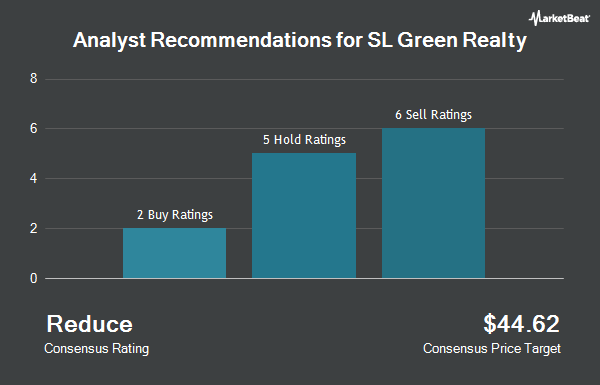

Shares of SL Green Realty Corp. (NYSE:SLG - Get Free Report) have earned a consensus recommendation of "Hold" from the fourteen brokerages that are covering the firm, MarketBeat.com reports. Two investment analysts have rated the stock with a sell recommendation, ten have given a hold recommendation and two have given a buy recommendation to the company. The average 12 month price objective among brokers that have covered the stock in the last year is $65.57.

Several brokerages recently commented on SLG. Scotiabank upped their price target on shares of SL Green Realty from $68.00 to $80.00 and gave the company a "sector perform" rating in a report on Friday, October 25th. Citigroup upgraded shares of SL Green Realty from a "sell" rating to a "neutral" rating and upped their price target for the company from $44.00 to $66.00 in a report on Friday, September 13th. Barclays upped their price target on shares of SL Green Realty from $66.00 to $78.00 and gave the company an "equal weight" rating in a report on Tuesday, October 22nd. Wells Fargo & Company upped their price target on shares of SL Green Realty from $43.00 to $63.00 and gave the company an "equal weight" rating in a report on Wednesday, September 11th. Finally, JPMorgan Chase & Co. upped their target price on shares of SL Green Realty from $44.00 to $51.00 and gave the stock an "underweight" rating in a research note on Tuesday, August 6th.

Check Out Our Latest Research Report on SLG

Hedge Funds Weigh In On SL Green Realty

Hedge funds and other institutional investors have recently modified their holdings of the business. Rosenberg Matthew Hamilton lifted its position in SL Green Realty by 6.6% during the third quarter. Rosenberg Matthew Hamilton now owns 2,313 shares of the real estate investment trust's stock valued at $161,000 after acquiring an additional 144 shares during the last quarter. Wealth Enhancement Advisory Services LLC lifted its position in SL Green Realty by 4.1% during the third quarter. Wealth Enhancement Advisory Services LLC now owns 3,769 shares of the real estate investment trust's stock valued at $262,000 after acquiring an additional 148 shares during the last quarter. Xponance Inc. lifted its position in SL Green Realty by 6.6% during the second quarter. Xponance Inc. now owns 4,234 shares of the real estate investment trust's stock valued at $240,000 after acquiring an additional 262 shares during the last quarter. Vert Asset Management LLC lifted its position in SL Green Realty by 1.5% during the third quarter. Vert Asset Management LLC now owns 26,909 shares of the real estate investment trust's stock valued at $1,873,000 after acquiring an additional 394 shares during the last quarter. Finally, Louisiana State Employees Retirement System lifted its position in SL Green Realty by 1.6% during the second quarter. Louisiana State Employees Retirement System now owns 32,600 shares of the real estate investment trust's stock valued at $1,846,000 after acquiring an additional 500 shares during the last quarter. 89.96% of the stock is currently owned by institutional investors.

SL Green Realty Price Performance

Shares of NYSE SLG traded down $1.22 during mid-day trading on Friday, hitting $74.39. 739,716 shares of the company's stock traded hands, compared to its average volume of 698,710. The company's 50-day moving average is $70.17 and its two-hundred day moving average is $61.40. The company has a debt-to-equity ratio of 1.07, a current ratio of 2.58 and a quick ratio of 2.59. The company has a market capitalization of $4.84 billion, a P/E ratio of -29.76, a PEG ratio of 2.00 and a beta of 1.82. SL Green Realty has a 1 year low of $29.26 and a 1 year high of $79.92.

SL Green Realty (NYSE:SLG - Get Free Report) last announced its earnings results on Wednesday, October 16th. The real estate investment trust reported ($0.21) earnings per share (EPS) for the quarter, missing the consensus estimate of $1.21 by ($1.42). The business had revenue of $229.69 million for the quarter, compared to analysts' expectations of $136.66 million. SL Green Realty had a negative net margin of 16.78% and a negative return on equity of 3.76%. During the same quarter in the prior year, the company posted $1.27 earnings per share. On average, equities analysts anticipate that SL Green Realty will post 7.61 EPS for the current fiscal year.

SL Green Realty Announces Dividend

The firm also recently disclosed a monthly dividend, which will be paid on Friday, November 15th. Stockholders of record on Thursday, October 31st will be paid a dividend of $0.25 per share. The ex-dividend date of this dividend is Thursday, October 31st. This represents a $3.00 dividend on an annualized basis and a dividend yield of 4.03%. SL Green Realty's dividend payout ratio is presently -120.00%.

SL Green Realty Company Profile

(

Get Free Report3SL Green Realty Corp., Manhattan’s largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing value of Manhattan commercial properties. As of June 30, 2022, SL Green held interests in 64 buildings totaling 34.4 million square feet.

Read More

Before you consider SL Green Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SL Green Realty wasn't on the list.

While SL Green Realty currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.