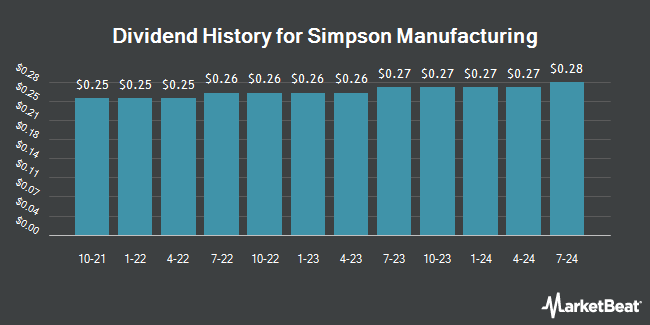

Simpson Manufacturing Co., Inc. (NYSE:SSD - Get Free Report) declared a quarterly dividend on Thursday, October 24th, RTT News reports. Shareholders of record on Thursday, January 2nd will be given a dividend of 0.28 per share by the construction company on Thursday, January 23rd. This represents a $1.12 dividend on an annualized basis and a yield of 0.62%.

Simpson Manufacturing has increased its dividend payment by an average of 15.4% annually over the last three years. Simpson Manufacturing has a payout ratio of 12.3% meaning its dividend is sufficiently covered by earnings. Equities analysts expect Simpson Manufacturing to earn $9.14 per share next year, which means the company should continue to be able to cover its $1.12 annual dividend with an expected future payout ratio of 12.3%.

Simpson Manufacturing Price Performance

SSD stock traded up $5.48 during midday trading on Thursday, reaching $181.96. The company had a trading volume of 277,183 shares, compared to its average volume of 282,152. Simpson Manufacturing has a 1 year low of $124.50 and a 1 year high of $218.38. The company has a market capitalization of $7.67 billion, a P/E ratio of 24.04 and a beta of 1.32. The firm has a 50-day moving average price of $184.33 and a 200-day moving average price of $178.02. The company has a debt-to-equity ratio of 0.24, a current ratio of 3.53 and a quick ratio of 2.21.

Simpson Manufacturing (NYSE:SSD - Get Free Report) last announced its quarterly earnings data on Monday, October 21st. The construction company reported $2.21 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $2.40 by ($0.19). Simpson Manufacturing had a net margin of 14.51% and a return on equity of 18.29%. The business had revenue of $587.15 million during the quarter, compared to analysts' expectations of $589.00 million. During the same period last year, the company posted $2.43 EPS. Simpson Manufacturing's revenue for the quarter was up 1.2% on a year-over-year basis. On average, research analysts anticipate that Simpson Manufacturing will post 7.55 earnings per share for the current fiscal year.

Insider Activity at Simpson Manufacturing

In related news, EVP Roger Dankel sold 2,700 shares of the company's stock in a transaction on Thursday, August 1st. The shares were sold at an average price of $190.44, for a total transaction of $514,188.00. Following the completion of the sale, the executive vice president now directly owns 24,064 shares in the company, valued at $4,582,748.16. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. In related news, EVP Michael Andersen sold 1,500 shares of the company's stock in a transaction on Monday, August 26th. The shares were sold at an average price of $187.46, for a total transaction of $281,190.00. Following the completion of the sale, the executive vice president now directly owns 8,438 shares in the company, valued at $1,581,787.48. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, EVP Roger Dankel sold 2,700 shares of the company's stock in a transaction on Thursday, August 1st. The stock was sold at an average price of $190.44, for a total transaction of $514,188.00. Following the completion of the transaction, the executive vice president now owns 24,064 shares of the company's stock, valued at $4,582,748.16. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 12,571 shares of company stock worth $2,348,027 in the last three months. 0.42% of the stock is owned by insiders.

Analysts Set New Price Targets

Separately, Robert W. Baird upped their price objective on shares of Simpson Manufacturing from $202.00 to $218.00 and gave the company an "outperform" rating in a research note on Monday.

View Our Latest Research Report on Simpson Manufacturing

Simpson Manufacturing Company Profile

(

Get Free Report)

Simpson Manufacturing Co, Inc, through its subsidiaries, designs, engineers, manufactures, and sells structural solutions for wood, concrete, and steel connections. The company offers wood construction products, including connectors, truss plates, fastening systems, fasteners and shearwalls, and pre-fabricated lateral systems for use in light-frame construction; and concrete construction products comprising adhesives, specialty chemicals, mechanical anchors, carbide drill bits, powder actuated tools, fiber-reinforced materials, and other repair products for use in concrete, masonry, and steel construction, as well as grouts, coatings, sealers, mortars, fiberglass and fiber-reinforced polymer systems, and asphalt products for use in concrete construction repair, and strengthening and protection products.

See Also

Before you consider Simpson Manufacturing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simpson Manufacturing wasn't on the list.

While Simpson Manufacturing currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.