Private Management Group Inc. trimmed its stake in United States Cellular Co. (NYSE:USM - Free Report) by 88.1% in the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 4,832 shares of the Wireless communications provider's stock after selling 35,715 shares during the quarter. Private Management Group Inc.'s holdings in United States Cellular were worth $264,000 as of its most recent filing with the SEC.

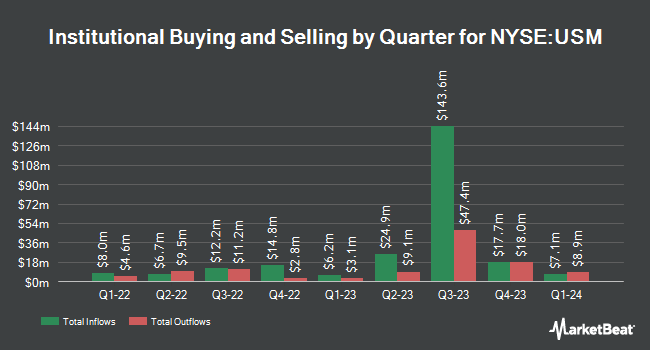

Several other institutional investors and hedge funds have also recently bought and sold shares of the stock. Summit Securities Group LLC purchased a new position in shares of United States Cellular in the 2nd quarter worth about $28,000. Creative Planning raised its holdings in United States Cellular by 12.4% in the third quarter. Creative Planning now owns 7,238 shares of the Wireless communications provider's stock valued at $396,000 after buying an additional 800 shares during the period. Victory Capital Management Inc. increased its position in shares of United States Cellular by 8.7% in the second quarter. Victory Capital Management Inc. now owns 12,475 shares of the Wireless communications provider's stock worth $696,000 after acquiring an additional 994 shares in the last quarter. SG Americas Securities LLC purchased a new position in shares of United States Cellular in the 2nd quarter valued at $115,000. Finally, Bailard Inc. acquired a new position in shares of United States Cellular during the 2nd quarter valued at $207,000. Institutional investors and hedge funds own 18.03% of the company's stock.

Insider Buying and Selling at United States Cellular

In related news, EVP Kevin R. Lowell sold 37,597 shares of United States Cellular stock in a transaction on Monday, August 5th. The shares were sold at an average price of $49.34, for a total transaction of $1,855,035.98. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. 1.00% of the stock is owned by corporate insiders.

United States Cellular Stock Down 6.8 %

NYSE USM traded down $4.21 during trading hours on Friday, hitting $57.49. The company had a trading volume of 397,807 shares, compared to its average volume of 142,034. The firm's 50 day moving average is $57.11 and its 200 day moving average is $52.18. The company has a debt-to-equity ratio of 0.62, a current ratio of 1.55 and a quick ratio of 1.39. United States Cellular Co. has a fifty-two week low of $32.01 and a fifty-two week high of $67.84. The company has a market capitalization of $4.94 billion, a price-to-earnings ratio of 70.11 and a beta of 0.47.

United States Cellular (NYSE:USM - Get Free Report) last posted its earnings results on Friday, November 1st. The Wireless communications provider reported $0.26 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.17 by $0.09. The business had revenue of $922.00 million during the quarter, compared to analyst estimates of $940.40 million. United States Cellular had a return on equity of 1.55% and a net margin of 1.88%. The company's revenue for the quarter was down 4.3% compared to the same quarter last year. During the same quarter last year, the firm earned $0.26 earnings per share. Sell-side analysts anticipate that United States Cellular Co. will post 0.61 earnings per share for the current fiscal year.

United States Cellular Profile

(

Free Report)

United States Cellular Corporation provides wireless telecommunications services in the United States. The company offers wireless services, including voice, messaging, and data services. It also provides wireless devices, such as handsets, tablets, mobile hotspots, home phones, and routers, as well as wireless essentials, including cases, screen protectors, chargers, and memory cards; and consumer electronics comprising audio, home automation, and networking products.

Further Reading

Before you consider United States Cellular, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United States Cellular wasn't on the list.

While United States Cellular currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.