Foresight Group Ltd Liability Partnership lessened its position in STAG Industrial, Inc. (NYSE:STAG - Free Report) by 14.2% in the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 110,681 shares of the real estate investment trust's stock after selling 18,282 shares during the quarter. STAG Industrial makes up about 1.8% of Foresight Group Ltd Liability Partnership's holdings, making the stock its 10th biggest holding. Foresight Group Ltd Liability Partnership owned 0.06% of STAG Industrial worth $4,327,000 at the end of the most recent reporting period.

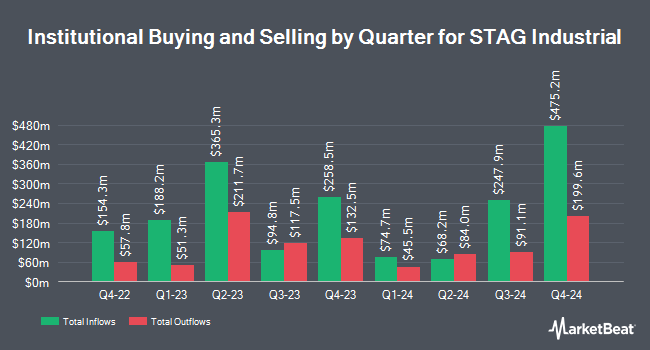

Other hedge funds have also made changes to their positions in the company. J.Safra Asset Management Corp lifted its position in STAG Industrial by 708.5% in the 1st quarter. J.Safra Asset Management Corp now owns 663 shares of the real estate investment trust's stock worth $25,000 after buying an additional 581 shares in the last quarter. Centerpoint Advisors LLC purchased a new stake in STAG Industrial in the 2nd quarter worth approximately $25,000. Fidelis Capital Partners LLC purchased a new stake in STAG Industrial in the 1st quarter worth approximately $29,000. UMB Bank n.a. lifted its position in STAG Industrial by 54.1% in the 3rd quarter. UMB Bank n.a. now owns 872 shares of the real estate investment trust's stock worth $34,000 after buying an additional 306 shares in the last quarter. Finally, GAMMA Investing LLC lifted its position in STAG Industrial by 56.1% in the 2nd quarter. GAMMA Investing LLC now owns 907 shares of the real estate investment trust's stock worth $33,000 after buying an additional 326 shares in the last quarter. Hedge funds and other institutional investors own 88.67% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts have issued reports on the stock. Evercore ISI increased their target price on shares of STAG Industrial from $43.00 to $44.00 and gave the stock an "outperform" rating in a research report on Wednesday, August 28th. Wells Fargo & Company raised their price target on shares of STAG Industrial from $37.00 to $41.00 and gave the company an "equal weight" rating in a report on Wednesday, August 28th. Wedbush raised their price target on shares of STAG Industrial from $44.00 to $45.00 and gave the company an "outperform" rating in a report on Monday, August 5th. Finally, Barclays raised their price target on shares of STAG Industrial from $38.00 to $42.00 and gave the company an "equal weight" rating in a report on Wednesday, August 14th. Five equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $41.22.

Get Our Latest Research Report on STAG Industrial

Insiders Place Their Bets

In other STAG Industrial news, Director Benjamin S. Butcher sold 34,000 shares of the firm's stock in a transaction on Thursday, August 1st. The shares were sold at an average price of $40.78, for a total value of $1,386,520.00. Following the sale, the director now directly owns 8,758 shares in the company, valued at $357,151.24. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Company insiders own 1.10% of the company's stock.

STAG Industrial Stock Performance

NYSE:STAG traded up $0.22 during midday trading on Wednesday, reaching $38.04. The stock had a trading volume of 838,401 shares, compared to its average volume of 1,067,548. STAG Industrial, Inc. has a 1-year low of $31.69 and a 1-year high of $41.63. The firm's fifty day simple moving average is $39.13 and its 200-day simple moving average is $37.44. The company has a debt-to-equity ratio of 0.82, a current ratio of 1.60 and a quick ratio of 1.60. The stock has a market capitalization of $6.93 billion, a P/E ratio of 36.48 and a beta of 1.09.

STAG Industrial Announces Dividend

The business also recently declared a monthly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Tuesday, December 31st will be given a $0.1233 dividend. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $1.48 annualized dividend and a yield of 3.89%. STAG Industrial's dividend payout ratio is 142.31%.

STAG Industrial Company Profile

(

Free Report)

We are a REIT focused on the acquisition, ownership, and operation of industrial properties throughout the United States. Our platform is designed to (i) identify properties for acquisition that offer relative value across CBRE-EA Tier 1 industrial real estate markets, industries, and tenants through the principled application of our proprietary risk assessment model, (ii) provide growth through sophisticated industrial operation and an attractive opportunity set, and (iii) capitalize our business appropriately given the characteristics of our assets.

Featured Stories

Before you consider STAG Industrial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and STAG Industrial wasn't on the list.

While STAG Industrial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.