SteelPeak Wealth LLC lifted its stake in AT&T Inc. (NYSE:T - Free Report) by 20.8% in the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 553,778 shares of the technology company's stock after buying an additional 95,239 shares during the period. SteelPeak Wealth LLC's holdings in AT&T were worth $12,183,000 at the end of the most recent reporting period.

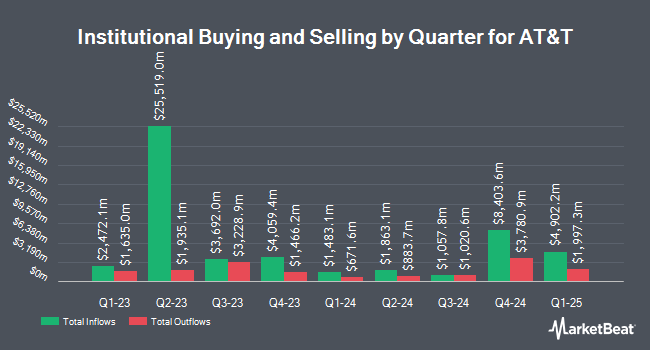

Other institutional investors have also added to or reduced their stakes in the company. Miracle Mile Advisors LLC raised its position in AT&T by 3.1% in the first quarter. Miracle Mile Advisors LLC now owns 35,699 shares of the technology company's stock worth $628,000 after purchasing an additional 1,061 shares in the last quarter. Valley National Advisers Inc. lifted its position in shares of AT&T by 3.7% during the 1st quarter. Valley National Advisers Inc. now owns 26,934 shares of the technology company's stock worth $474,000 after buying an additional 958 shares during the period. Kovack Advisors Inc. boosted its stake in AT&T by 8.0% in the 1st quarter. Kovack Advisors Inc. now owns 169,908 shares of the technology company's stock valued at $2,990,000 after buying an additional 12,584 shares in the last quarter. First Trust Direct Indexing L.P. grew its position in AT&T by 3.8% in the first quarter. First Trust Direct Indexing L.P. now owns 191,305 shares of the technology company's stock valued at $3,367,000 after acquiring an additional 6,932 shares during the period. Finally, Uncommon Cents Investing LLC raised its stake in AT&T by 2.6% during the first quarter. Uncommon Cents Investing LLC now owns 29,000 shares of the technology company's stock worth $510,000 after acquiring an additional 735 shares in the last quarter. 57.10% of the stock is owned by institutional investors and hedge funds.

AT&T Stock Down 0.8 %

T traded down $0.17 during trading on Wednesday, hitting $22.01. The company had a trading volume of 36,252,066 shares, compared to its average volume of 35,665,242. The company has a market capitalization of $157.82 billion, a PE ratio of 17.89, a PEG ratio of 3.74 and a beta of 0.60. The company has a quick ratio of 0.67, a current ratio of 0.73 and a debt-to-equity ratio of 1.09. AT&T Inc. has a one year low of $15.25 and a one year high of $22.58. The firm's 50-day moving average price is $21.31 and its 200 day moving average price is $19.23.

AT&T (NYSE:T - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The technology company reported $0.60 EPS for the quarter, beating analysts' consensus estimates of $0.57 by $0.03. The company had revenue of $30.20 billion for the quarter, compared to analyst estimates of $30.50 billion. AT&T had a return on equity of 13.97% and a net margin of 7.42%. The company's quarterly revenue was down .5% compared to the same quarter last year. During the same period in the previous year, the company posted $0.64 earnings per share. As a group, equities analysts expect that AT&T Inc. will post 2.21 earnings per share for the current year.

AT&T Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, November 1st. Stockholders of record on Thursday, October 10th will be issued a $0.2775 dividend. The ex-dividend date of this dividend is Thursday, October 10th. This represents a $1.11 dividend on an annualized basis and a dividend yield of 5.04%. AT&T's dividend payout ratio (DPR) is presently 90.24%.

Analyst Upgrades and Downgrades

T has been the subject of several analyst reports. JPMorgan Chase & Co. lifted their price target on shares of AT&T from $21.00 to $24.00 and gave the company an "overweight" rating in a report on Thursday, July 25th. Scotiabank lowered AT&T from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, August 6th. Royal Bank of Canada restated a "sector perform" rating and set a $22.00 target price on shares of AT&T in a report on Thursday, October 24th. Oppenheimer upped their price target on shares of AT&T from $23.00 to $24.00 and gave the stock an "outperform" rating in a research report on Thursday, October 24th. Finally, TD Cowen raised their price objective on shares of AT&T from $21.00 to $23.00 and gave the company a "hold" rating in a research report on Thursday, July 25th. One analyst has rated the stock with a sell rating, eight have given a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $23.40.

View Our Latest Stock Report on AT&T

About AT&T

(

Free Report)

AT&T Inc provides telecommunications and technology services worldwide. The company operates through two segments, Communications and Latin America. The Communications segment offers wireless voice and data communications services; and sells handsets, wireless data cards, wireless computing devices, carrying cases/protective covers, and wireless chargers through its own company-owned stores, agents, and third-party retail stores.

Featured Articles

Before you consider AT&T, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AT&T wasn't on the list.

While AT&T currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.