Highland Capital Management LLC reduced its position in shares of Synchrony Financial (NYSE:SYF - Free Report) by 7.2% during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 119,763 shares of the financial services provider's stock after selling 9,320 shares during the quarter. Highland Capital Management LLC's holdings in Synchrony Financial were worth $5,974,000 as of its most recent filing with the Securities & Exchange Commission.

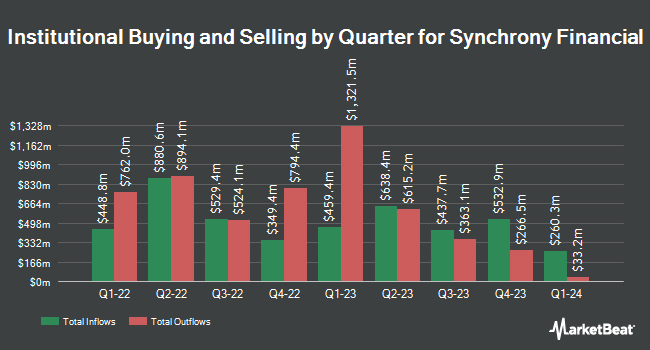

A number of other institutional investors and hedge funds have also bought and sold shares of the company. Dimensional Fund Advisors LP boosted its position in Synchrony Financial by 4.9% during the 2nd quarter. Dimensional Fund Advisors LP now owns 6,686,486 shares of the financial services provider's stock valued at $315,381,000 after acquiring an additional 313,128 shares in the last quarter. Boston Partners boosted its position in Synchrony Financial by 66.6% during the first quarter. Boston Partners now owns 6,374,260 shares of the financial services provider's stock valued at $274,892,000 after purchasing an additional 2,548,180 shares in the last quarter. AQR Capital Management LLC boosted its position in Synchrony Financial by 14.6% during the second quarter. AQR Capital Management LLC now owns 5,726,704 shares of the financial services provider's stock valued at $264,917,000 after purchasing an additional 727,649 shares in the last quarter. Jacobs Levy Equity Management Inc. grew its stake in Synchrony Financial by 2.9% in the first quarter. Jacobs Levy Equity Management Inc. now owns 3,496,009 shares of the financial services provider's stock valued at $150,748,000 after purchasing an additional 97,235 shares during the last quarter. Finally, Hsbc Holdings PLC raised its holdings in Synchrony Financial by 18.7% in the second quarter. Hsbc Holdings PLC now owns 3,131,599 shares of the financial services provider's stock worth $147,599,000 after purchasing an additional 492,312 shares in the last quarter. 96.48% of the stock is owned by institutional investors.

Synchrony Financial Stock Performance

NYSE:SYF traded down $0.11 during mid-day trading on Friday, hitting $55.15. The company's stock had a trading volume of 3,213,760 shares, compared to its average volume of 3,938,657. The business's fifty day moving average is $50.37 and its two-hundred day moving average is $47.08. The stock has a market cap of $22.15 billion, a price-to-earnings ratio of 7.91, a PEG ratio of 1.22 and a beta of 1.61. The company has a debt-to-equity ratio of 1.06, a current ratio of 1.25 and a quick ratio of 1.23. Synchrony Financial has a 1 year low of $27.65 and a 1 year high of $57.26.

Synchrony Financial (NYSE:SYF - Get Free Report) last posted its earnings results on Wednesday, October 16th. The financial services provider reported $1.94 EPS for the quarter, topping the consensus estimate of $1.77 by $0.17. The firm had revenue of $3.81 billion for the quarter, compared to analyst estimates of $3.76 billion. Synchrony Financial had a return on equity of 16.64% and a net margin of 13.98%. Synchrony Financial's revenue for the quarter was up 9.8% compared to the same quarter last year. During the same period last year, the company earned $1.48 earnings per share. Analysts anticipate that Synchrony Financial will post 6.19 EPS for the current fiscal year.

Synchrony Financial Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, November 15th. Investors of record on Monday, November 4th will be paid a $0.25 dividend. This represents a $1.00 annualized dividend and a dividend yield of 1.81%. The ex-dividend date of this dividend is Monday, November 4th. Synchrony Financial's dividend payout ratio is currently 14.35%.

Analysts Set New Price Targets

A number of analysts have recently weighed in on the stock. Deutsche Bank Aktiengesellschaft raised their price target on shares of Synchrony Financial from $58.00 to $68.00 and gave the company a "buy" rating in a report on Thursday, October 17th. JPMorgan Chase & Co. raised their target price on shares of Synchrony Financial from $46.00 to $52.00 and gave the company a "neutral" rating in a research note on Monday, July 8th. Baird R W raised Synchrony Financial to a "strong-buy" rating in a research report on Friday, June 28th. Barclays raised their price objective on Synchrony Financial from $49.00 to $59.00 and gave the stock an "equal weight" rating in a research report on Thursday, October 17th. Finally, Wells Fargo & Company increased their price target on Synchrony Financial from $53.00 to $60.00 and gave the company an "equal weight" rating in a research note on Thursday, October 17th. One equities research analyst has rated the stock with a sell rating, eight have assigned a hold rating, thirteen have assigned a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, Synchrony Financial currently has a consensus rating of "Moderate Buy" and a consensus target price of $56.25.

View Our Latest Stock Analysis on Synchrony Financial

Insider Buying and Selling

In other Synchrony Financial news, insider Bart Schaller sold 930 shares of Synchrony Financial stock in a transaction on Thursday, August 1st. The shares were sold at an average price of $50.84, for a total value of $47,281.20. Following the completion of the transaction, the insider now owns 49,390 shares of the company's stock, valued at approximately $2,510,987.60. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. In related news, insider Bart Schaller sold 930 shares of the firm's stock in a transaction dated Thursday, August 1st. The shares were sold at an average price of $50.84, for a total value of $47,281.20. Following the transaction, the insider now directly owns 49,390 shares of the company's stock, valued at approximately $2,510,987.60. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, insider Brian J. Sr. Wenzel sold 74,698 shares of Synchrony Financial stock in a transaction that occurred on Monday, August 19th. The stock was sold at an average price of $46.73, for a total value of $3,490,637.54. Following the completion of the sale, the insider now directly owns 76,251 shares in the company, valued at $3,563,209.23. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.33% of the stock is currently owned by insiders.

Synchrony Financial Profile

(

Free Report)

Synchrony Financial, together with its subsidiaries, operates as a consumer financial services company in the United States. It provides credit products, such as credit cards, commercial credit products, and consumer installment loans. The company also offers private label credit cards, dual co-brand and general purpose credit cards, short- and long-term installment loans, and consumer banking products; and deposit products, including certificates of deposit, individual retirement accounts, money market accounts, and savings accounts, and sweep and affinity deposits, as well as accepts deposits through third-party securities brokerage firms.

Featured Articles

Before you consider Synchrony Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synchrony Financial wasn't on the list.

While Synchrony Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report