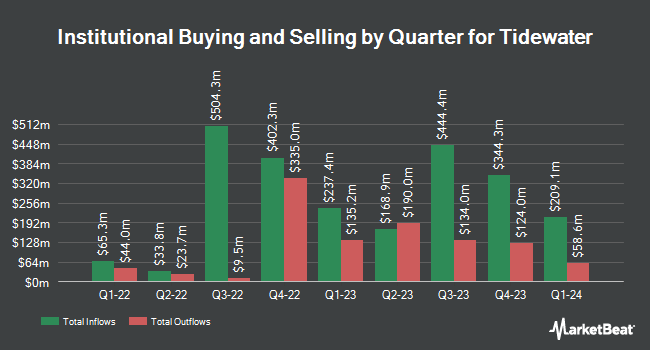

Van ECK Associates Corp acquired a new position in Tidewater Inc. (NYSE:TDW - Free Report) during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund acquired 711,643 shares of the oil and gas company's stock, valued at approximately $51,089,000. Van ECK Associates Corp owned about 1.35% of Tidewater as of its most recent SEC filing.

Several other large investors have also recently modified their holdings of TDW. Empire Life Investments Inc. grew its holdings in Tidewater by 29.3% in the third quarter. Empire Life Investments Inc. now owns 293,884 shares of the oil and gas company's stock worth $21,098,000 after purchasing an additional 66,528 shares during the last quarter. Harbor Capital Advisors Inc. increased its position in Tidewater by 207.8% during the 3rd quarter. Harbor Capital Advisors Inc. now owns 124,391 shares of the oil and gas company's stock valued at $8,930,000 after buying an additional 83,975 shares in the last quarter. VELA Investment Management LLC raised its stake in Tidewater by 7.1% in the third quarter. VELA Investment Management LLC now owns 23,832 shares of the oil and gas company's stock valued at $1,711,000 after buying an additional 1,583 shares during the last quarter. Chicago Partners Investment Group LLC boosted its holdings in Tidewater by 17.6% in the third quarter. Chicago Partners Investment Group LLC now owns 5,622 shares of the oil and gas company's stock worth $404,000 after acquiring an additional 840 shares in the last quarter. Finally, Tectonic Advisors LLC purchased a new stake in shares of Tidewater during the third quarter worth about $1,233,000. Institutional investors own 95.13% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages recently issued reports on TDW. StockNews.com lowered Tidewater from a "hold" rating to a "sell" rating in a research note on Saturday, October 26th. Raymond James lifted their target price on Tidewater from $133.00 to $138.00 and gave the stock a "strong-buy" rating in a report on Thursday, August 8th. One investment analyst has rated the stock with a sell rating, four have issued a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, Tidewater has an average rating of "Moderate Buy" and a consensus target price of $111.25.

View Our Latest Report on Tidewater

Tidewater Price Performance

NYSE TDW traded up $0.95 on Monday, hitting $59.77. The company had a trading volume of 788,721 shares, compared to its average volume of 886,261. The company has a debt-to-equity ratio of 0.56, a current ratio of 1.90 and a quick ratio of 1.82. The company has a market capitalization of $3.14 billion, a PE ratio of 20.11 and a beta of 1.15. Tidewater Inc. has a 12-month low of $54.53 and a 12-month high of $111.42. The company's fifty day moving average price is $71.55 and its 200-day moving average price is $87.91.

Tidewater (NYSE:TDW - Get Free Report) last posted its quarterly earnings data on Tuesday, August 6th. The oil and gas company reported $0.94 EPS for the quarter, beating the consensus estimate of $0.72 by $0.22. The firm had revenue of $339.20 million during the quarter, compared to the consensus estimate of $331.85 million. Tidewater had a return on equity of 18.04% and a net margin of 12.77%. The firm's revenue was up 57.8% compared to the same quarter last year. During the same period in the prior year, the company earned $0.46 EPS. As a group, analysts predict that Tidewater Inc. will post 4.4 earnings per share for the current year.

Tidewater declared that its board has authorized a share buyback program on Tuesday, August 6th that authorizes the company to buyback $13.90 million in shares. This buyback authorization authorizes the oil and gas company to buy up to 0.3% of its shares through open market purchases. Shares buyback programs are generally a sign that the company's board believes its stock is undervalued.

Tidewater Company Profile

(

Free Report)

Tidewater Inc, together with its subsidiaries, provides offshore support vessels and marine support services to the offshore energy industry through the operation of a fleet of marine service vessels worldwide. It provides services in support of offshore oil and gas exploration, field development, and production, as well as windfarm development and maintenance, including towing of and anchor handling for mobile offshore drilling units; transporting supplies and personnel necessary to sustain drilling, workover, and production activities; offshore construction, and seismic and subsea support; geotechnical survey support for windfarm construction; and various specialized services, such as pipe and cable laying.

See Also

Before you consider Tidewater, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tidewater wasn't on the list.

While Tidewater currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.