Triumph Group (NYSE:TGI - Get Free Report) will be announcing its earnings results before the market opens on Monday, November 4th. Analysts expect the company to announce earnings of $0.05 per share for the quarter. Triumph Group has set its FY25 guidance at $0.52 EPS and its FY 2025 guidance at 0.520-0.520 EPS.Investors interested in registering for the company's conference call can do so using this link.

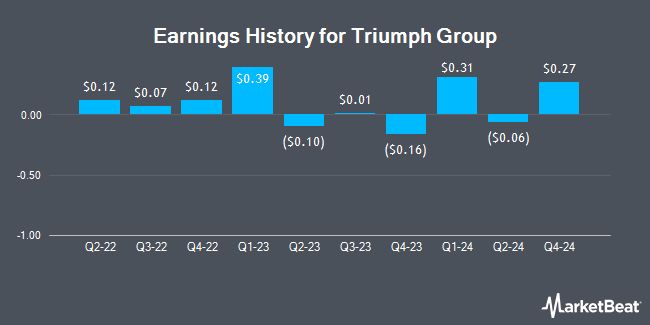

Triumph Group (NYSE:TGI - Get Free Report) last posted its quarterly earnings results on Wednesday, August 7th. The aerospace company reported ($0.06) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.05) by ($0.01). The business had revenue of $281.00 million for the quarter, compared to the consensus estimate of $274.64 million. Triumph Group had a negative return on equity of 1.77% and a net margin of 40.39%. Triumph Group's quarterly revenue was up 6.5% on a year-over-year basis. During the same quarter in the previous year, the company posted ($0.10) earnings per share. On average, analysts expect Triumph Group to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Triumph Group Stock Performance

Shares of Triumph Group stock traded up $0.31 on Monday, reaching $14.90. 479,022 shares of the company's stock were exchanged, compared to its average volume of 878,928. The company has a market capitalization of $1.15 billion, a P/E ratio of 2.25 and a beta of 2.49. Triumph Group has a 52 week low of $7.23 and a 52 week high of $17.87. The firm's 50-day moving average is $13.58 and its two-hundred day moving average is $14.32.

Wall Street Analyst Weigh In

A number of equities analysts have issued reports on TGI shares. Bank of America cut Triumph Group from a "buy" rating to an "underperform" rating and cut their price target for the stock from $17.00 to $12.00 in a report on Tuesday, September 24th. Jefferies Financial Group reiterated a "hold" rating and issued a $14.00 target price (down from $20.00) on shares of Triumph Group in a report on Monday, August 12th. Truist Financial cut their target price on Triumph Group from $15.00 to $12.00 and set a "hold" rating on the stock in a report on Friday, October 18th. JPMorgan Chase & Co. cut Triumph Group from a "neutral" rating to an "underweight" rating and cut their target price for the stock from $15.00 to $12.00 in a report on Monday, October 14th. Finally, Barclays cut their target price on Triumph Group from $18.00 to $16.00 and set an "overweight" rating on the stock in a report on Monday, August 12th. Two equities research analysts have rated the stock with a sell rating, five have assigned a hold rating and three have given a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Hold" and an average target price of $14.78.

View Our Latest Analysis on TGI

About Triumph Group

(

Get Free Report)

Triumph Group, Inc designs, engineers, manufactures, repairs, overhauls, and distributes aircraft, aircraft components, accessories, subassemblies, and systems worldwide. It operates in two segments, Triumph Systems & Support, and Triumph Interiors. The company offers aircraft and engine-mounted accessory drives, thermal control systems and components, cargo hooks, high lift actuations, cockpit control levers, hydraulic systems and components, control system valve bodies, landing gear actuation systems, electronic engine controls, landing gear components and assemblies, cyber protected process controllers, main engine gearbox assemblies, geared transmissions and drive train components, main fuel pumps, fuel-metering units, primary and secondary flight control systems, and vibration absorbers.

Further Reading

Before you consider Triumph Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Triumph Group wasn't on the list.

While Triumph Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.