Jade Capital Advisors LLC purchased a new position in SPX Technologies, Inc. (NYSE:SPXC - Free Report) in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm purchased 10,000 shares of the company's stock, valued at approximately $1,595,000. SPX Technologies makes up 1.0% of Jade Capital Advisors LLC's portfolio, making the stock its 29th biggest holding.

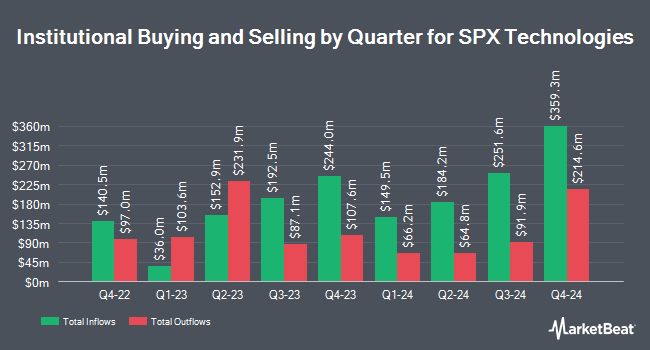

Several other institutional investors also recently bought and sold shares of SPXC. Crewe Advisors LLC purchased a new stake in SPX Technologies during the 2nd quarter valued at $28,000. Canada Pension Plan Investment Board purchased a new position in shares of SPX Technologies in the second quarter worth $28,000. V Square Quantitative Management LLC purchased a new position in SPX Technologies during the 3rd quarter worth approximately $28,000. UMB Bank n.a. grew its stake in shares of SPX Technologies by 965.0% during the 2nd quarter. UMB Bank n.a. now owns 213 shares of the company's stock worth $30,000 after purchasing an additional 193 shares during the period. Finally, Hilltop National Bank purchased a new position in SPX Technologies during the second quarter worth approximately $39,000. 92.82% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Separately, Oppenheimer lowered shares of SPX Technologies from an "outperform" rating to a "market perform" rating in a research note on Thursday, July 18th.

Read Our Latest Stock Analysis on SPX Technologies

SPX Technologies Trading Down 1.5 %

NYSE:SPXC traded down $2.42 during mid-day trading on Tuesday, reaching $158.31. The company's stock had a trading volume of 284,971 shares, compared to its average volume of 249,246. The company has a debt-to-equity ratio of 0.40, a current ratio of 1.28 and a quick ratio of 0.81. The stock has a market cap of $7.33 billion, a P/E ratio of 71.31, a P/E/G ratio of 1.65 and a beta of 1.21. SPX Technologies, Inc. has a twelve month low of $77.90 and a twelve month high of $173.30. The company's fifty day simple moving average is $157.55 and its two-hundred day simple moving average is $144.96.

SPX Technologies (NYSE:SPXC - Get Free Report) last released its quarterly earnings results on Thursday, August 1st. The company reported $1.42 earnings per share for the quarter, topping analysts' consensus estimates of $1.25 by $0.17. SPX Technologies had a return on equity of 19.20% and a net margin of 5.53%. The firm had revenue of $501.30 million during the quarter, compared to analysts' expectations of $492.08 million. During the same quarter in the prior year, the business earned $1.06 EPS. SPX Technologies's quarterly revenue was up 18.4% compared to the same quarter last year. On average, equities analysts predict that SPX Technologies, Inc. will post 5.54 EPS for the current year.

About SPX Technologies

(

Free Report)

SPX Technologies, Inc supplies infrastructure equipment serving the heating, ventilation, and cooling (HVAC); and detection and measurement markets worldwide. The company operates in two segments, HVAC and Detection and Measurement. The HVAC segment engineers, designs, manufactures, installs, and services package and process cooling products and engineered air movement solutions for the HVAC industrial and power generation markets, as well as boilers, heating, and ventilation products for the residential and commercial markets.

See Also

Before you consider SPX Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SPX Technologies wasn't on the list.

While SPX Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.