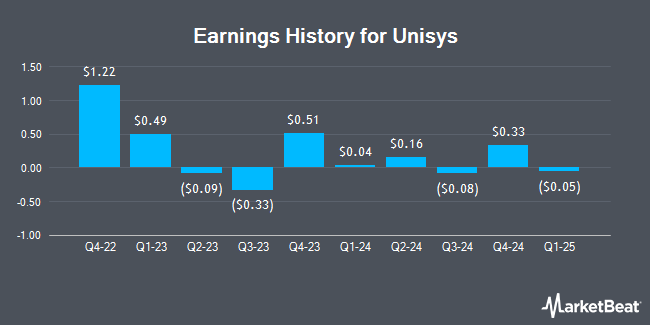

Unisys (NYSE:UIS - Get Free Report) posted its quarterly earnings data on Tuesday. The information technology services provider reported ($0.08) earnings per share for the quarter, missing analysts' consensus estimates of $0.13 by ($0.21), Briefing.com reports. Unisys had a negative return on equity of 24.50% and a negative net margin of 18.95%. The company had revenue of $497.00 million for the quarter, compared to analysts' expectations of $486.50 million. During the same period in the previous year, the business posted ($0.33) EPS. The business's revenue for the quarter was up 7.0% on a year-over-year basis. Unisys updated its FY 2024 guidance to EPS.

Unisys Stock Up 33.6 %

UIS traded up $1.81 on Wednesday, reaching $7.19. The company's stock had a trading volume of 3,171,691 shares, compared to its average volume of 584,828. The company has a market capitalization of $497.76 million, a price-to-earnings ratio of -1.21, a P/E/G ratio of 1.79 and a beta of 0.78. Unisys has a fifty-two week low of $2.60 and a fifty-two week high of $8.12. The stock has a 50 day moving average of $5.79 and a two-hundred day moving average of $5.06.

Analyst Ratings Changes

Separately, StockNews.com upgraded shares of Unisys from a "hold" rating to a "buy" rating in a report on Friday, October 25th.

Read Our Latest Stock Analysis on Unisys

About Unisys

(

Get Free Report)

Unisys Corporation, together with its subsidiaries, operates as an information technology solutions company in the United States and internationally. It operates in three segments: Digital Workplace Solutions (DWS); Cloud, Applications & Infrastructure Solutions (CA&I); and Enterprise Computing Solutions.

Featured Stories

Before you consider Unisys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unisys wasn't on the list.

While Unisys currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.