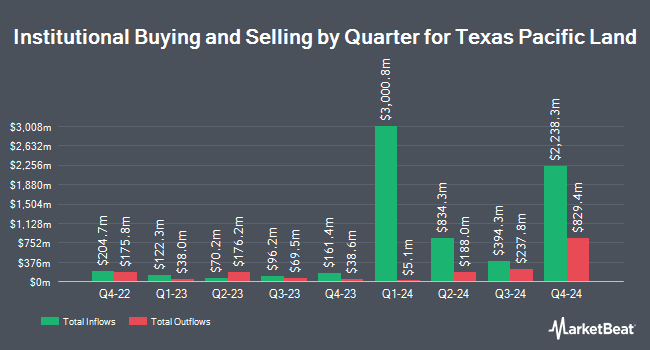

Mad River Investors lessened its holdings in Texas Pacific Land Co. (NYSE:TPL - Free Report) by 1.5% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 97,778 shares of the financial services provider's stock after selling 1,532 shares during the period. Texas Pacific Land makes up 48.0% of Mad River Investors' portfolio, making the stock its biggest position. Mad River Investors owned about 0.43% of Texas Pacific Land worth $86,509,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in TPL. Vanguard Group Inc. raised its position in Texas Pacific Land by 199.8% in the 1st quarter. Vanguard Group Inc. now owns 1,901,206 shares of the financial services provider's stock valued at $1,099,867,000 after purchasing an additional 1,267,123 shares during the last quarter. Magnolia Capital Advisors LLC acquired a new position in Texas Pacific Land during the 2nd quarter worth about $131,014,000. Bank of New York Mellon Corp grew its holdings in Texas Pacific Land by 74.2% during the 2nd quarter. Bank of New York Mellon Corp now owns 204,176 shares of the financial services provider's stock worth $149,920,000 after acquiring an additional 86,975 shares during the last quarter. Principal Financial Group Inc. increased its position in Texas Pacific Land by 1,541.2% in the 2nd quarter. Principal Financial Group Inc. now owns 64,319 shares of the financial services provider's stock valued at $47,228,000 after acquiring an additional 60,400 shares in the last quarter. Finally, Hodges Capital Management Inc. increased its position in Texas Pacific Land by 130.9% in the 1st quarter. Hodges Capital Management Inc. now owns 77,137 shares of the financial services provider's stock valued at $44,625,000 after acquiring an additional 43,726 shares in the last quarter. Institutional investors own 59.94% of the company's stock.

Wall Street Analyst Weigh In

Separately, BWS Financial restated a "buy" rating and set a $917.00 target price on shares of Texas Pacific Land in a research report on Monday, August 12th.

View Our Latest Stock Report on TPL

Texas Pacific Land Trading Down 0.7 %

Shares of NYSE:TPL traded down $7.47 during trading on Wednesday, hitting $1,084.26. 59,434 shares of the company's stock were exchanged, compared to its average volume of 103,738. The firm has a 50-day moving average price of $903.61 and a two-hundred day moving average price of $765.17. Texas Pacific Land Co. has a 1-year low of $467.62 and a 1-year high of $1,095.75. The firm has a market cap of $24.92 billion, a P/E ratio of 55.36 and a beta of 1.60.

Texas Pacific Land (NYSE:TPL - Get Free Report) last issued its earnings results on Wednesday, August 7th. The financial services provider reported $4.98 EPS for the quarter, missing the consensus estimate of $5.36 by ($0.38). Texas Pacific Land had a net margin of 66.71% and a return on equity of 41.29%. The business had revenue of $172.33 million for the quarter, compared to the consensus estimate of $182.35 million. During the same quarter in the previous year, the firm posted $4.35 EPS.

Texas Pacific Land Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Tuesday, September 17th. Stockholders of record on Tuesday, September 3rd were paid a $1.17 dividend. The ex-dividend date was Tuesday, September 3rd. This represents a $4.68 dividend on an annualized basis and a dividend yield of 0.43%. Texas Pacific Land's dividend payout ratio (DPR) is presently 24.07%.

About Texas Pacific Land

(

Free Report)

Texas Pacific Land Corporation engages in the land and resource management, and water services and operations businesses. The company owns a 1/128th nonparticipating perpetual oil and gas royalty interest (NPRI) under approximately 85,000 acres of land; a 1/16th NPRI under approximately 371,000 acres of land; and approximately 4,000 additional net royalty acres, total of approximately 195,000 NRA located in the western part of Texas.

See Also

Before you consider Texas Pacific Land, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Pacific Land wasn't on the list.

While Texas Pacific Land currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.