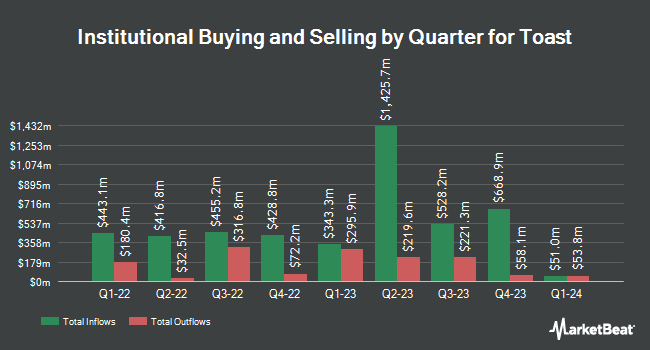

Creative Planning lowered its holdings in Toast, Inc. (NYSE:TOST - Free Report) by 41.4% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 25,432 shares of the company's stock after selling 17,931 shares during the period. Creative Planning's holdings in Toast were worth $718,000 as of its most recent filing with the Securities and Exchange Commission.

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in TOST. Wynn Capital LLC increased its position in shares of Toast by 23.4% during the 3rd quarter. Wynn Capital LLC now owns 12,700 shares of the company's stock worth $360,000 after purchasing an additional 2,405 shares during the last quarter. Livforsakringsbolaget Skandia Omsesidigt acquired a new position in shares of Toast during the 3rd quarter worth about $82,000. Trevian Wealth Management LLC bought a new stake in shares of Toast in the 3rd quarter valued at about $1,398,000. Atomi Financial Group Inc. acquired a new position in Toast during the third quarter worth approximately $330,000. Finally, Mirador Capital Partners LP raised its stake in Toast by 7.4% in the third quarter. Mirador Capital Partners LP now owns 41,578 shares of the company's stock valued at $1,177,000 after buying an additional 2,862 shares during the period. 82.91% of the stock is currently owned by institutional investors and hedge funds.

Toast Stock Performance

Shares of TOST stock traded down $0.66 on Monday, hitting $30.32. The company had a trading volume of 5,429,002 shares, compared to its average volume of 7,075,534. The stock's 50-day moving average is $27.37 and its two-hundred day moving average is $25.65. The firm has a market cap of $13.98 billion, a P/E ratio of -107.10 and a beta of 1.74. Toast, Inc. has a twelve month low of $13.77 and a twelve month high of $31.57.

Toast (NYSE:TOST - Get Free Report) last announced its earnings results on Tuesday, August 6th. The company reported $0.02 earnings per share for the quarter, topping analysts' consensus estimates of ($0.02) by $0.04. The business had revenue of $1.24 billion during the quarter, compared to the consensus estimate of $1.22 billion. Toast had a negative net margin of 3.10% and a negative return on equity of 11.27%. Toast's quarterly revenue was up 27.0% on a year-over-year basis. During the same quarter last year, the firm earned ($0.19) earnings per share. Equities research analysts predict that Toast, Inc. will post -0.1 EPS for the current year.

Analyst Upgrades and Downgrades

Several analysts recently commented on the stock. Stephens lifted their target price on shares of Toast from $28.00 to $30.00 and gave the stock an "equal weight" rating in a report on Friday, October 18th. Deutsche Bank Aktiengesellschaft upped their target price on Toast from $24.00 to $30.00 and gave the company a "hold" rating in a research report on Monday. Needham & Company LLC reissued a "buy" rating and set a $30.00 price target on shares of Toast in a report on Wednesday, August 7th. DA Davidson upped their price objective on Toast from $32.00 to $35.00 and gave the company a "buy" rating in a report on Tuesday, October 29th. Finally, Wedbush raised Toast to a "strong-buy" rating in a report on Friday, September 6th. One analyst has rated the stock with a sell rating, nine have assigned a hold rating, ten have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, Toast has an average rating of "Moderate Buy" and an average price target of $29.30.

View Our Latest Report on TOST

Insider Activity

In other news, General Counsel Brian R. Elworthy sold 300,000 shares of the company's stock in a transaction dated Friday, October 18th. The shares were sold at an average price of $30.39, for a total transaction of $9,117,000.00. Following the transaction, the general counsel now owns 177,836 shares in the company, valued at approximately $5,404,436.04. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. In other news, General Counsel Brian R. Elworthy sold 300,000 shares of the company's stock in a transaction that occurred on Friday, October 18th. The stock was sold at an average price of $30.39, for a total transaction of $9,117,000.00. Following the transaction, the general counsel now directly owns 177,836 shares of the company's stock, valued at $5,404,436.04. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, General Counsel Brian R. Elworthy sold 2,878 shares of the stock in a transaction on Wednesday, October 2nd. The stock was sold at an average price of $27.77, for a total value of $79,922.06. Following the completion of the transaction, the general counsel now owns 177,836 shares in the company, valued at approximately $4,938,505.72. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 1,370,721 shares of company stock worth $37,996,988 in the last quarter. 13.32% of the stock is owned by corporate insiders.

Toast Profile

(

Free Report)

Toast, Inc operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India. The company offers software products for restaurant operations and point of sale, such as Toast POS, Toast now, multi-location management, kitchen display system, Toast mobile order and pay, Toast catering and events, Toast invoicing, Toast tables, and restaurant retail; and hardware products, including Toast flex, Toast flex for guest, Toast go 2, Toast tap, kiosks, and Delphi by Toast.

Read More

Before you consider Toast, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toast wasn't on the list.

While Toast currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report