GHP Investment Advisors Inc. raised its position in shares of Teledyne Technologies Incorporated (NYSE:TDY - Free Report) by 3.7% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 30,480 shares of the scientific and technical instruments company's stock after purchasing an additional 1,085 shares during the period. GHP Investment Advisors Inc. owned 0.07% of Teledyne Technologies worth $13,340,000 at the end of the most recent quarter.

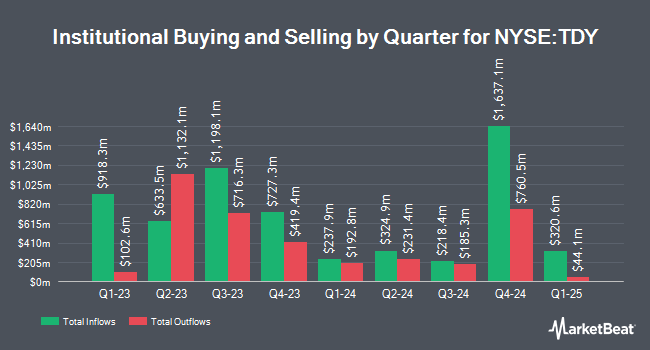

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Orion Portfolio Solutions LLC boosted its stake in Teledyne Technologies by 46.2% during the 1st quarter. Orion Portfolio Solutions LLC now owns 4,161 shares of the scientific and technical instruments company's stock valued at $1,786,000 after purchasing an additional 1,315 shares during the period. Clearbridge Investments LLC boosted its stake in Teledyne Technologies by 11.2% during the 1st quarter. Clearbridge Investments LLC now owns 267,036 shares of the scientific and technical instruments company's stock valued at $114,644,000 after purchasing an additional 26,793 shares during the period. State Board of Administration of Florida Retirement System boosted its stake in Teledyne Technologies by 3.6% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 48,288 shares of the scientific and technical instruments company's stock valued at $21,602,000 after purchasing an additional 1,665 shares during the period. SG Americas Securities LLC boosted its stake in Teledyne Technologies by 49.8% during the 1st quarter. SG Americas Securities LLC now owns 13,349 shares of the scientific and technical instruments company's stock valued at $5,731,000 after purchasing an additional 4,440 shares during the period. Finally, Envestnet Portfolio Solutions Inc. boosted its stake in Teledyne Technologies by 38.2% during the 1st quarter. Envestnet Portfolio Solutions Inc. now owns 12,781 shares of the scientific and technical instruments company's stock valued at $5,487,000 after purchasing an additional 3,532 shares during the period. 91.58% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of analysts have recently weighed in on the stock. StockNews.com raised shares of Teledyne Technologies from a "hold" rating to a "buy" rating in a research note on Wednesday, October 2nd. Needham & Company LLC increased their price objective on shares of Teledyne Technologies from $482.00 to $528.00 and gave the company a "buy" rating in a report on Thursday. Vertical Research began coverage on shares of Teledyne Technologies in a report on Tuesday, July 23rd. They issued a "buy" rating and a $470.00 price objective for the company. Finally, TD Cowen increased their price objective on shares of Teledyne Technologies from $450.00 to $500.00 and gave the company a "buy" rating in a report on Thursday. One investment analyst has rated the stock with a hold rating and four have issued a buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $474.50.

Read Our Latest Analysis on Teledyne Technologies

Teledyne Technologies Price Performance

NYSE:TDY traded down $3.67 during trading hours on Friday, reaching $469.19. 205,880 shares of the company's stock were exchanged, compared to its average volume of 240,819. The company has a market capitalization of $21.95 billion, a P/E ratio of 25.51, a price-to-earnings-growth ratio of 3.11 and a beta of 1.01. Teledyne Technologies Incorporated has a 12 month low of $355.41 and a 12 month high of $475.73. The company has a quick ratio of 1.28, a current ratio of 1.98 and a debt-to-equity ratio of 0.28. The business's 50-day simple moving average is $435.99 and its two-hundred day simple moving average is $410.52.

Teledyne Technologies (NYSE:TDY - Get Free Report) last issued its earnings results on Wednesday, October 23rd. The scientific and technical instruments company reported $5.10 earnings per share for the quarter, topping analysts' consensus estimates of $4.97 by $0.13. The firm had revenue of $1.44 billion during the quarter, compared to analysts' expectations of $1.42 billion. Teledyne Technologies had a net margin of 15.86% and a return on equity of 10.27%. The firm's revenue for the quarter was up 2.9% compared to the same quarter last year. During the same period last year, the firm posted $5.05 earnings per share. Sell-side analysts expect that Teledyne Technologies Incorporated will post 19.43 EPS for the current fiscal year.

Teledyne Technologies Profile

(

Free Report)

Teledyne Technologies Incorporated, together with its subsidiaries, provides enabling technologies for industrial growth markets in the United States and internationally. Its Digital Imaging segment provides visible spectrum sensors and digital cameras; and infrared, ultraviolet, visible, and X-ray spectra; as well as micro electromechanical systems and semiconductors, including analog-to-digital and digital-to-analog converters.

Featured Articles

Before you consider Teledyne Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teledyne Technologies wasn't on the list.

While Teledyne Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.