Kimelman & Baird LLC bought a new position in shares of United Parcel Service, Inc. (NYSE:UPS - Free Report) in the second quarter, according to the company in its most recent filing with the SEC. The fund bought 138,995 shares of the transportation company's stock, valued at approximately $19,021,000. United Parcel Service accounts for 1.6% of Kimelman & Baird LLC's investment portfolio, making the stock its 23rd biggest position.

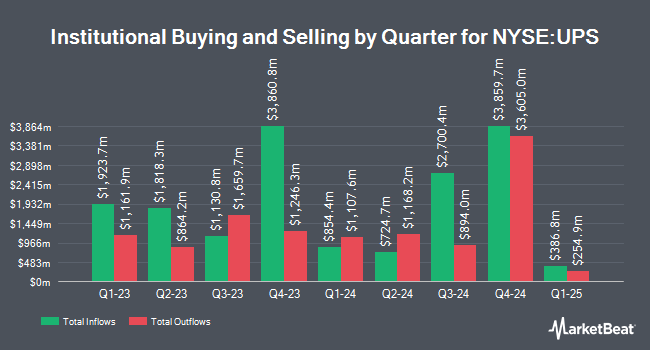

A number of other institutional investors and hedge funds have also recently bought and sold shares of UPS. B. Riley Wealth Advisors Inc. grew its holdings in United Parcel Service by 8.3% during the second quarter. B. Riley Wealth Advisors Inc. now owns 24,205 shares of the transportation company's stock worth $3,312,000 after acquiring an additional 1,863 shares during the period. Quarry LP grew its position in United Parcel Service by 453.6% in the second quarter. Quarry LP now owns 537 shares of the transportation company's stock valued at $73,000 after acquiring an additional 440 shares during the period. Wallace Advisory Group LLC boosted its stake in United Parcel Service by 161.0% in the second quarter. Wallace Advisory Group LLC now owns 3,469 shares of the transportation company's stock worth $475,000 after purchasing an additional 2,140 shares in the last quarter. Sunbelt Securities Inc. lifted its stake in shares of United Parcel Service by 4.1% during the second quarter. Sunbelt Securities Inc. now owns 16,630 shares of the transportation company's stock valued at $2,276,000 after acquiring an additional 648 shares during the period. Finally, Copperwynd Financial LLC increased its holdings in shares of United Parcel Service by 7.0% in the second quarter. Copperwynd Financial LLC now owns 1,908 shares of the transportation company's stock worth $249,000 after acquiring an additional 124 shares in the last quarter. Hedge funds and other institutional investors own 60.26% of the company's stock.

Insider Buying and Selling at United Parcel Service

In other news, Director William R. Johnson purchased 5,000 shares of the stock in a transaction dated Thursday, July 25th. The stock was acquired at an average cost of $128.61 per share, for a total transaction of $643,050.00. Following the completion of the acquisition, the director now directly owns 5,160 shares in the company, valued at approximately $663,627.60. The purchase was disclosed in a filing with the SEC, which is available through the SEC website. 0.13% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

A number of research firms have recently issued reports on UPS. Stifel Nicolaus cut their price objective on United Parcel Service from $170.00 to $151.00 and set a "buy" rating for the company in a research report on Wednesday, July 24th. Baird R W raised United Parcel Service to a "strong-buy" rating in a research note on Wednesday, July 24th. Robert W. Baird dropped their price objective on United Parcel Service from $170.00 to $160.00 and set an "outperform" rating on the stock in a research note on Wednesday, July 24th. Wells Fargo & Company decreased their price target on shares of United Parcel Service from $156.00 to $134.00 and set an "overweight" rating on the stock in a report on Wednesday, July 24th. Finally, Oppenheimer reduced their price objective on United Parcel Service from $157.00 to $140.00 and set an "outperform" rating on the stock in a research note on Wednesday, July 24th. One equities research analyst has rated the stock with a sell rating, eleven have issued a hold rating, eight have assigned a buy rating and two have issued a strong buy rating to the company's stock. According to MarketBeat, United Parcel Service has a consensus rating of "Moderate Buy" and a consensus price target of $149.68.

Get Our Latest Research Report on United Parcel Service

United Parcel Service Stock Performance

United Parcel Service stock traded up $2.04 during midday trading on Monday, hitting $136.30. 4,115,558 shares of the company's stock were exchanged, compared to its average volume of 4,278,704. United Parcel Service, Inc. has a 12-month low of $123.12 and a 12-month high of $163.82. The stock has a market cap of $116.61 billion, a price-to-earnings ratio of 19.71, a price-to-earnings-growth ratio of 1.98 and a beta of 0.99. The company has a debt-to-equity ratio of 1.18, a quick ratio of 1.25 and a current ratio of 1.25. The firm's 50 day simple moving average is $128.75 and its 200 day simple moving average is $138.36.

United Parcel Service (NYSE:UPS - Get Free Report) last released its earnings results on Tuesday, July 23rd. The transportation company reported $1.79 EPS for the quarter, missing the consensus estimate of $1.99 by ($0.20). United Parcel Service had a return on equity of 35.27% and a net margin of 5.87%. The firm had revenue of $21.82 billion during the quarter, compared to analyst estimates of $22.17 billion. During the same quarter last year, the business posted $2.54 EPS. The firm's revenue was down 1.1% on a year-over-year basis. Equities research analysts predict that United Parcel Service, Inc. will post 7.43 EPS for the current year.

United Parcel Service Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, September 5th. Investors of record on Monday, August 19th were paid a $1.63 dividend. This represents a $6.52 annualized dividend and a dividend yield of 4.78%. The ex-dividend date was Monday, August 19th. United Parcel Service's dividend payout ratio (DPR) is 94.49%.

About United Parcel Service

(

Free Report)

United Parcel Service, Inc, a package delivery company, provides transportation and delivery, distribution, contract logistics, ocean freight, airfreight, customs brokerage, and insurance services. It operates through two segments, U.S. Domestic Package and International Package. The U.S. Domestic Package segment offers time-definite delivery of express letters, documents, small packages, and palletized freight through air and ground services in the United States.

Featured Stories

Before you consider United Parcel Service, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Parcel Service wasn't on the list.

While United Parcel Service currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.