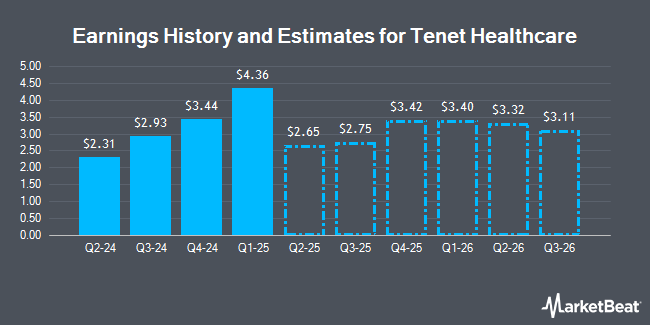

Tenet Healthcare Co. (NYSE:THC - Free Report) - Research analysts at Leerink Partnrs boosted their Q1 2025 earnings estimates for Tenet Healthcare in a note issued to investors on Wednesday, October 23rd. Leerink Partnrs analyst W. Mayo now forecasts that the company will post earnings of $2.56 per share for the quarter, up from their prior estimate of $2.50. The consensus estimate for Tenet Healthcare's current full-year earnings is $10.72 per share. Leerink Partnrs also issued estimates for Tenet Healthcare's Q2 2025 earnings at $2.75 EPS and Q4 2025 earnings at $4.19 EPS.

Other equities research analysts have also recently issued reports about the company. Cantor Fitzgerald reiterated an "overweight" rating and issued a $168.00 price target on shares of Tenet Healthcare in a research note on Tuesday, October 1st. Barclays raised their price target on shares of Tenet Healthcare from $156.00 to $171.00 and gave the stock an "overweight" rating in a report on Monday, July 29th. Truist Financial increased their price objective on Tenet Healthcare from $170.00 to $180.00 and gave the company a "buy" rating in a report on Monday, October 14th. Wells Fargo & Company upped their target price on Tenet Healthcare from $175.00 to $195.00 and gave the company an "overweight" rating in a research report on Tuesday, October 22nd. Finally, Citigroup upped their price objective on shares of Tenet Healthcare from $139.00 to $171.00 and gave the company a "buy" rating in a report on Thursday, July 25th. One research analyst has rated the stock with a hold rating, fourteen have given a buy rating and four have issued a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Buy" and an average target price of $157.24.

Check Out Our Latest Analysis on Tenet Healthcare

Tenet Healthcare Stock Down 0.2 %

Shares of Tenet Healthcare stock traded down $0.28 on Monday, reaching $139.49. The stock had a trading volume of 1,781,335 shares, compared to its average volume of 1,196,522. The stock has a market capitalization of $13.63 billion, a P/E ratio of 5.41, a P/E/G ratio of 0.80 and a beta of 2.14. Tenet Healthcare has a 1 year low of $51.04 and a 1 year high of $171.20. The company has a quick ratio of 1.38, a current ratio of 1.45 and a debt-to-equity ratio of 2.53. The company has a 50 day moving average price of $159.85 and a 200 day moving average price of $140.77.

Tenet Healthcare declared that its board has initiated a share buyback plan on Wednesday, July 24th that authorizes the company to repurchase $1.50 billion in shares. This repurchase authorization authorizes the company to repurchase up to 10.3% of its stock through open market purchases. Stock repurchase plans are typically an indication that the company's management believes its stock is undervalued.

Insider Buying and Selling

In other Tenet Healthcare news, insider R. Scott Ramsey sold 11,599 shares of the business's stock in a transaction dated Thursday, September 5th. The shares were sold at an average price of $162.06, for a total value of $1,879,733.94. Following the transaction, the insider now directly owns 6,324 shares in the company, valued at $1,024,867.44. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. In related news, Director Richard W. Fisher sold 2,000 shares of the firm's stock in a transaction dated Tuesday, August 27th. The stock was sold at an average price of $163.67, for a total transaction of $327,340.00. Following the completion of the sale, the director now directly owns 14,227 shares of the company's stock, valued at approximately $2,328,533.09. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider R. Scott Ramsey sold 11,599 shares of the company's stock in a transaction dated Thursday, September 5th. The shares were sold at an average price of $162.06, for a total transaction of $1,879,733.94. Following the completion of the transaction, the insider now directly owns 6,324 shares in the company, valued at $1,024,867.44. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 128,203 shares of company stock worth $19,754,997 in the last 90 days. Insiders own 0.93% of the company's stock.

Hedge Funds Weigh In On Tenet Healthcare

Several large investors have recently made changes to their positions in THC. Price T Rowe Associates Inc. MD lifted its stake in Tenet Healthcare by 11.1% during the first quarter. Price T Rowe Associates Inc. MD now owns 7,915,000 shares of the company's stock worth $831,947,000 after purchasing an additional 790,684 shares in the last quarter. 8 Knots Management LLC grew its position in Tenet Healthcare by 74.5% in the 1st quarter. 8 Knots Management LLC now owns 1,025,730 shares of the company's stock valued at $107,814,000 after acquiring an additional 438,033 shares in the last quarter. Acadian Asset Management LLC lifted its position in shares of Tenet Healthcare by 7,223.1% during the second quarter. Acadian Asset Management LLC now owns 326,244 shares of the company's stock worth $43,385,000 after purchasing an additional 321,789 shares in the last quarter. Farallon Capital Management LLC grew its holdings in shares of Tenet Healthcare by 70.1% in the first quarter. Farallon Capital Management LLC now owns 637,442 shares of the company's stock valued at $67,002,000 after purchasing an additional 262,600 shares in the last quarter. Finally, Allspring Global Investments Holdings LLC boosted its position in Tenet Healthcare by 344.7% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 317,198 shares of the company's stock valued at $52,718,000 after buying an additional 245,875 shares during the period. 95.44% of the stock is currently owned by institutional investors and hedge funds.

Tenet Healthcare Company Profile

(

Get Free Report)

Tenet Healthcare Corporation operates as a diversified healthcare services company in the United States. The company operates through two segments: Hospital Operations and Services, and Ambulatory Care. Its general hospitals offer acute care services, operating and recovery rooms, radiology and respiratory therapy services, clinical laboratories, and pharmacies.

See Also

Before you consider Tenet Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tenet Healthcare wasn't on the list.

While Tenet Healthcare currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.