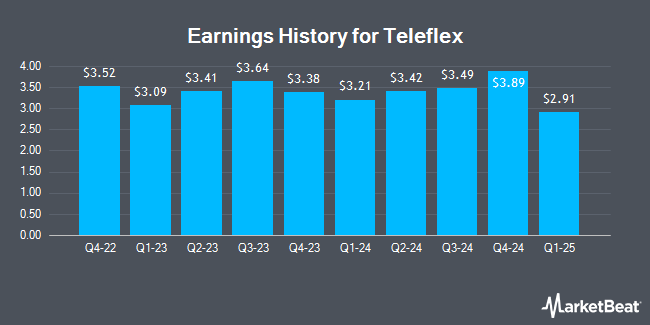

Teleflex (NYSE:TFX - Get Free Report) released its quarterly earnings results on Thursday. The medical technology company reported $3.49 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.38 by $0.11, Briefing.com reports. The business had revenue of $764.40 million during the quarter, compared to the consensus estimate of $768.68 million. Teleflex had a return on equity of 14.19% and a net margin of 7.85%. The company's quarterly revenue was up 2.4% on a year-over-year basis. During the same quarter in the previous year, the business earned $3.64 EPS. Teleflex updated its FY 2024 guidance to 13.900-14.200 EPS and its FY24 guidance to $13.90-14.20 EPS.

Teleflex Stock Performance

Shares of TFX traded up $10.15 during mid-day trading on Friday, hitting $211.21. The stock had a trading volume of 1,057,520 shares, compared to its average volume of 337,919. Teleflex has a 52 week low of $190.49 and a 52 week high of $257.85. The company has a debt-to-equity ratio of 0.37, a current ratio of 2.42 and a quick ratio of 1.44. The business has a fifty day moving average price of $239.55 and a 200-day moving average price of $224.02. The firm has a market cap of $9.95 billion, a P/E ratio of 41.99, a PEG ratio of 1.82 and a beta of 1.18.

Teleflex Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Friday, November 15th will be issued a dividend of $0.34 per share. This represents a $1.36 annualized dividend and a yield of 0.64%. The ex-dividend date of this dividend is Friday, November 15th. Teleflex's dividend payout ratio (DPR) is 27.04%.

Analyst Upgrades and Downgrades

TFX has been the subject of several recent research reports. Needham & Company LLC reiterated a "hold" rating on shares of Teleflex in a report on Friday. Truist Financial lifted their price objective on shares of Teleflex from $247.00 to $255.00 and gave the stock a "hold" rating in a report on Monday, October 14th. Mizuho lowered their target price on shares of Teleflex from $275.00 to $250.00 and set a "neutral" rating for the company in a report on Friday. Royal Bank of Canada cut their price target on shares of Teleflex from $275.00 to $245.00 and set an "outperform" rating on the stock in a report on Friday. Finally, Stephens increased their price objective on shares of Teleflex from $275.00 to $290.00 and gave the company an "overweight" rating in a research note on Friday, August 2nd. Four investment analysts have rated the stock with a hold rating and six have issued a buy rating to the company. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $262.75.

View Our Latest Stock Analysis on TFX

Insider Transactions at Teleflex

In other news, Director Stuart A. Randle sold 2,674 shares of Teleflex stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $238.93, for a total value of $638,898.82. Following the completion of the transaction, the director now owns 5,496 shares in the company, valued at $1,313,159.28. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 1.43% of the stock is owned by corporate insiders.

About Teleflex

(

Get Free Report)

Teleflex Incorporated designs, develops, manufactures, and supplies single-use medical devices for common diagnostic and therapeutic procedures in critical care and surgical applications worldwide. The company provides vascular access products that comprise Arrow branded catheters, catheter navigation and tip positioning systems, and intraosseous access systems for the administration of intravenous therapies, the measurement of blood pressure, and the withdrawal of blood samples through a single puncture site.

Recommended Stories

Before you consider Teleflex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teleflex wasn't on the list.

While Teleflex currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.