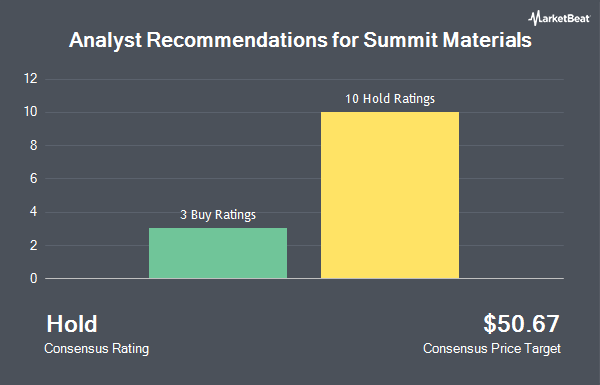

Shares of Summit Materials, Inc. (NYSE:SUM - Get Free Report) have been assigned an average rating of "Moderate Buy" from the twelve ratings firms that are presently covering the stock, Marketbeat Ratings reports. Three analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. The average 1-year price objective among brokerages that have covered the stock in the last year is $47.83.

SUM has been the subject of a number of research analyst reports. Morgan Stanley initiated coverage on Summit Materials in a report on Monday, August 26th. They issued an "overweight" rating and a $51.00 target price for the company. Truist Financial lowered their target price on Summit Materials from $53.00 to $47.00 and set a "buy" rating for the company in a report on Wednesday, August 7th. Stifel Nicolaus decreased their price objective on Summit Materials from $55.00 to $47.00 and set a "buy" rating for the company in a report on Wednesday, July 3rd. Jefferies Financial Group decreased their price objective on Summit Materials from $58.00 to $56.00 and set a "buy" rating for the company in a report on Wednesday, October 9th. Finally, Royal Bank of Canada upgraded Summit Materials from a "sector perform" rating to an "outperform" rating and boosted their price objective for the company from $45.00 to $53.00 in a report on Friday.

View Our Latest Stock Report on Summit Materials

Institutional Investors Weigh In On Summit Materials

Several institutional investors have recently bought and sold shares of the stock. V Square Quantitative Management LLC purchased a new position in Summit Materials in the third quarter worth $27,000. Toth Financial Advisory Corp boosted its position in Summit Materials by 147.1% in the third quarter. Toth Financial Advisory Corp now owns 840 shares of the construction company's stock worth $33,000 after purchasing an additional 500 shares during the last quarter. International Assets Investment Management LLC boosted its position in Summit Materials by 3,804.2% in the third quarter. International Assets Investment Management LLC now owns 937 shares of the construction company's stock worth $37,000 after purchasing an additional 913 shares during the last quarter. Register Financial Advisors LLC purchased a new position in Summit Materials in the first quarter worth $45,000. Finally, Quest Partners LLC purchased a new position in Summit Materials in the second quarter worth $40,000.

Summit Materials Trading Up 4.2 %

Shares of Summit Materials stock traded up $1.80 during midday trading on Friday, reaching $45.10. The company had a trading volume of 4,311,160 shares, compared to its average volume of 1,028,031. The stock has a fifty day moving average price of $38.80 and a 200 day moving average price of $38.73. The company has a debt-to-equity ratio of 0.64, a current ratio of 2.62 and a quick ratio of 2.01. The firm has a market cap of $7.91 billion, a PE ratio of 20.13 and a beta of 1.17. Summit Materials has a fifty-two week low of $30.83 and a fifty-two week high of $46.20.

Summit Materials (NYSE:SUM - Get Free Report) last posted its quarterly earnings data on Monday, August 5th. The construction company reported $0.66 EPS for the quarter, topping analysts' consensus estimates of $0.61 by $0.05. The company had revenue of $1.08 billion for the quarter, compared to analyst estimates of $1.14 billion. Summit Materials had a return on equity of 7.00% and a net margin of 8.06%. The firm's quarterly revenue was up 58.1% on a year-over-year basis. During the same period in the previous year, the firm earned $0.71 earnings per share. On average, equities analysts anticipate that Summit Materials will post 1.63 earnings per share for the current year.

Summit Materials Company Profile

(

Get Free ReportSummit Materials, Inc operates as a vertically integrated construction materials company in the United States and Canada. It operates in three segments: West, East, and Cement. The company offers aggregates, cement, ready-mix concrete, asphalt paving mixes, and concrete products, as well as plastics components.

Featured Stories

Before you consider Summit Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Summit Materials wasn't on the list.

While Summit Materials currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.