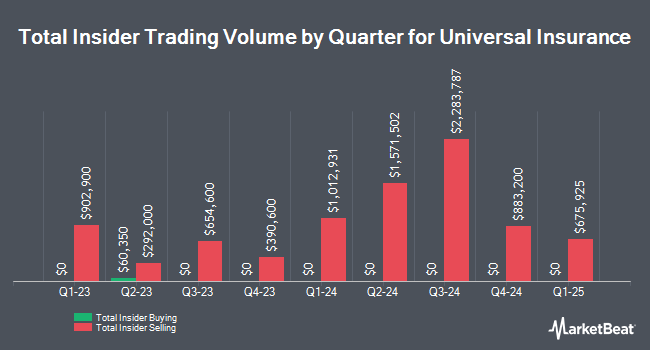

Universal Insurance Holdings, Inc. (NYSE:UVE - Get Free Report) Chairman Sean P. Downes sold 20,000 shares of the company's stock in a transaction dated Thursday, September 19th. The shares were sold at an average price of $22.47, for a total transaction of $449,400.00. Following the transaction, the chairman now owns 1,082,262 shares in the company, valued at $24,318,427.14. The sale was disclosed in a filing with the SEC, which is available at this hyperlink.

Universal Insurance Trading Down 2.5 %

UVE stock traded down $0.57 during mid-day trading on Friday, reaching $21.89. The company had a trading volume of 482,005 shares, compared to its average volume of 178,646. The company has a debt-to-equity ratio of 0.26, a current ratio of 0.54 and a quick ratio of 0.54. The company has a market capitalization of $623.43 million, a PE ratio of 8.80 and a beta of 0.89. The firm has a 50 day moving average of $20.25 and a 200 day moving average of $19.70. Universal Insurance Holdings, Inc. has a 12 month low of $12.86 and a 12 month high of $23.27.

Universal Insurance (NYSE:UVE - Get Free Report) last released its quarterly earnings data on Thursday, July 25th. The insurance provider reported $1.18 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.15 by $0.03. Universal Insurance had a net margin of 5.60% and a return on equity of 21.14%. The firm had revenue of $380.21 million for the quarter, compared to the consensus estimate of $340.09 million. During the same period last year, the firm earned $0.87 earnings per share. On average, equities analysts predict that Universal Insurance Holdings, Inc. will post 2.3 earnings per share for the current fiscal year.

Universal Insurance Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, August 9th. Shareholders of record on Friday, August 2nd were issued a $0.16 dividend. The ex-dividend date was Friday, August 2nd. This represents a $0.64 dividend on an annualized basis and a dividend yield of 2.92%. Universal Insurance's dividend payout ratio is currently 25.10%.

Analysts Set New Price Targets

Separately, StockNews.com downgraded shares of Universal Insurance from a "strong-buy" rating to a "buy" rating in a research note on Monday, August 5th.

Check Out Our Latest Stock Analysis on Universal Insurance

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently made changes to their positions in UVE. Quarry LP grew its position in Universal Insurance by 424.4% during the second quarter. Quarry LP now owns 1,395 shares of the insurance provider's stock valued at $26,000 after buying an additional 1,129 shares during the period. Occidental Asset Management LLC acquired a new stake in shares of Universal Insurance in the second quarter valued at about $196,000. SG Americas Securities LLC grew its position in shares of Universal Insurance by 17.4% in the second quarter. SG Americas Securities LLC now owns 12,374 shares of the insurance provider's stock valued at $232,000 after purchasing an additional 1,833 shares during the period. Counterpoint Mutual Funds LLC purchased a new position in shares of Universal Insurance in the first quarter worth about $289,000. Finally, State Board of Administration of Florida Retirement System purchased a new position in shares of Universal Insurance in the first quarter worth about $326,000. Hedge funds and other institutional investors own 66.61% of the company's stock.

Universal Insurance Company Profile

(

Get Free Report)

Universal Insurance Holdings, Inc, together with its subsidiaries, operates as an integrated insurance holding company in the United States. It develops, markets, and underwrites insurance products for personal residential insurance, such as homeowners, renters/tenants, condo unit owners, and dwelling/fire; and offers allied lines, coverage for other structures, and personal property, liability, and personal articles coverages.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Universal Insurance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Insurance wasn't on the list.

While Universal Insurance currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.