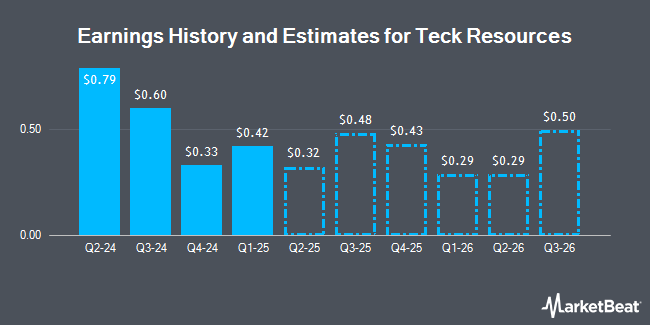

Teck Resources Limited (NYSE:TECK - Free Report) TSE: TECK - Investment analysts at B. Riley dropped their FY2025 earnings per share estimates for shares of Teck Resources in a research report issued to clients and investors on Tuesday, October 22nd. B. Riley analyst L. Pipes now forecasts that the basic materials company will post earnings of $1.20 per share for the year, down from their prior forecast of $1.24. The consensus estimate for Teck Resources' current full-year earnings is $1.93 per share. B. Riley also issued estimates for Teck Resources' FY2026 earnings at $0.99 EPS.

Teck Resources (NYSE:TECK - Get Free Report) TSE: TECK last posted its quarterly earnings data on Wednesday, July 24th. The basic materials company reported $0.79 EPS for the quarter, beating the consensus estimate of $0.47 by $0.32. Teck Resources had a return on equity of 6.52% and a net margin of 9.40%. The business had revenue of $3.87 billion for the quarter, compared to the consensus estimate of $2.67 billion. During the same quarter in the prior year, the business earned $0.91 earnings per share. Teck Resources's revenue for the quarter was up 10.1% on a year-over-year basis.

Several other equities analysts also recently commented on the company. Paradigm Capital upgraded Teck Resources to a "moderate buy" rating in a research note on Friday, July 26th. UBS Group upgraded Teck Resources from a "neutral" rating to a "buy" rating and increased their target price for the stock from $76.00 to $78.00 in a research report on Wednesday, September 4th. Eight Capital downgraded Teck Resources from a "strong-buy" rating to a "hold" rating in a research report on Thursday, July 11th. Scotiabank increased their target price on Teck Resources from $78.00 to $79.00 and gave the stock a "sector outperform" rating in a research report on Tuesday, October 8th. Finally, Benchmark restated a "buy" rating and set a $55.00 target price on shares of Teck Resources in a research report on Thursday, July 25th. Three analysts have rated the stock with a hold rating, eight have given a buy rating and one has given a strong buy rating to the company. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $67.43.

View Our Latest Report on Teck Resources

Teck Resources Stock Performance

Teck Resources stock traded down $2.72 during trading on Thursday, hitting $46.83. The stock had a trading volume of 9,389,567 shares, compared to its average volume of 3,446,553. Teck Resources has a 1 year low of $34.38 and a 1 year high of $55.13. The company has a quick ratio of 0.77, a current ratio of 1.48 and a debt-to-equity ratio of 0.19. The stock's 50 day moving average is $48.80 and its two-hundred day moving average is $48.74. The stock has a market cap of $23.70 billion, a price-to-earnings ratio of 22.73 and a beta of 1.02.

Hedge Funds Weigh In On Teck Resources

A number of hedge funds and other institutional investors have recently bought and sold shares of TECK. Vanguard Group Inc. lifted its holdings in shares of Teck Resources by 1.8% during the 1st quarter. Vanguard Group Inc. now owns 16,721,130 shares of the basic materials company's stock worth $765,493,000 after acquiring an additional 290,034 shares during the last quarter. Janus Henderson Group PLC boosted its holdings in shares of Teck Resources by 2.4% in the 1st quarter. Janus Henderson Group PLC now owns 8,604,605 shares of the basic materials company's stock worth $394,178,000 after purchasing an additional 203,607 shares in the last quarter. CIBC Asset Management Inc increased its position in shares of Teck Resources by 1.4% during the 2nd quarter. CIBC Asset Management Inc now owns 6,330,121 shares of the basic materials company's stock valued at $303,161,000 after purchasing an additional 90,089 shares during the last quarter. Principal Financial Group Inc. raised its holdings in shares of Teck Resources by 7.3% during the 2nd quarter. Principal Financial Group Inc. now owns 6,103,740 shares of the basic materials company's stock valued at $292,441,000 after buying an additional 416,070 shares in the last quarter. Finally, Mackenzie Financial Corp lifted its position in Teck Resources by 10.3% in the 2nd quarter. Mackenzie Financial Corp now owns 5,855,836 shares of the basic materials company's stock worth $280,655,000 after buying an additional 546,801 shares during the last quarter. Hedge funds and other institutional investors own 78.06% of the company's stock.

About Teck Resources

(

Get Free Report)

Teck Resources Limited engages in exploring for, acquiring, developing, and producing natural resources in Asia, Europe, and North America. The company operates through Steelmaking Coal, Copper, Zinc, and Energy segments. Its principal products include copper, zinc, steelmaking coal, and blended bitumen.

Recommended Stories

Before you consider Teck Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teck Resources wasn't on the list.

While Teck Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.