Lunt Capital Management Inc. trimmed its position in Texas Pacific Land Co. (NYSE:TPL - Free Report) by 29.9% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 11,270 shares of the financial services provider's stock after selling 4,811 shares during the quarter. Texas Pacific Land comprises 4.7% of Lunt Capital Management Inc.'s holdings, making the stock its 4th largest position. Lunt Capital Management Inc.'s holdings in Texas Pacific Land were worth $9,971,000 at the end of the most recent quarter.

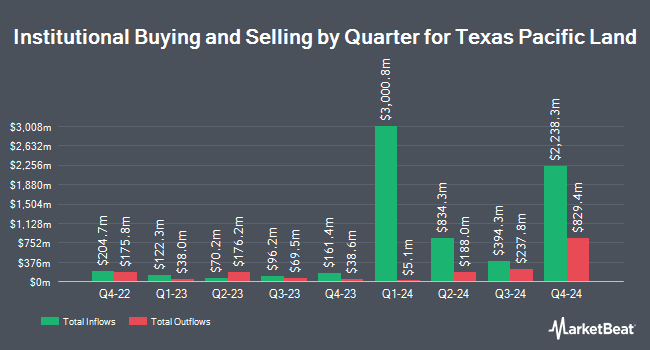

Several other institutional investors have also recently modified their holdings of TPL. Wealth Enhancement Advisory Services LLC raised its stake in shares of Texas Pacific Land by 559.2% in the first quarter. Wealth Enhancement Advisory Services LLC now owns 9,242 shares of the financial services provider's stock worth $5,346,000 after purchasing an additional 7,840 shares during the last quarter. Allspring Global Investments Holdings LLC grew its holdings in Texas Pacific Land by 522.7% during the first quarter. Allspring Global Investments Holdings LLC now owns 741 shares of the financial services provider's stock worth $429,000 after acquiring an additional 622 shares during the period. State of Michigan Retirement System grew its holdings in Texas Pacific Land by 200.0% during the first quarter. State of Michigan Retirement System now owns 1,200 shares of the financial services provider's stock worth $694,000 after acquiring an additional 800 shares during the period. Sumitomo Mitsui Trust Holdings Inc. grew its holdings in Texas Pacific Land by 198.5% during the first quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 42,600 shares of the financial services provider's stock worth $24,645,000 after acquiring an additional 28,329 shares during the period. Finally, Azzad Asset Management Inc. ADV grew its holdings in Texas Pacific Land by 213.2% during the first quarter. Azzad Asset Management Inc. ADV now owns 3,702 shares of the financial services provider's stock worth $2,142,000 after acquiring an additional 2,520 shares during the period. 59.94% of the stock is currently owned by hedge funds and other institutional investors.

Texas Pacific Land Stock Performance

Texas Pacific Land stock traded down $6.42 during midday trading on Monday, hitting $1,091.59. 46,341 shares of the company were exchanged, compared to its average volume of 102,918. The firm has a market capitalization of $25.08 billion, a PE ratio of 56.15 and a beta of 1.60. Texas Pacific Land Co. has a fifty-two week low of $467.62 and a fifty-two week high of $1,106.87. The business has a fifty day simple moving average of $924.62 and a two-hundred day simple moving average of $779.22.

Texas Pacific Land (NYSE:TPL - Get Free Report) last issued its quarterly earnings data on Wednesday, August 7th. The financial services provider reported $4.98 EPS for the quarter, missing the consensus estimate of $5.36 by ($0.38). Texas Pacific Land had a net margin of 66.71% and a return on equity of 41.29%. The business had revenue of $172.33 million during the quarter, compared to analyst estimates of $182.35 million. During the same period in the previous year, the business posted $4.35 earnings per share.

Texas Pacific Land Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, September 17th. Shareholders of record on Tuesday, September 3rd were issued a $1.17 dividend. This represents a $4.68 annualized dividend and a yield of 0.43%. The ex-dividend date of this dividend was Tuesday, September 3rd. Texas Pacific Land's payout ratio is currently 24.07%.

Wall Street Analyst Weigh In

Separately, BWS Financial reaffirmed a "buy" rating and set a $917.00 target price on shares of Texas Pacific Land in a report on Monday, August 12th.

Read Our Latest Research Report on Texas Pacific Land

Texas Pacific Land Profile

(

Free Report)

Texas Pacific Land Corporation engages in the land and resource management, and water services and operations businesses. The company owns a 1/128th nonparticipating perpetual oil and gas royalty interest (NPRI) under approximately 85,000 acres of land; a 1/16th NPRI under approximately 371,000 acres of land; and approximately 4,000 additional net royalty acres, total of approximately 195,000 NRA located in the western part of Texas.

Further Reading

Before you consider Texas Pacific Land, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Pacific Land wasn't on the list.

While Texas Pacific Land currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.