Argonautica Private Wealth Management Inc. bought a new stake in shares of Block, Inc. (NYSE:SQ - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The fund bought 8,922 shares of the technology company's stock, valued at approximately $599,000.

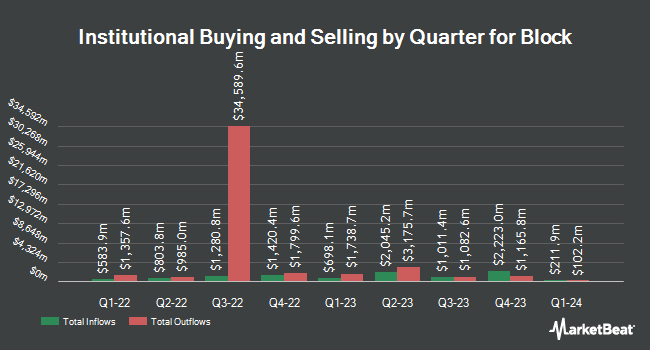

Several other large investors also recently added to or reduced their stakes in SQ. Baillie Gifford & Co. raised its stake in Block by 45.7% during the 2nd quarter. Baillie Gifford & Co. now owns 10,085,229 shares of the technology company's stock valued at $650,396,000 after purchasing an additional 3,163,975 shares during the period. Lone Pine Capital LLC raised its holdings in shares of Block by 13.9% during the second quarter. Lone Pine Capital LLC now owns 7,670,523 shares of the technology company's stock worth $494,672,000 after acquiring an additional 934,588 shares in the last quarter. D1 Capital Partners L.P. raised its holdings in shares of Block by 76.7% during the second quarter. D1 Capital Partners L.P. now owns 1,831,342 shares of the technology company's stock worth $118,103,000 after acquiring an additional 795,000 shares in the last quarter. Canada Pension Plan Investment Board raised its holdings in shares of Block by 1,061.0% during the second quarter. Canada Pension Plan Investment Board now owns 657,667 shares of the technology company's stock worth $42,413,000 after acquiring an additional 601,020 shares in the last quarter. Finally, Capital World Investors raised its holdings in shares of Block by 4.7% during the first quarter. Capital World Investors now owns 13,096,614 shares of the technology company's stock worth $1,107,712,000 after acquiring an additional 582,826 shares in the last quarter. 70.44% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several analysts recently issued reports on the company. Royal Bank of Canada reiterated an "outperform" rating and set a $88.00 price objective on shares of Block in a report on Monday, October 21st. Keefe, Bruyette & Woods decreased their price target on Block from $82.00 to $74.00 and set a "market perform" rating for the company in a research note on Monday, July 8th. Needham & Company LLC cut their price objective on Block from $105.00 to $80.00 and set a "buy" rating on the stock in a research note on Monday, August 5th. Morgan Stanley decreased their target price on Block from $60.00 to $55.00 and set an "underweight" rating for the company in a research report on Tuesday, July 30th. Finally, Wells Fargo & Company dropped their price target on shares of Block from $95.00 to $85.00 and set an "overweight" rating on the stock in a research report on Friday, August 2nd. One investment analyst has rated the stock with a sell rating, six have given a hold rating, twenty-four have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, Block has a consensus rating of "Moderate Buy" and a consensus price target of $88.79.

Read Our Latest Stock Analysis on SQ

Insider Transactions at Block

In related news, Director Roelof Botha purchased 434,405 shares of the stock in a transaction that occurred on Tuesday, August 6th. The stock was acquired at an average price of $57.55 per share, with a total value of $25,000,007.75. Following the completion of the acquisition, the director now directly owns 434,405 shares in the company, valued at approximately $25,000,007.75. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. In other Block news, Director Roelof Botha acquired 434,405 shares of Block stock in a transaction on Tuesday, August 6th. The shares were purchased at an average cost of $57.55 per share, with a total value of $25,000,007.75. Following the completion of the purchase, the director now owns 434,405 shares in the company, valued at $25,000,007.75. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CAO Ajmere Dale sold 500 shares of Block stock in a transaction on Tuesday, August 13th. The stock was sold at an average price of $61.88, for a total transaction of $30,940.00. Following the transaction, the chief accounting officer now directly owns 92,366 shares in the company, valued at approximately $5,715,608.08. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 25,214 shares of company stock valued at $1,637,932. Corporate insiders own 10.49% of the company's stock.

Block Price Performance

Shares of NYSE SQ traded down $0.17 during mid-day trading on Friday, hitting $72.15. 5,643,079 shares of the stock were exchanged, compared to its average volume of 4,882,765. The company has a market cap of $44.42 billion, a P/E ratio of 56.37, a PEG ratio of 0.99 and a beta of 2.48. The stock's fifty day simple moving average is $68.00 and its two-hundred day simple moving average is $66.86. The company has a debt-to-equity ratio of 0.26, a quick ratio of 1.82 and a current ratio of 1.82. Block, Inc. has a twelve month low of $42.78 and a twelve month high of $87.52.

Block (NYSE:SQ - Get Free Report) last posted its quarterly earnings data on Thursday, August 1st. The technology company reported $0.93 earnings per share for the quarter, topping the consensus estimate of $0.84 by $0.09. The company had revenue of $6.16 billion during the quarter, compared to analyst estimates of $6.27 billion. Block had a net margin of 3.47% and a return on equity of 3.77%. The company's revenue was up 11.2% on a year-over-year basis. During the same quarter last year, the business posted $0.40 earnings per share. As a group, analysts forecast that Block, Inc. will post 1.71 EPS for the current fiscal year.

Block Company Profile

(

Free Report)

Square, Inc provides payment and point-of-sale solutions in the United States and internationally. The company's commerce ecosystem includes point-of-sale software and hardware that enables sellers to turn mobile and computing devices into payment and point-of-sale solutions. It offers hardware products, including Magstripe reader, which enables swiped transactions of magnetic stripe cards; Contactless and chip reader that accepts EMV® chip cards and Near Field Communication payments; Chip card reader, which accepts EMV® chip cards and enables swiped transactions of magnetic stripe cards; Square Stand, which enables an iPad to be used as a payment terminal or full point of sale solution; and Square Register that combines its hardware, point-of-sale software, and payments technology, as well as managed payments solutions.

Recommended Stories

Before you consider Block, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Block wasn't on the list.

While Block currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report