Donald Smith & CO. Inc. lessened its stake in Tutor Perini Co. (NYSE:TPC - Free Report) by 1.1% in the third quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 3,270,438 shares of the construction company's stock after selling 36,601 shares during the period. Tutor Perini accounts for 2.1% of Donald Smith & CO. Inc.'s portfolio, making the stock its 21st biggest holding. Donald Smith & CO. Inc. owned about 6.26% of Tutor Perini worth $88,825,000 as of its most recent filing with the Securities & Exchange Commission.

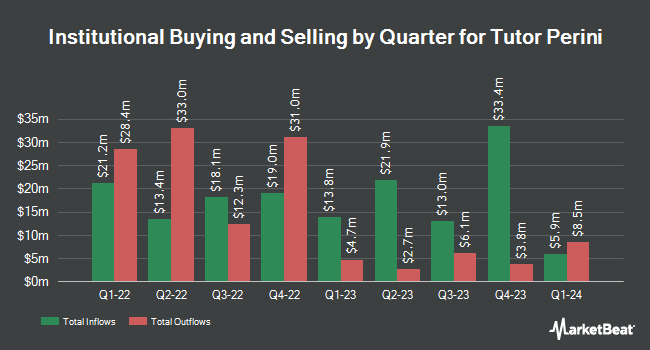

A number of other hedge funds have also modified their holdings of TPC. CWM LLC grew its holdings in Tutor Perini by 142.8% during the second quarter. CWM LLC now owns 1,714 shares of the construction company's stock valued at $37,000 after purchasing an additional 1,008 shares during the period. Allspring Global Investments Holdings LLC acquired a new stake in shares of Tutor Perini in the 2nd quarter valued at $51,000. nVerses Capital LLC acquired a new stake in shares of Tutor Perini during the second quarter valued at about $63,000. EntryPoint Capital LLC bought a new position in Tutor Perini during the first quarter worth $77,000. Finally, Quest Partners LLC increased its position in Tutor Perini by 537.2% in the 2nd quarter. Quest Partners LLC now owns 4,148 shares of the construction company's stock valued at $90,000 after buying an additional 3,497 shares in the last quarter. 65.01% of the stock is currently owned by institutional investors and hedge funds.

Tutor Perini Stock Performance

Shares of TPC stock traded down $0.04 on Wednesday, hitting $26.54. The company had a trading volume of 235,751 shares, compared to its average volume of 446,674. The company has a quick ratio of 1.65, a current ratio of 1.65 and a debt-to-equity ratio of 0.50. The firm has a market cap of $1.39 billion, a P/E ratio of -13.05 and a beta of 1.50. The company has a 50-day moving average price of $25.20 and a 200-day moving average price of $22.05. Tutor Perini Co. has a twelve month low of $6.86 and a twelve month high of $30.99.

Tutor Perini (NYSE:TPC - Get Free Report) last announced its quarterly earnings data on Thursday, August 1st. The construction company reported $0.02 EPS for the quarter, missing analysts' consensus estimates of $0.17 by ($0.15). Tutor Perini had a negative return on equity of 4.49% and a negative net margin of 1.59%. The company had revenue of $1.13 billion for the quarter, compared to analyst estimates of $1.14 billion. During the same period in the prior year, the firm posted ($0.72) earnings per share. The business's quarterly revenue was up 10.4% compared to the same quarter last year. As a group, equities research analysts predict that Tutor Perini Co. will post 1.12 earnings per share for the current fiscal year.

Analyst Ratings Changes

TPC has been the topic of a number of recent research reports. UBS Group increased their price objective on Tutor Perini from $27.00 to $39.00 and gave the stock a "buy" rating in a report on Wednesday, October 23rd. StockNews.com downgraded shares of Tutor Perini from a "buy" rating to a "hold" rating in a report on Thursday, October 24th.

Check Out Our Latest Report on TPC

About Tutor Perini

(

Free Report)

Tutor Perini Corporation, a construction company, provides diversified general contracting, construction management, and design-build services to private customers and public agencies in the United States and internationally. It operates through three segments: Civil, Building, and Specialty Contractors.

Featured Articles

Before you consider Tutor Perini, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tutor Perini wasn't on the list.

While Tutor Perini currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.