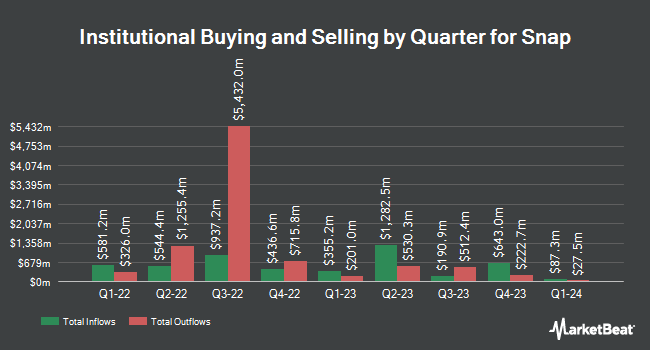

Dynamic Advisor Solutions LLC purchased a new position in shares of Snap Inc. (NYSE:SNAP - Free Report) in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 77,776 shares of the company's stock, valued at approximately $832,000.

A number of other institutional investors also recently added to or reduced their stakes in the stock. Hollencrest Capital Management bought a new stake in shares of Snap in the 2nd quarter worth about $33,000. Blue Trust Inc. grew its stake in Snap by 354.1% during the second quarter. Blue Trust Inc. now owns 2,157 shares of the company's stock worth $36,000 after buying an additional 1,682 shares during the last quarter. Rothschild Investment LLC acquired a new stake in shares of Snap during the second quarter worth approximately $40,000. J.Safra Asset Management Corp raised its stake in shares of Snap by 534.4% in the second quarter. J.Safra Asset Management Corp now owns 2,766 shares of the company's stock valued at $46,000 after acquiring an additional 2,330 shares during the last quarter. Finally, JTC Employer Solutions Trustee Ltd acquired a new position in shares of Snap in the 1st quarter worth approximately $100,000. 47.52% of the stock is owned by institutional investors and hedge funds.

Snap Stock Up 4.4 %

SNAP stock traded up $0.47 during midday trading on Friday, hitting $11.13. The company's stock had a trading volume of 17,306,013 shares, compared to its average volume of 27,070,797. The company's fifty day moving average price is $9.63 and its 200 day moving average price is $12.73. The company has a debt-to-equity ratio of 1.74, a current ratio of 3.98 and a quick ratio of 3.98. Snap Inc. has a twelve month low of $8.29 and a twelve month high of $17.90. The stock has a market capitalization of $18.47 billion, a P/E ratio of -15.46 and a beta of 1.01.

Snap (NYSE:SNAP - Get Free Report) last posted its quarterly earnings results on Thursday, August 1st. The company reported ($0.13) earnings per share for the quarter, topping the consensus estimate of ($0.15) by $0.02. The firm had revenue of $1.24 billion for the quarter, compared to analyst estimates of $1.25 billion. Snap had a negative return on equity of 42.84% and a negative net margin of 23.49%. As a group, equities research analysts predict that Snap Inc. will post -0.47 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of research analysts recently issued reports on the company. Cantor Fitzgerald reaffirmed a "neutral" rating and issued a $8.00 price target on shares of Snap in a report on Monday, October 7th. Benchmark reiterated a "hold" rating on shares of Snap in a research report on Tuesday, August 6th. Susquehanna decreased their price target on shares of Snap from $15.00 to $12.00 and set a "neutral" rating on the stock in a research note on Friday, August 2nd. HSBC cut shares of Snap from a "buy" rating to a "hold" rating in a research report on Friday, August 2nd. Finally, Hsbc Global Res lowered Snap from a "strong-buy" rating to a "hold" rating in a research report on Friday, August 2nd. One investment analyst has rated the stock with a sell rating, twenty-four have issued a hold rating and seven have issued a buy rating to the company's stock. According to data from MarketBeat, Snap currently has a consensus rating of "Hold" and a consensus price target of $13.85.

View Our Latest Research Report on Snap

Insiders Place Their Bets

In related news, General Counsel Michael J. O'sullivan sold 18,000 shares of the stock in a transaction on Wednesday, July 31st. The stock was sold at an average price of $13.28, for a total value of $239,040.00. Following the sale, the general counsel now owns 463,908 shares in the company, valued at approximately $6,160,698.24. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other news, SVP Eric Young sold 114,097 shares of the business's stock in a transaction that occurred on Friday, August 16th. The stock was sold at an average price of $9.11, for a total transaction of $1,039,423.67. Following the completion of the sale, the senior vice president now owns 3,041,723 shares in the company, valued at $27,710,096.53. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, General Counsel Michael J. O'sullivan sold 18,000 shares of the stock in a transaction that occurred on Wednesday, July 31st. The stock was sold at an average price of $13.28, for a total value of $239,040.00. Following the transaction, the general counsel now owns 463,908 shares in the company, valued at approximately $6,160,698.24. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 1,510,352 shares of company stock valued at $13,446,353 over the last 90 days. 22.68% of the stock is currently owned by insiders.

Snap Profile

(

Free Report)

Snap Inc operates as a technology company in North America, Europe, and internationally. The company offers Snapchat, a visual messaging application with various tabs, such as camera, visual messaging, snap map, stories, and spotlight that enable people to communicate visually through short videos and images.

Further Reading

Before you consider Snap, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Snap wasn't on the list.

While Snap currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.