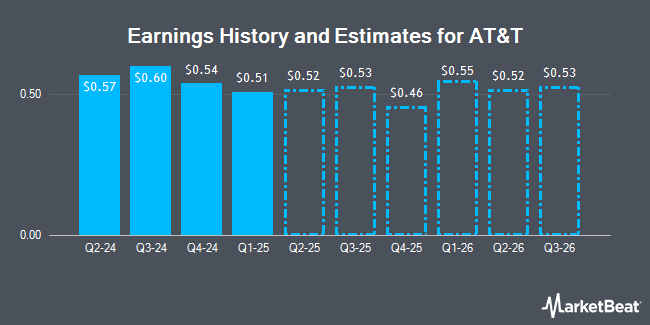

AT&T (NYSE:T - Get Free Report) updated its FY 2024 earnings guidance on Friday. The company provided earnings per share (EPS) guidance of 2.150-2.250 for the period, compared to the consensus estimate of 2.200. The company issued revenue guidance of -.

AT&T Stock Down 1.9 %

T stock traded down $0.42 during midday trading on Friday, hitting $22.12. The company's stock had a trading volume of 37,146,556 shares, compared to its average volume of 35,785,090. The company's fifty day moving average price is $21.47 and its 200 day moving average price is $19.31. The company has a debt-to-equity ratio of 1.09, a current ratio of 0.73 and a quick ratio of 0.67. AT&T has a twelve month low of $15.46 and a twelve month high of $22.73. The stock has a market capitalization of $158.72 billion, a P/E ratio of 17.98, a PEG ratio of 3.31 and a beta of 0.60.

AT&T (NYSE:T - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The technology company reported $0.60 EPS for the quarter, beating the consensus estimate of $0.57 by $0.03. AT&T had a return on equity of 13.97% and a net margin of 7.42%. The company had revenue of $30.20 billion during the quarter, compared to the consensus estimate of $30.50 billion. During the same quarter in the prior year, the firm posted $0.64 EPS. The firm's revenue for the quarter was down .5% compared to the same quarter last year. As a group, equities research analysts predict that AT&T will post 2.22 EPS for the current year.

AT&T Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, November 1st. Investors of record on Thursday, October 10th will be paid a $0.2775 dividend. This represents a $1.11 dividend on an annualized basis and a yield of 5.02%. The ex-dividend date of this dividend is Thursday, October 10th. AT&T's dividend payout ratio (DPR) is presently 90.24%.

Analyst Ratings Changes

Several equities analysts have recently commented on the company. Daiwa America raised AT&T to a "hold" rating in a research report on Friday, July 26th. JPMorgan Chase & Co. upped their price objective on AT&T from $21.00 to $24.00 and gave the company an "overweight" rating in a report on Thursday, July 25th. Moffett Nathanson lifted their target price on AT&T from $17.00 to $18.00 and gave the stock a "neutral" rating in a report on Thursday, August 15th. Scotiabank downgraded shares of AT&T from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, August 6th. Finally, Redburn Atlantic raised shares of AT&T to a "strong sell" rating in a research report on Monday, September 16th. One equities research analyst has rated the stock with a sell rating, eight have given a hold rating, ten have issued a buy rating and one has given a strong buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $23.40.

Get Our Latest Report on T

AT&T Company Profile

(

Get Free Report)

AT&T Inc provides telecommunications and technology services worldwide. The company operates through two segments, Communications and Latin America. The Communications segment offers wireless voice and data communications services; and sells handsets, wireless data cards, wireless computing devices, carrying cases/protective covers, and wireless chargers through its own company-owned stores, agents, and third-party retail stores.

Further Reading

Before you consider AT&T, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AT&T wasn't on the list.

While AT&T currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.