Raymond James & Associates increased its stake in shares of Sensata Technologies Holding plc (NYSE:ST - Free Report) by 148.4% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 194,149 shares of the scientific and technical instruments company's stock after buying an additional 115,986 shares during the quarter. Raymond James & Associates owned about 0.13% of Sensata Technologies worth $6,962,000 at the end of the most recent quarter.

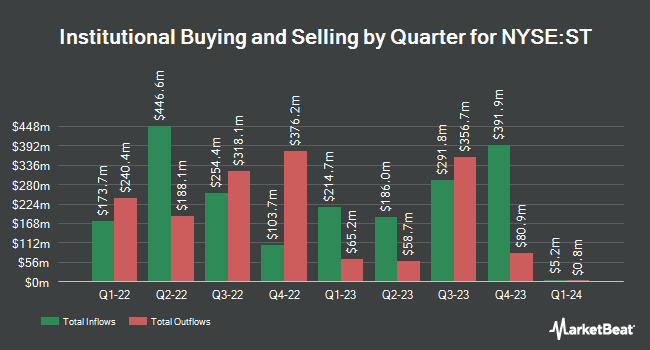

Other institutional investors have also recently added to or reduced their stakes in the company. State of Michigan Retirement System increased its stake in Sensata Technologies by 2.5% in the 1st quarter. State of Michigan Retirement System now owns 37,200 shares of the scientific and technical instruments company's stock valued at $1,367,000 after buying an additional 900 shares during the period. Retirement Systems of Alabama lifted its position in Sensata Technologies by 0.3% in the first quarter. Retirement Systems of Alabama now owns 190,063 shares of the scientific and technical instruments company's stock valued at $6,983,000 after purchasing an additional 498 shares during the period. Graypoint LLC lifted its position in Sensata Technologies by 10.1% in the first quarter. Graypoint LLC now owns 11,481 shares of the scientific and technical instruments company's stock valued at $422,000 after purchasing an additional 1,050 shares during the period. Easterly Investment Partners LLC purchased a new stake in Sensata Technologies in the 1st quarter valued at approximately $8,096,000. Finally, Coronation Fund Managers Ltd. increased its position in Sensata Technologies by 102.3% during the 1st quarter. Coronation Fund Managers Ltd. now owns 172,093 shares of the scientific and technical instruments company's stock worth $6,323,000 after purchasing an additional 87,005 shares during the period. Institutional investors and hedge funds own 99.42% of the company's stock.

Sensata Technologies Price Performance

Shares of NYSE ST traded down $0.64 during trading on Thursday, reaching $34.34. The company had a trading volume of 1,560,811 shares, compared to its average volume of 1,858,696. The company has a current ratio of 1.77, a quick ratio of 1.31 and a debt-to-equity ratio of 1.06. Sensata Technologies Holding plc has a twelve month low of $30.56 and a twelve month high of $43.14. The stock has a 50-day moving average price of $35.83 and a two-hundred day moving average price of $37.64. The stock has a market capitalization of $5.18 billion, a PE ratio of 858.50, a price-to-earnings-growth ratio of 1.39 and a beta of 1.25.

Sensata Technologies (NYSE:ST - Get Free Report) last posted its quarterly earnings data on Monday, July 29th. The scientific and technical instruments company reported $0.93 earnings per share for the quarter, meeting analysts' consensus estimates of $0.93. The business had revenue of $1.04 billion during the quarter, compared to analyst estimates of $1.04 billion. Sensata Technologies had a net margin of 0.21% and a return on equity of 17.57%. The company's revenue was down 2.5% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.97 earnings per share. As a group, sell-side analysts predict that Sensata Technologies Holding plc will post 3.55 earnings per share for the current year.

Sensata Technologies Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, November 27th. Shareholders of record on Wednesday, November 13th will be paid a dividend of $0.12 per share. This represents a $0.48 dividend on an annualized basis and a dividend yield of 1.40%. The ex-dividend date is Wednesday, November 13th. Sensata Technologies's dividend payout ratio is presently 1,200.00%.

Analyst Ratings Changes

ST has been the subject of several recent analyst reports. The Goldman Sachs Group reduced their price target on Sensata Technologies from $41.00 to $39.00 and set a "neutral" rating for the company in a report on Tuesday, October 1st. JPMorgan Chase & Co. decreased their target price on shares of Sensata Technologies from $35.00 to $34.00 and set an "underweight" rating on the stock in a research report on Friday, October 4th. Evercore ISI lowered their price target on shares of Sensata Technologies from $60.00 to $50.00 and set an "outperform" rating on the stock in a research note on Tuesday, October 15th. Truist Financial decreased their price objective on shares of Sensata Technologies from $46.00 to $38.00 and set a "hold" rating on the stock in a report on Tuesday, July 30th. Finally, Wolfe Research assumed coverage on shares of Sensata Technologies in a research report on Thursday, September 5th. They set a "peer perform" rating on the stock. One research analyst has rated the stock with a sell rating, seven have given a hold rating and three have given a buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Hold" and a consensus target price of $43.40.

Check Out Our Latest Stock Report on ST

About Sensata Technologies

(

Free Report)

Sensata Technologies Holding plc develops, manufactures, and sells sensors and sensor-rich solutions, electrical protection components and systems, and other products used in mission-critical systems and applications in the United States and internationally. It operates in two segments, Performance Sensing and Sensing Solutions.

See Also

Before you consider Sensata Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sensata Technologies wasn't on the list.

While Sensata Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.