Moody Aldrich Partners LLC lifted its holdings in shares of SL Green Realty Corp. (NYSE:SLG - Free Report) by 12.8% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 117,926 shares of the real estate investment trust's stock after purchasing an additional 13,427 shares during the quarter. SL Green Realty makes up about 1.5% of Moody Aldrich Partners LLC's holdings, making the stock its 7th biggest position. Moody Aldrich Partners LLC owned approximately 0.18% of SL Green Realty worth $8,209,000 at the end of the most recent quarter.

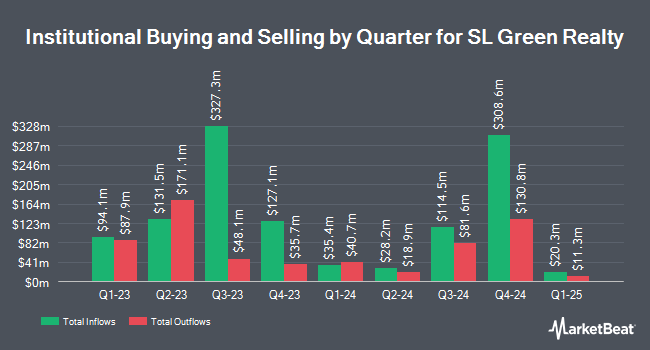

A number of other hedge funds and other institutional investors have also modified their holdings of SLG. Russell Investments Group Ltd. boosted its position in SL Green Realty by 24.7% during the first quarter. Russell Investments Group Ltd. now owns 799,431 shares of the real estate investment trust's stock worth $44,067,000 after purchasing an additional 158,268 shares during the period. Daiwa Securities Group Inc. grew its stake in SL Green Realty by 479.1% in the 1st quarter. Daiwa Securities Group Inc. now owns 113,028 shares of the real estate investment trust's stock valued at $6,231,000 after buying an additional 93,511 shares during the last quarter. Lighthouse Investment Partners LLC lifted its position in SL Green Realty by 150.0% during the 2nd quarter. Lighthouse Investment Partners LLC now owns 150,000 shares of the real estate investment trust's stock worth $8,496,000 after acquiring an additional 90,000 shares during the last quarter. Dimensional Fund Advisors LP boosted its holdings in SL Green Realty by 9.7% during the second quarter. Dimensional Fund Advisors LP now owns 994,909 shares of the real estate investment trust's stock valued at $56,350,000 after acquiring an additional 88,309 shares during the period. Finally, Swedbank AB acquired a new stake in shares of SL Green Realty in the first quarter valued at about $4,675,000. Institutional investors own 89.96% of the company's stock.

Wall Street Analyst Weigh In

Several brokerages recently weighed in on SLG. Truist Financial increased their target price on SL Green Realty from $47.00 to $55.00 and gave the company a "hold" rating in a research note on Friday, July 19th. The Goldman Sachs Group increased their price objective on SL Green Realty from $38.00 to $42.00 and gave the company a "sell" rating in a research report on Wednesday, July 31st. Morgan Stanley boosted their target price on shares of SL Green Realty from $47.00 to $50.00 and gave the stock an "equal weight" rating in a research report on Wednesday, October 9th. Compass Point set a $65.00 target price on shares of SL Green Realty and gave the company a "neutral" rating in a research note on Friday, October 18th. Finally, Barclays raised their price target on shares of SL Green Realty from $66.00 to $78.00 and gave the stock an "equal weight" rating in a research report on Tuesday. Three equities research analysts have rated the stock with a sell rating, ten have issued a hold rating and two have given a buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $64.71.

View Our Latest Stock Report on SL Green Realty

SL Green Realty Price Performance

NYSE SLG traded up $1.89 during trading on Thursday, reaching $77.47. 626,100 shares of the company traded hands, compared to its average volume of 985,162. SL Green Realty Corp. has a 1-year low of $28.55 and a 1-year high of $79.08. The company has a market cap of $5.04 billion, a price-to-earnings ratio of -30.99, a P/E/G ratio of 2.12 and a beta of 1.83. The stock's 50 day moving average price is $68.72 and its two-hundred day moving average price is $60.30. The company has a debt-to-equity ratio of 1.07, a quick ratio of 2.59 and a current ratio of 2.58.

SL Green Realty (NYSE:SLG - Get Free Report) last announced its quarterly earnings results on Wednesday, October 16th. The real estate investment trust reported ($0.21) EPS for the quarter, missing the consensus estimate of $1.21 by ($1.42). SL Green Realty had a negative net margin of 16.78% and a negative return on equity of 3.76%. The company had revenue of $229.69 million during the quarter, compared to analyst estimates of $136.66 million. During the same period in the prior year, the firm earned $1.27 EPS. As a group, analysts anticipate that SL Green Realty Corp. will post 7.62 EPS for the current year.

SL Green Realty Dividend Announcement

The company also recently announced a monthly dividend, which will be paid on Friday, November 15th. Investors of record on Thursday, October 31st will be given a dividend of $0.25 per share. This represents a $3.00 dividend on an annualized basis and a dividend yield of 3.87%. The ex-dividend date of this dividend is Thursday, October 31st. SL Green Realty's dividend payout ratio (DPR) is currently -120.00%.

SL Green Realty Company Profile

(

Free Report)

3SL Green Realty Corp., Manhattan’s largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing value of Manhattan commercial properties. As of June 30, 2022, SL Green held interests in 64 buildings totaling 34.4 million square feet.

Recommended Stories

Before you consider SL Green Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SL Green Realty wasn't on the list.

While SL Green Realty currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.