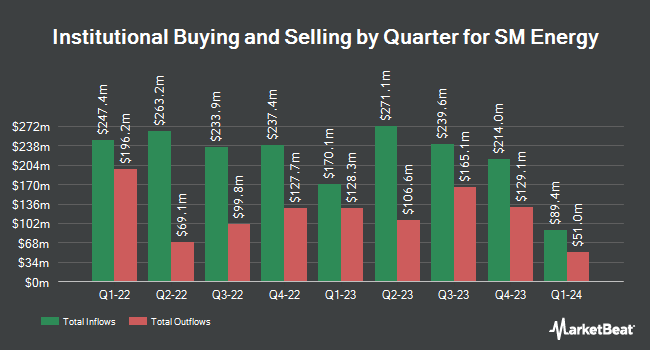

River Road Asset Management LLC increased its holdings in SM Energy (NYSE:SM - Free Report) by 0.7% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,792,573 shares of the energy company's stock after buying an additional 12,669 shares during the quarter. River Road Asset Management LLC owned about 1.56% of SM Energy worth $71,649,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds have also added to or reduced their stakes in the business. Dimensional Fund Advisors LP boosted its stake in SM Energy by 6.5% during the 2nd quarter. Dimensional Fund Advisors LP now owns 6,341,875 shares of the energy company's stock valued at $274,161,000 after purchasing an additional 384,675 shares in the last quarter. American Century Companies Inc. boosted its stake in SM Energy by 1.2% during the 2nd quarter. American Century Companies Inc. now owns 2,361,149 shares of the energy company's stock valued at $102,072,000 after purchasing an additional 28,005 shares in the last quarter. Westwood Holdings Group Inc. boosted its stake in SM Energy by 10.2% during the 2nd quarter. Westwood Holdings Group Inc. now owns 1,709,927 shares of the energy company's stock valued at $73,920,000 after purchasing an additional 157,923 shares in the last quarter. Bank of New York Mellon Corp boosted its stake in shares of SM Energy by 0.3% during the 2nd quarter. Bank of New York Mellon Corp now owns 1,335,624 shares of the energy company's stock worth $57,739,000 after acquiring an additional 4,611 shares in the last quarter. Finally, Jupiter Asset Management Ltd. grew its holdings in shares of SM Energy by 929.6% in the 2nd quarter. Jupiter Asset Management Ltd. now owns 1,159,488 shares of the energy company's stock worth $50,125,000 after acquiring an additional 1,046,872 shares during the last quarter. 94.56% of the stock is owned by institutional investors.

SM Energy Stock Performance

SM stock traded up $0.13 during midday trading on Tuesday, hitting $41.07. 1,675,401 shares of the company traded hands, compared to its average volume of 1,740,922. SM Energy has a twelve month low of $34.13 and a twelve month high of $53.26. The company has a quick ratio of 1.29, a current ratio of 3.52 and a debt-to-equity ratio of 0.67. The business has a 50 day simple moving average of $42.31 and a 200-day simple moving average of $45.19. The stock has a market capitalization of $4.70 billion, a price-to-earnings ratio of 5.71 and a beta of 4.18.

SM Energy (NYSE:SM - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The energy company reported $1.62 earnings per share for the quarter, beating the consensus estimate of $1.52 by $0.10. The company had revenue of $643.60 million during the quarter, compared to analysts' expectations of $643.67 million. SM Energy had a return on equity of 19.62% and a net margin of 33.89%. SM Energy's revenue for the quarter was up .4% compared to the same quarter last year. During the same period in the prior year, the business earned $1.73 earnings per share. As a group, equities research analysts predict that SM Energy will post 7.05 earnings per share for the current year.

SM Energy Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, November 4th. Stockholders of record on Friday, October 25th were paid a $0.20 dividend. The ex-dividend date was Friday, October 25th. This is a positive change from SM Energy's previous quarterly dividend of $0.18. This represents a $0.80 dividend on an annualized basis and a dividend yield of 1.95%. SM Energy's dividend payout ratio (DPR) is 11.17%.

Wall Street Analyst Weigh In

A number of equities analysts recently weighed in on the company. Truist Financial dropped their price target on SM Energy from $46.00 to $38.00 and set a "hold" rating on the stock in a research note on Monday, September 30th. TD Cowen raised shares of SM Energy from a "hold" rating to a "buy" rating and reduced their price objective for the company from $64.00 to $60.00 in a research note on Tuesday, October 15th. Stephens upped their price objective on shares of SM Energy from $56.00 to $57.00 and gave the company an "overweight" rating in a research note on Friday. JPMorgan Chase & Co. upped their price objective on shares of SM Energy from $50.00 to $54.00 and gave the company an "overweight" rating in a research note on Tuesday, October 8th. Finally, KeyCorp reduced their price objective on shares of SM Energy from $65.00 to $60.00 and set an "overweight" rating for the company in a research note on Wednesday, October 16th. Six equities research analysts have rated the stock with a hold rating, eight have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $50.73.

Check Out Our Latest Research Report on SM Energy

SM Energy Company Profile

(

Free Report)

SM Energy Company, an independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas. It has working interests in oil and gas producing wells in the Midland Basin and South Texas. The company was formerly known as St.

See Also

Before you consider SM Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SM Energy wasn't on the list.

While SM Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.