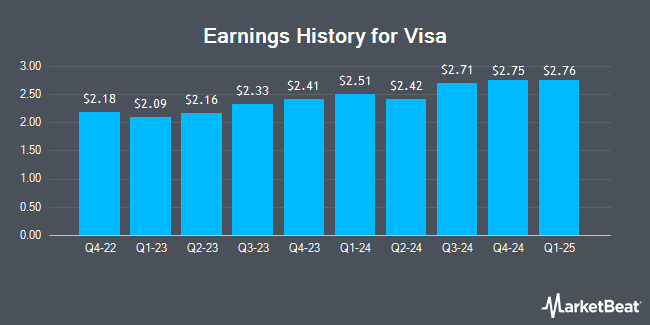

Visa (NYSE:V - Get Free Report) announced its quarterly earnings results on Tuesday. The credit-card processor reported $2.71 EPS for the quarter, beating the consensus estimate of $2.58 by $0.13, Briefing.com reports. Visa had a return on equity of 51.94% and a net margin of 54.72%. The firm had revenue of $9.62 billion for the quarter, compared to analyst estimates of $9.49 billion. During the same quarter last year, the firm posted $2.33 earnings per share. The business's revenue for the quarter was up 11.7% on a year-over-year basis.

Visa Trading Up 2.9 %

NYSE:V traded up $8.28 on Wednesday, reaching $290.16. 9,051,672 shares of the company's stock were exchanged, compared to its average volume of 7,072,043. The business has a fifty day moving average of $279.65 and a 200-day moving average of $273.26. The company has a quick ratio of 1.37, a current ratio of 1.37 and a debt-to-equity ratio of 0.54. Visa has a 52-week low of $232.99 and a 52-week high of $295.78. The firm has a market capitalization of $530.68 billion, a price-to-earnings ratio of 32.42, a price-to-earnings-growth ratio of 1.95 and a beta of 0.96.

Wall Street Analysts Forecast Growth

Several research analysts have recently commented on the company. BMO Capital Markets boosted their price target on Visa from $310.00 to $320.00 and gave the stock an "outperform" rating in a research report on Wednesday. Bank of America increased their price target on shares of Visa from $279.00 to $308.00 and gave the company a "neutral" rating in a research report on Tuesday, September 17th. William Blair raised shares of Visa to a "strong-buy" rating in a research report on Tuesday, July 23rd. Jefferies Financial Group boosted their price objective on shares of Visa from $320.00 to $330.00 and gave the stock a "buy" rating in a research note on Wednesday. Finally, Morgan Stanley raised their target price on shares of Visa from $322.00 to $326.00 and gave the company an "overweight" rating in a research note on Wednesday. Four analysts have rated the stock with a hold rating, twenty-four have given a buy rating and two have issued a strong buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $320.07.

Read Our Latest Report on Visa

Insider Buying and Selling

In related news, CEO Ryan Mcinerney sold 8,620 shares of the business's stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $276.37, for a total transaction of $2,382,309.40. Following the completion of the transaction, the chief executive officer now directly owns 538 shares of the company's stock, valued at $148,687.06. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. 0.19% of the stock is owned by insiders.

Visa Company Profile

(

Get Free Report)

Visa Inc operates as a payment technology company in the United States and internationally. The company operates VisaNet, a transaction processing network that enables authorization, clearing, and settlement of payment transactions. It also offers credit, debit, and prepaid card products; tap to pay, tokenization, and click to pay services; Visa Direct, a solution that facilitates the delivery of funds to eligible cards, deposit accounts, and digital wallets; Visa B2B Connect, a multilateral business-to-business cross-border payments network; Visa Cross-Border Solution, a cross-border consumer payments solution; and Visa DPS that provides a range of value-added services, including fraud mitigation, dispute management, data analytics, campaign management, a suite of digital solutions, and contact center services.

Recommended Stories

Before you consider Visa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Visa wasn't on the list.

While Visa currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.