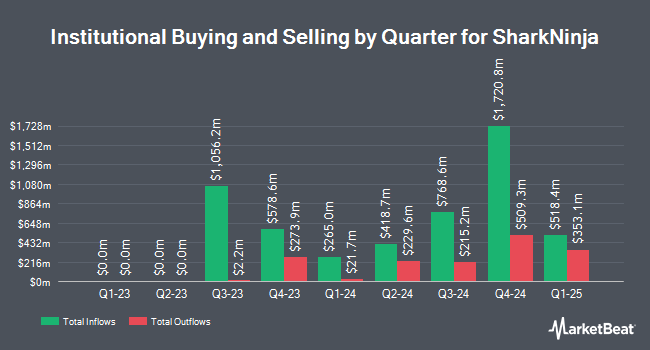

abrdn plc increased its holdings in SharkNinja, Inc. (NYSE:SN - Free Report) by 17.8% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 419,660 shares of the company's stock after acquiring an additional 63,299 shares during the quarter. abrdn plc owned about 0.30% of SharkNinja worth $45,621,000 as of its most recent filing with the Securities & Exchange Commission.

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Nisa Investment Advisors LLC purchased a new position in SharkNinja during the third quarter valued at $1,357,000. Waldron Private Wealth LLC purchased a new position in SharkNinja during the third quarter valued at $65,000. Signaturefd LLC lifted its position in SharkNinja by 104.6% during the third quarter. Signaturefd LLC now owns 356 shares of the company's stock valued at $39,000 after buying an additional 182 shares during the period. Fortis Group Advisors LLC lifted its position in SharkNinja by 11.4% during the third quarter. Fortis Group Advisors LLC now owns 9,594 shares of the company's stock valued at $1,043,000 after buying an additional 980 shares during the period. Finally, Seven Grand Managers LLC lifted its position in SharkNinja by 150.0% during the third quarter. Seven Grand Managers LLC now owns 125,000 shares of the company's stock valued at $13,589,000 after buying an additional 75,000 shares during the period. Hedge funds and other institutional investors own 34.77% of the company's stock.

SharkNinja Stock Performance

NYSE SN traded down $18.70 during trading hours on Thursday, hitting $92.22. The company's stock had a trading volume of 7,576,394 shares, compared to its average volume of 1,145,733. SharkNinja, Inc. has a 12 month low of $40.27 and a 12 month high of $112.93. The company's 50 day simple moving average is $103.42 and its two-hundred day simple moving average is $84.63. The company has a market cap of $12.91 billion, a P/E ratio of 53.00, a price-to-earnings-growth ratio of 1.90 and a beta of 0.77. The company has a debt-to-equity ratio of 0.46, a current ratio of 1.71 and a quick ratio of 1.04.

SharkNinja (NYSE:SN - Get Free Report) last announced its quarterly earnings data on Thursday, October 31st. The company reported $1.21 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.04 by $0.17. The company had revenue of $1.43 billion during the quarter, compared to the consensus estimate of $1.31 billion. SharkNinja had a return on equity of 32.29% and a net margin of 5.16%. The firm's revenue was up 33.3% on a year-over-year basis. During the same period in the previous year, the company posted $0.95 EPS. As a group, sell-side analysts expect that SharkNinja, Inc. will post 3.9 EPS for the current fiscal year.

Analysts Set New Price Targets

SN has been the subject of several recent research reports. JPMorgan Chase & Co. raised their price objective on SharkNinja from $97.00 to $128.00 and gave the company an "overweight" rating in a research report on Monday, September 30th. Canaccord Genuity Group lifted their price target on SharkNinja from $126.00 to $128.00 and gave the stock a "buy" rating in a research report on Friday, October 25th. Bank of America lifted their price target on SharkNinja from $100.00 to $110.00 and gave the stock a "buy" rating in a research report on Tuesday, August 13th. Guggenheim lifted their price target on SharkNinja from $100.00 to $120.00 and gave the stock a "buy" rating in a research report on Monday, October 7th. Finally, Jefferies Financial Group lifted their price target on SharkNinja from $115.00 to $150.00 and gave the stock a "buy" rating in a research report on Wednesday, October 23rd. One investment analyst has rated the stock with a hold rating and ten have issued a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $109.05.

View Our Latest Analysis on SharkNinja

SharkNinja Profile

(

Free Report)

SharkNinja, Inc, a product design and technology company, engages in the provision of various solutions for consumers worldwide. It offers cleaning appliances, including corded and cordless vacuums, including handheld and robotic vacuums, as well as other floorcare products comprising steam mops, wet/dry cleaning floor products, and carpet extraction; cooking and beverage appliances, such as air fryers, multi-cookers, outdoor and countertop grills and ovens, coffee systems, carbonation, cookware, cutlery, kettles, toasters and bakeware; food preparation appliances comprising blenders, food processors, ice cream makers, and juicers; and beauty appliances, such as hair dryers and stylers, as well as home environment products comprising air purifiers and humidifiers.

See Also

Before you consider SharkNinja, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SharkNinja wasn't on the list.

While SharkNinja currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.