Boston Financial Mangement LLC lessened its stake in STERIS plc (NYSE:STE - Free Report) by 1.3% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 202,982 shares of the medical equipment provider's stock after selling 2,755 shares during the period. STERIS comprises about 1.5% of Boston Financial Mangement LLC's investment portfolio, making the stock its 15th largest position. Boston Financial Mangement LLC owned approximately 0.21% of STERIS worth $49,231,000 as of its most recent filing with the Securities and Exchange Commission.

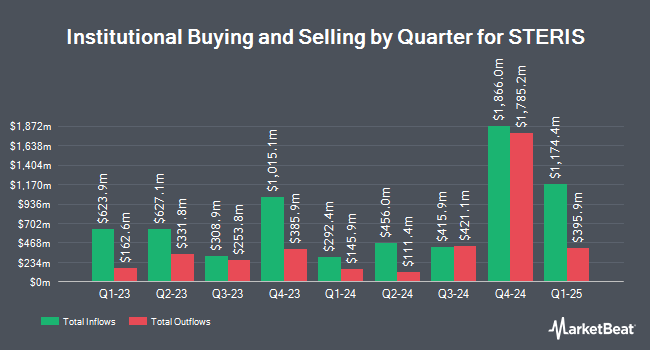

A number of other institutional investors have also modified their holdings of the stock. Central Pacific Bank Trust Division bought a new stake in STERIS in the third quarter valued at about $28,000. J.Safra Asset Management Corp raised its position in shares of STERIS by 77.9% during the 1st quarter. J.Safra Asset Management Corp now owns 121 shares of the medical equipment provider's stock valued at $27,000 after acquiring an additional 53 shares in the last quarter. Quent Capital LLC lifted its stake in STERIS by 112.7% during the first quarter. Quent Capital LLC now owns 134 shares of the medical equipment provider's stock worth $30,000 after purchasing an additional 71 shares during the last quarter. Headlands Technologies LLC acquired a new position in STERIS in the first quarter worth $36,000. Finally, Versant Capital Management Inc increased its stake in STERIS by 2,262.5% during the second quarter. Versant Capital Management Inc now owns 189 shares of the medical equipment provider's stock valued at $41,000 after purchasing an additional 181 shares during the last quarter. Institutional investors and hedge funds own 94.69% of the company's stock.

STERIS Price Performance

Shares of NYSE STE traded down $0.14 during mid-day trading on Tuesday, reaching $223.87. 495,484 shares of the company traded hands, compared to its average volume of 474,318. STERIS plc has a fifty-two week low of $195.47 and a fifty-two week high of $248.24. The firm has a market cap of $22.08 billion, a PE ratio of 55.59 and a beta of 0.84. The stock has a fifty day simple moving average of $234.57 and a 200-day simple moving average of $226.59. The company has a debt-to-equity ratio of 0.35, a current ratio of 2.33 and a quick ratio of 1.49.

STERIS (NYSE:STE - Get Free Report) last announced its quarterly earnings data on Tuesday, August 6th. The medical equipment provider reported $2.14 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.98 by $0.16. STERIS had a net margin of 7.36% and a return on equity of 13.85%. The company had revenue of $1.28 billion for the quarter, compared to analysts' expectations of $1.27 billion. During the same quarter in the previous year, the company posted $2.00 EPS. The business's revenue was down .4% compared to the same quarter last year. Equities research analysts anticipate that STERIS plc will post 9.06 EPS for the current fiscal year.

STERIS Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, September 20th. Investors of record on Thursday, September 5th were paid a $0.57 dividend. The ex-dividend date was Thursday, September 5th. This represents a $2.28 dividend on an annualized basis and a yield of 1.02%. This is a boost from STERIS's previous quarterly dividend of $0.52. STERIS's dividend payout ratio (DPR) is currently 56.58%.

Wall Street Analysts Forecast Growth

Several research firms have recently commented on STE. JMP Securities reaffirmed a "market outperform" rating and issued a $265.00 price target on shares of STERIS in a report on Wednesday, August 7th. KeyCorp lifted their target price on STERIS from $255.00 to $265.00 and gave the company an "overweight" rating in a research note on Tuesday, September 3rd. StockNews.com downgraded STERIS from a "strong-buy" rating to a "buy" rating in a report on Tuesday. Stephens restated an "overweight" rating and set a $260.00 price objective on shares of STERIS in a research note on Wednesday, August 7th. Finally, Needham & Company LLC reiterated a "hold" rating on shares of STERIS in a research note on Thursday, August 8th. Two investment analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $253.00.

Get Our Latest Stock Analysis on STE

Insiders Place Their Bets

In other STERIS news, CFO Michael J. Tokich sold 23,332 shares of the firm's stock in a transaction dated Tuesday, September 10th. The shares were sold at an average price of $247.00, for a total value of $5,763,004.00. Following the completion of the transaction, the chief financial officer now directly owns 42,930 shares in the company, valued at $10,603,710. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through this link. In other news, CFO Michael J. Tokich sold 23,332 shares of the stock in a transaction on Tuesday, September 10th. The stock was sold at an average price of $247.00, for a total value of $5,763,004.00. Following the completion of the sale, the chief financial officer now owns 42,930 shares in the company, valued at $10,603,710. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Christopher S. Holland sold 473 shares of the firm's stock in a transaction on Thursday, August 8th. The stock was sold at an average price of $239.68, for a total value of $113,368.64. Following the completion of the sale, the director now directly owns 582 shares of the company's stock, valued at approximately $139,493.76. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 1.14% of the company's stock.

About STERIS

(

Free Report)

STERIS plc provides infection prevention products and services worldwide. It operates through four segments: Healthcare, Applied Sterilization Technologies, Life Sciences, and Dental. The Healthcare segment offers cleaning chemistries and sterility assurance products; automated endoscope reprocessing system and tracking products; endoscopy accessories, washers, sterilizers, and other pieces of capital equipment for the operation of a sterile processing department; and equipment used directly in the operating room, including surgical tables, lights, and connectivity solutions, as well as equipment management services.

See Also

Before you consider STERIS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and STERIS wasn't on the list.

While STERIS currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.