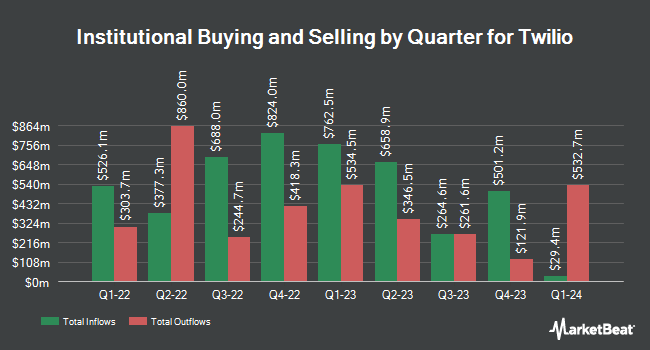

Assenagon Asset Management S.A. reduced its position in Twilio Inc. (NYSE:TWLO - Free Report) by 71.0% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 7,694 shares of the technology company's stock after selling 18,826 shares during the quarter. Assenagon Asset Management S.A.'s holdings in Twilio were worth $502,000 at the end of the most recent quarter.

A number of other large investors also recently modified their holdings of the company. SouthState Corp raised its stake in Twilio by 159.1% in the second quarter. SouthState Corp now owns 500 shares of the technology company's stock valued at $28,000 after purchasing an additional 307 shares in the last quarter. Migdal Insurance & Financial Holdings Ltd. purchased a new stake in Twilio in the second quarter valued at approximately $29,000. GAMMA Investing LLC raised its stake in Twilio by 70.6% in the second quarter. GAMMA Investing LLC now owns 638 shares of the technology company's stock valued at $36,000 after purchasing an additional 264 shares in the last quarter. Lynx Investment Advisory purchased a new stake in Twilio in the second quarter valued at approximately $45,000. Finally, HHM Wealth Advisors LLC raised its stake in Twilio by 43.3% in the second quarter. HHM Wealth Advisors LLC now owns 860 shares of the technology company's stock valued at $49,000 after purchasing an additional 260 shares in the last quarter. 84.27% of the stock is currently owned by institutional investors.

Insider Transactions at Twilio

In other news, insider Dana Wagner sold 4,512 shares of Twilio stock in a transaction dated Thursday, October 31st. The stock was sold at an average price of $80.00, for a total value of $360,960.00. Following the completion of the transaction, the insider now owns 142,291 shares of the company's stock, valued at $11,383,280. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In other Twilio news, CFO Aidan Viggiano sold 1,931 shares of the business's stock in a transaction dated Tuesday, August 20th. The stock was sold at an average price of $61.67, for a total value of $119,084.77. Following the completion of the transaction, the chief financial officer now owns 184,570 shares of the company's stock, valued at approximately $11,382,431.90. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider Dana Wagner sold 4,512 shares of the business's stock in a transaction dated Thursday, October 31st. The stock was sold at an average price of $80.00, for a total value of $360,960.00. Following the completion of the transaction, the insider now directly owns 142,291 shares of the company's stock, valued at approximately $11,383,280. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 56,418 shares of company stock valued at $3,749,556 in the last quarter. 4.50% of the stock is owned by insiders.

Twilio Stock Up 3.1 %

Shares of TWLO stock traded up $2.66 during mid-day trading on Monday, reaching $87.50. 4,354,532 shares of the company's stock traded hands, compared to its average volume of 2,661,639. Twilio Inc. has a 12 month low of $52.45 and a 12 month high of $88.96. The company has a market cap of $14.05 billion, a P/E ratio of -34.05, a P/E/G ratio of 4.59 and a beta of 1.32. The company has a quick ratio of 5.57, a current ratio of 5.57 and a debt-to-equity ratio of 0.11. The company's 50-day moving average price is $66.33 and its 200-day moving average price is $61.35.

Twilio (NYSE:TWLO - Get Free Report) last announced its earnings results on Thursday, August 1st. The technology company reported $0.87 EPS for the quarter, beating analysts' consensus estimates of $0.70 by $0.17. The firm had revenue of $1.08 billion for the quarter, compared to analysts' expectations of $1.06 billion. Twilio had a negative net margin of 10.65% and a positive return on equity of 0.83%. The company's quarterly revenue was up 4.4% on a year-over-year basis. During the same quarter in the previous year, the business posted ($0.23) EPS. On average, equities analysts expect that Twilio Inc. will post 0.54 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several research analysts have commented on the stock. Mizuho lifted their price target on shares of Twilio from $60.00 to $70.00 and gave the stock a "neutral" rating in a research note on Thursday. UBS Group lifted their price target on shares of Twilio from $74.00 to $88.00 and gave the stock a "buy" rating in a research note on Thursday. JPMorgan Chase & Co. lifted their price target on shares of Twilio from $78.00 to $83.00 and gave the stock an "overweight" rating in a research note on Thursday. JMP Securities reissued a "market outperform" rating and set a $110.00 price target on shares of Twilio in a research note on Tuesday, October 8th. Finally, The Goldman Sachs Group lifted their price target on shares of Twilio from $67.00 to $77.00 and gave the stock a "neutral" rating in a research note on Friday. Two analysts have rated the stock with a sell rating, twelve have assigned a hold rating and ten have assigned a buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Hold" and a consensus target price of $79.55.

Read Our Latest Stock Analysis on TWLO

Twilio Company Profile

(

Free Report)

Twilio Inc, together with its subsidiaries, provides customer engagement platform solutions in the United States and internationally. It operates through two segments, Twilio Communications and Twilio Segment. The company provides various application programming interfaces and software solutions for communications between customers and end users, including messaging, voice, email, flex, marketing campaigns, and user identity and authentication.

Recommended Stories

Before you consider Twilio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Twilio wasn't on the list.

While Twilio currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.