Cantor Fitzgerald Investment Advisors L.P. grew its holdings in United Parcel Service, Inc. (NYSE:UPS - Free Report) by 87.0% during the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 118,652 shares of the transportation company's stock after acquiring an additional 55,198 shares during the period. Cantor Fitzgerald Investment Advisors L.P.'s holdings in United Parcel Service were worth $16,177,000 as of its most recent filing with the Securities & Exchange Commission.

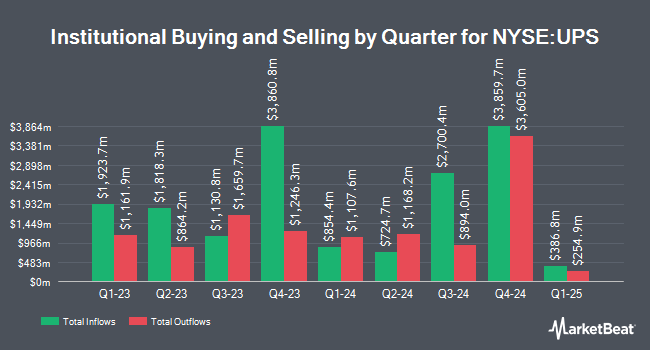

A number of other hedge funds have also recently made changes to their positions in the business. Diversified Trust Co boosted its position in shares of United Parcel Service by 1.4% during the first quarter. Diversified Trust Co now owns 11,833 shares of the transportation company's stock worth $1,759,000 after acquiring an additional 163 shares during the last quarter. Claro Advisors LLC grew its position in shares of United Parcel Service by 10.9% during the first quarter. Claro Advisors LLC now owns 2,711 shares of the transportation company's stock valued at $403,000 after purchasing an additional 267 shares in the last quarter. MV Capital Management Inc. increased its holdings in shares of United Parcel Service by 8.6% in the first quarter. MV Capital Management Inc. now owns 969 shares of the transportation company's stock worth $144,000 after purchasing an additional 77 shares during the last quarter. Silverlake Wealth Management LLC lifted its position in shares of United Parcel Service by 6.7% in the first quarter. Silverlake Wealth Management LLC now owns 2,914 shares of the transportation company's stock worth $433,000 after buying an additional 183 shares in the last quarter. Finally, Azzad Asset Management Inc. ADV lifted its position in shares of United Parcel Service by 1.7% in the first quarter. Azzad Asset Management Inc. ADV now owns 13,276 shares of the transportation company's stock worth $1,973,000 after buying an additional 216 shares in the last quarter. Institutional investors own 60.26% of the company's stock.

Analysts Set New Price Targets

UPS has been the topic of several recent research reports. Wells Fargo & Company upped their price objective on United Parcel Service from $134.00 to $142.00 and gave the stock an "overweight" rating in a report on Thursday, October 10th. Stephens decreased their price target on shares of United Parcel Service from $168.00 to $140.00 and set an "equal weight" rating on the stock in a research note on Wednesday, July 24th. Baird R W raised shares of United Parcel Service to a "strong-buy" rating in a research note on Wednesday, July 24th. JPMorgan Chase & Co. dropped their target price on United Parcel Service from $140.00 to $139.00 and set a "neutral" rating for the company in a report on Friday. Finally, Susquehanna increased their price target on United Parcel Service from $135.00 to $140.00 and gave the company a "neutral" rating in a report on Friday. Two investment analysts have rated the stock with a sell rating, nine have issued a hold rating, eleven have assigned a buy rating and two have assigned a strong buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $151.71.

Read Our Latest Stock Analysis on United Parcel Service

United Parcel Service Stock Down 0.8 %

United Parcel Service stock traded down $1.03 during mid-day trading on Tuesday, reaching $134.31. 3,026,286 shares of the company were exchanged, compared to its average volume of 4,214,950. United Parcel Service, Inc. has a 12-month low of $123.12 and a 12-month high of $163.82. The business has a fifty day moving average of $131.12 and a 200 day moving average of $135.73. The firm has a market cap of $115.05 billion, a P/E ratio of 20.29, a PEG ratio of 2.03 and a beta of 0.99. The company has a debt-to-equity ratio of 1.20, a quick ratio of 1.25 and a current ratio of 1.14.

United Parcel Service (NYSE:UPS - Get Free Report) last issued its quarterly earnings results on Thursday, October 24th. The transportation company reported $1.76 earnings per share for the quarter, topping the consensus estimate of $1.63 by $0.13. United Parcel Service had a return on equity of 37.38% and a net margin of 6.25%. The business had revenue of $22.20 billion during the quarter, compared to the consensus estimate of $22.10 billion. During the same quarter last year, the company earned $1.57 earnings per share. The company's quarterly revenue was up 5.4% on a year-over-year basis. Research analysts anticipate that United Parcel Service, Inc. will post 7.41 earnings per share for the current fiscal year.

United Parcel Service Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Thursday, September 5th. Shareholders of record on Monday, August 19th were paid a dividend of $1.63 per share. The ex-dividend date was Monday, August 19th. This represents a $6.52 annualized dividend and a yield of 4.85%. United Parcel Service's payout ratio is presently 98.49%.

United Parcel Service Company Profile

(

Free Report)

United Parcel Service, Inc, a package delivery company, provides transportation and delivery, distribution, contract logistics, ocean freight, airfreight, customs brokerage, and insurance services. It operates through two segments, U.S. Domestic Package and International Package. The U.S. Domestic Package segment offers time-definite delivery of express letters, documents, small packages, and palletized freight through air and ground services in the United States.

Further Reading

Before you consider United Parcel Service, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Parcel Service wasn't on the list.

While United Parcel Service currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.