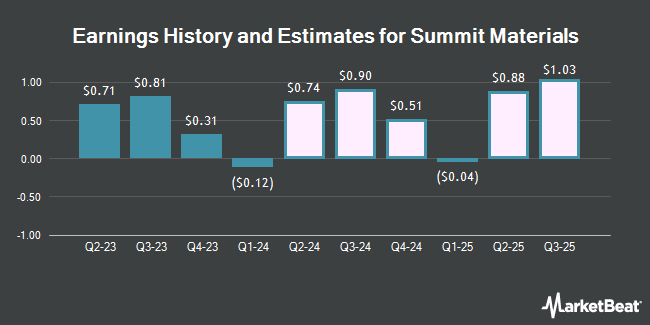

Summit Materials, Inc. (NYSE:SUM - Free Report) - Stock analysts at Seaport Res Ptn reduced their Q3 2024 EPS estimates for Summit Materials in a research note issued on Monday, October 28th. Seaport Res Ptn analyst R. Seth now anticipates that the construction company will post earnings per share of $0.66 for the quarter, down from their previous forecast of $0.73. The consensus estimate for Summit Materials' current full-year earnings is $1.63 per share. Seaport Res Ptn also issued estimates for Summit Materials' FY2024 earnings at $1.50 EPS and FY2025 earnings at $1.90 EPS.

Other research analysts have also issued reports about the stock. Royal Bank of Canada raised shares of Summit Materials from a "sector perform" rating to an "outperform" rating and raised their target price for the company from $45.00 to $53.00 in a report on Friday. Truist Financial lowered their target price on shares of Summit Materials from $53.00 to $47.00 and set a "buy" rating for the company in a research note on Wednesday, August 7th. Stephens reissued an "overweight" rating and set a $47.00 target price on shares of Summit Materials in a research note on Tuesday, August 6th. DA Davidson reissued a "neutral" rating and set a $41.00 target price on shares of Summit Materials in a research note on Tuesday, October 15th. Finally, Morgan Stanley started coverage on shares of Summit Materials in a research note on Monday, August 26th. They set an "overweight" rating and a $51.00 target price for the company. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and ten have given a buy rating to the company. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $48.42.

View Our Latest Analysis on SUM

Summit Materials Price Performance

Shares of SUM stock traded up $0.38 on Tuesday, reaching $46.01. The company's stock had a trading volume of 1,604,131 shares, compared to its average volume of 1,041,604. The stock's fifty day simple moving average is $39.06 and its 200-day simple moving average is $38.73. Summit Materials has a 1 year low of $31.67 and a 1 year high of $46.40. The company has a current ratio of 2.62, a quick ratio of 2.01 and a debt-to-equity ratio of 0.64. The company has a market capitalization of $8.07 billion, a price-to-earnings ratio of 20.40 and a beta of 1.17.

Summit Materials (NYSE:SUM - Get Free Report) last posted its earnings results on Monday, August 5th. The construction company reported $0.66 earnings per share for the quarter, beating analysts' consensus estimates of $0.61 by $0.05. Summit Materials had a net margin of 8.06% and a return on equity of 7.00%. The firm had revenue of $1.08 billion during the quarter, compared to analyst estimates of $1.14 billion. During the same period last year, the firm posted $0.71 earnings per share. Summit Materials's revenue for the quarter was up 58.1% compared to the same quarter last year.

Institutional Investors Weigh In On Summit Materials

Large investors have recently modified their holdings of the business. Hood River Capital Management LLC purchased a new stake in Summit Materials in the first quarter valued at approximately $33,206,000. Massachusetts Financial Services Co. MA boosted its position in Summit Materials by 6.6% in the second quarter. Massachusetts Financial Services Co. MA now owns 7,210,736 shares of the construction company's stock valued at $263,985,000 after buying an additional 448,922 shares during the last quarter. Interval Partners LP purchased a new stake in Summit Materials in the first quarter valued at approximately $18,051,000. Millennium Management LLC boosted its position in Summit Materials by 16.9% in the second quarter. Millennium Management LLC now owns 2,753,816 shares of the construction company's stock valued at $100,817,000 after buying an additional 399,072 shares during the last quarter. Finally, Troluce Capital Advisors LLC purchased a new stake in Summit Materials in the second quarter valued at approximately $10,983,000.

Summit Materials Company Profile

(

Get Free Report)

Summit Materials, Inc operates as a vertically integrated construction materials company in the United States and Canada. It operates in three segments: West, East, and Cement. The company offers aggregates, cement, ready-mix concrete, asphalt paving mixes, and concrete products, as well as plastics components.

Read More

Before you consider Summit Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Summit Materials wasn't on the list.

While Summit Materials currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.