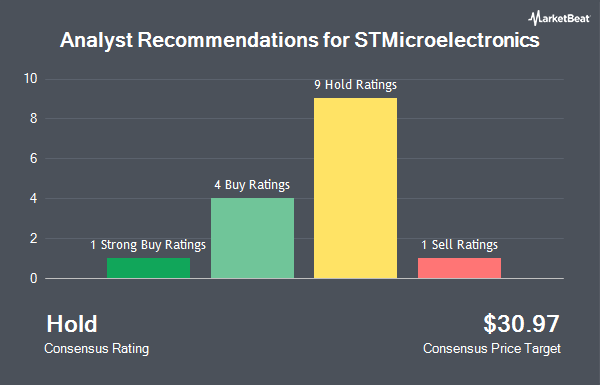

STMicroelectronics (NYSE:STM - Get Free Report) has received a consensus recommendation of "Moderate Buy" from the twelve analysts that are currently covering the company, Marketbeat Ratings reports. Four analysts have rated the stock with a hold rating, seven have given a buy rating and one has assigned a strong buy rating to the company. The average 12 month target price among brokers that have covered the stock in the last year is $39.80.

Several equities analysts have recently weighed in on the stock. Morgan Stanley lowered shares of STMicroelectronics from an "overweight" rating to an "equal weight" rating in a research report on Friday, July 26th. Citigroup upgraded shares of STMicroelectronics to a "strong-buy" rating in a research report on Thursday, October 10th. Sanford C. Bernstein reduced their price objective on shares of STMicroelectronics from $54.00 to $41.00 and set an "outperform" rating for the company in a research report on Tuesday, July 30th. Susquehanna reduced their price objective on shares of STMicroelectronics from $45.00 to $35.00 and set a "positive" rating for the company in a research note on Monday, October 21st. Finally, TD Cowen reduced their price objective on shares of STMicroelectronics from $50.00 to $40.00 and set a "buy" rating for the company in a research note on Friday, July 26th.

Read Our Latest Stock Analysis on STM

Institutional Trading of STMicroelectronics

A number of hedge funds have recently made changes to their positions in the stock. Wealth Enhancement Advisory Services LLC increased its holdings in STMicroelectronics by 41.7% in the first quarter. Wealth Enhancement Advisory Services LLC now owns 12,026 shares of the semiconductor producer's stock worth $520,000 after buying an additional 3,542 shares during the last quarter. Allspring Global Investments Holdings LLC acquired a new position in STMicroelectronics in the first quarter worth approximately $113,000. Naviter Wealth LLC acquired a new position in STMicroelectronics in the first quarter worth approximately $349,000. Legacy Wealth Asset Management LLC acquired a new position in STMicroelectronics in the first quarter worth approximately $543,000. Finally, Commonwealth Equity Services LLC increased its holdings in STMicroelectronics by 6.1% in the first quarter. Commonwealth Equity Services LLC now owns 30,232 shares of the semiconductor producer's stock worth $1,307,000 after buying an additional 1,732 shares during the last quarter. 5.05% of the stock is owned by hedge funds and other institutional investors.

STMicroelectronics Price Performance

Shares of NYSE:STM traded up $0.39 during trading hours on Tuesday, hitting $28.93. 4,968,510 shares of the company's stock traded hands, compared to its average volume of 3,890,424. STMicroelectronics has a 52 week low of $26.63 and a 52 week high of $51.27. The company has a debt-to-equity ratio of 0.17, a quick ratio of 2.56 and a current ratio of 3.35. The company's fifty day simple moving average is $28.91 and its two-hundred day simple moving average is $35.60. The company has a market cap of $26.14 billion, a price-to-earnings ratio of 8.98, a price-to-earnings-growth ratio of 3.47 and a beta of 1.57.

STMicroelectronics Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, December 27th. Stockholders of record on Tuesday, December 17th will be given a $0.09 dividend. This represents a $0.36 dividend on an annualized basis and a dividend yield of 1.24%. The ex-dividend date is Tuesday, December 17th. STMicroelectronics's dividend payout ratio (DPR) is 9.63%.

STMicroelectronics Company Profile

(

Get Free ReportSTMicroelectronics N.V., together with its subsidiaries, designs, develops, manufactures, and sells semiconductor products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific. The company operates through Automotive and Discrete Group; Analog, MEMS and Sensors Group; and Microcontrollers and Digital ICs Group segments.

Featured Articles

Before you consider STMicroelectronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and STMicroelectronics wasn't on the list.

While STMicroelectronics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.