approximately $4,686,000.

Wall Street Analyst Weigh In

SILA has been the topic of several recent research reports. Truist Financial assumed coverage on shares of Sila Realty Trust in a report on Monday, October 7th. They set a "buy" rating and a $29.00 target price on the stock. Janney Montgomery Scott initiated coverage on Sila Realty Trust in a research note on Thursday, October 3rd. They set a "buy" rating and a $28.00 price objective on the stock.

Get Our Latest Stock Analysis on SILA

Sila Realty Trust Stock Down 2.1 %

Shares of NYSE SILA traded down $0.55 during mid-day trading on Friday, hitting $25.21. The stock had a trading volume of 488,581 shares, compared to its average volume of 591,195. The business's 50 day moving average price is $24.94. Sila Realty Trust, Inc. has a 1 year low of $7.45 and a 1 year high of $26.50. The company has a quick ratio of 2.24, a current ratio of 2.24 and a debt-to-equity ratio of 0.35.

Sila Realty Trust Dividend Announcement

The company also recently disclosed a monthly dividend, which will be paid on Friday, November 15th. Shareholders of record on Thursday, October 31st will be given a $0.1333 dividend. This represents a $1.60 dividend on an annualized basis and a dividend yield of 6.35%. The ex-dividend date of this dividend is Thursday, October 31st.

About Sila Realty Trust

(

Free Report)

Sila Realty Trust, Inc, headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the large, growing, and resilient healthcare sector. The Company invests in high quality healthcare facilities along the continuum of care, which, we believe, generate predictable, durable, and growing income streams.

Featured Stories

Before you consider Sila Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sila Realty Trust wasn't on the list.

While Sila Realty Trust currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.