Forsta AP Fonden grew its stake in shares of Molson Coors Beverage (NYSE:TAP - Free Report) by 35.7% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 174,000 shares of the company's stock after purchasing an additional 45,800 shares during the quarter. Forsta AP Fonden owned approximately 0.08% of Molson Coors Beverage worth $10,008,000 at the end of the most recent quarter.

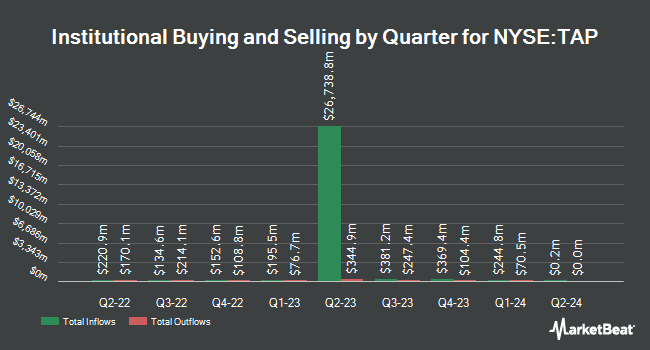

Other hedge funds have also recently made changes to their positions in the company. Family Firm Inc. purchased a new position in Molson Coors Beverage during the 2nd quarter worth $26,000. Altshuler Shaham Ltd purchased a new position in shares of Molson Coors Beverage during the second quarter valued at $27,000. GPS Wealth Strategies Group LLC raised its holdings in shares of Molson Coors Beverage by 83.8% in the second quarter. GPS Wealth Strategies Group LLC now owns 645 shares of the company's stock valued at $33,000 after acquiring an additional 294 shares in the last quarter. Crewe Advisors LLC purchased a new stake in Molson Coors Beverage in the first quarter worth about $43,000. Finally, Quarry LP bought a new position in Molson Coors Beverage during the 2nd quarter worth about $54,000. 78.46% of the stock is currently owned by institutional investors.

Molson Coors Beverage Stock Performance

Shares of TAP traded up $0.24 during trading hours on Monday, reaching $56.01. 891,211 shares of the company traded hands, compared to its average volume of 1,903,555. The company has a quick ratio of 0.75, a current ratio of 0.95 and a debt-to-equity ratio of 0.46. The business has a fifty day moving average price of $55.12 and a 200-day moving average price of $54.78. Molson Coors Beverage has a 12-month low of $49.19 and a 12-month high of $69.18. The stock has a market capitalization of $11.87 billion, a P/E ratio of 11.20, a P/E/G ratio of 2.35 and a beta of 0.81.

Molson Coors Beverage (NYSE:TAP - Get Free Report) last announced its quarterly earnings data on Tuesday, August 6th. The company reported $1.92 earnings per share for the quarter, beating analysts' consensus estimates of $1.68 by $0.24. Molson Coors Beverage had a return on equity of 9.58% and a net margin of 8.27%. The business had revenue of $3.25 billion for the quarter, compared to analyst estimates of $3.18 billion. During the same period in the prior year, the company earned $1.78 earnings per share. The company's revenue was down .4% on a year-over-year basis. Equities analysts anticipate that Molson Coors Beverage will post 5.74 EPS for the current fiscal year.

Wall Street Analyst Weigh In

Several equities research analysts have recently weighed in on the stock. Piper Sandler upped their price target on shares of Molson Coors Beverage from $57.00 to $59.00 and gave the stock a "neutral" rating in a research report on Wednesday, August 7th. Wells Fargo & Company increased their target price on Molson Coors Beverage from $50.00 to $54.00 and gave the company an "underweight" rating in a research report on Wednesday, August 7th. Citigroup reduced their price target on Molson Coors Beverage from $53.00 to $47.00 and set a "sell" rating for the company in a research report on Wednesday, July 10th. UBS Group raised their price objective on Molson Coors Beverage from $55.00 to $58.00 and gave the company a "neutral" rating in a research report on Wednesday, August 7th. Finally, Deutsche Bank Aktiengesellschaft boosted their target price on shares of Molson Coors Beverage from $56.00 to $57.00 and gave the stock a "hold" rating in a report on Wednesday, August 7th. Three investment analysts have rated the stock with a sell rating, ten have assigned a hold rating and two have assigned a buy rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $59.43.

View Our Latest Analysis on TAP

Molson Coors Beverage Company Profile

(

Free Report)

Molson Coors Beverage Company manufactures, markets, and sells beer and other malt beverage products under various brands in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers flavored malt beverages including hard seltzers, craft, spirits and energy, and ready to drink beverages.

See Also

Before you consider Molson Coors Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molson Coors Beverage wasn't on the list.

While Molson Coors Beverage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.