Gulf International Bank UK Ltd reduced its stake in shares of Visa Inc. (NYSE:V - Free Report) by 4.4% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 124,553 shares of the credit-card processor's stock after selling 5,751 shares during the quarter. Visa accounts for 0.9% of Gulf International Bank UK Ltd's holdings, making the stock its 15th largest position. Gulf International Bank UK Ltd's holdings in Visa were worth $34,245,000 as of its most recent filing with the Securities and Exchange Commission.

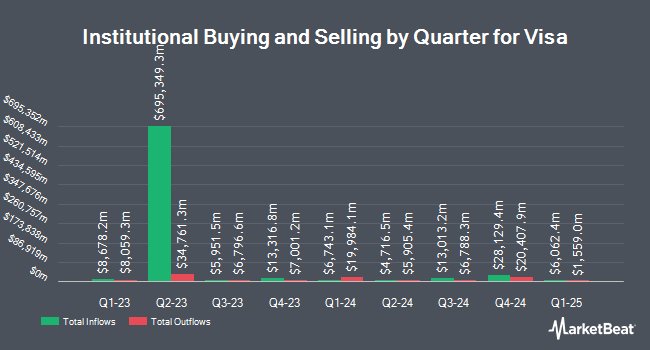

Other large investors also recently bought and sold shares of the company. Vanguard Group Inc. grew its position in shares of Visa by 0.6% during the 1st quarter. Vanguard Group Inc. now owns 142,202,830 shares of the credit-card processor's stock valued at $39,685,966,000 after acquiring an additional 788,908 shares during the period. Capital International Investors boosted its position in Visa by 2.7% during the first quarter. Capital International Investors now owns 23,570,391 shares of the credit-card processor's stock worth $6,578,025,000 after purchasing an additional 626,618 shares in the last quarter. Capital World Investors grew its holdings in Visa by 5.4% in the first quarter. Capital World Investors now owns 18,863,796 shares of the credit-card processor's stock valued at $5,264,508,000 after purchasing an additional 968,008 shares during the period. Ameriprise Financial Inc. increased its position in shares of Visa by 2.4% in the second quarter. Ameriprise Financial Inc. now owns 14,610,590 shares of the credit-card processor's stock valued at $3,833,981,000 after buying an additional 345,829 shares in the last quarter. Finally, Legal & General Group Plc raised its stake in shares of Visa by 2.2% during the 2nd quarter. Legal & General Group Plc now owns 14,416,394 shares of the credit-card processor's stock worth $3,783,857,000 after buying an additional 312,286 shares during the period. 82.15% of the stock is owned by institutional investors and hedge funds.

Visa Stock Up 0.5 %

Shares of V traded up $1.51 during mid-day trading on Tuesday, reaching $293.36. The company's stock had a trading volume of 3,748,087 shares, compared to its average volume of 7,042,683. The company's 50 day moving average is $281.92 and its 200 day moving average is $273.97. The stock has a market cap of $534.59 billion, a PE ratio of 30.15, a price-to-earnings-growth ratio of 1.95 and a beta of 0.95. Visa Inc. has a 12-month low of $240.97 and a 12-month high of $296.34. The company has a debt-to-equity ratio of 0.55, a current ratio of 1.28 and a quick ratio of 1.37.

Visa (NYSE:V - Get Free Report) last released its quarterly earnings data on Tuesday, October 29th. The credit-card processor reported $2.71 earnings per share for the quarter, topping analysts' consensus estimates of $2.58 by $0.13. Visa had a net margin of 54.96% and a return on equity of 53.16%. The company had revenue of $9.62 billion for the quarter, compared to analysts' expectations of $9.49 billion. The firm's revenue for the quarter was up 11.7% on a year-over-year basis. During the same quarter last year, the company earned $2.33 earnings per share. Equities analysts anticipate that Visa Inc. will post 11.18 EPS for the current fiscal year.

Visa Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 2nd. Shareholders of record on Tuesday, November 12th will be paid a $0.59 dividend. This represents a $2.36 annualized dividend and a yield of 0.80%. The ex-dividend date of this dividend is Tuesday, November 12th. This is an increase from Visa's previous quarterly dividend of $0.52. Visa's dividend payout ratio is currently 24.25%.

Analyst Ratings Changes

A number of equities research analysts recently issued reports on V shares. Deutsche Bank Aktiengesellschaft lifted their price target on shares of Visa from $300.00 to $340.00 and gave the company a "buy" rating in a research note on Wednesday, October 30th. Compass Point started coverage on shares of Visa in a research report on Wednesday, September 4th. They issued a "buy" rating and a $319.00 target price on the stock. BNP Paribas upgraded shares of Visa from a "neutral" rating to an "outperform" rating and set a $325.00 price target for the company in a research report on Tuesday, September 3rd. Oppenheimer reiterated an "outperform" rating and issued a $321.00 price objective (up from $318.00) on shares of Visa in a report on Wednesday, October 30th. Finally, Macquarie increased their target price on Visa from $300.00 to $335.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. Four equities research analysts have rated the stock with a hold rating, twenty-four have assigned a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $321.74.

Get Our Latest Stock Analysis on V

Insiders Place Their Bets

In other Visa news, CEO Ryan Mcinerney sold 8,620 shares of Visa stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of $276.37, for a total transaction of $2,382,309.40. Following the transaction, the chief executive officer now owns 538 shares of the company's stock, valued at $148,687.06. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Corporate insiders own 0.19% of the company's stock.

Visa Profile

(

Free Report)

Visa Inc operates as a payment technology company in the United States and internationally. The company operates VisaNet, a transaction processing network that enables authorization, clearing, and settlement of payment transactions. It also offers credit, debit, and prepaid card products; tap to pay, tokenization, and click to pay services; Visa Direct, a solution that facilitates the delivery of funds to eligible cards, deposit accounts, and digital wallets; Visa B2B Connect, a multilateral business-to-business cross-border payments network; Visa Cross-Border Solution, a cross-border consumer payments solution; and Visa DPS that provides a range of value-added services, including fraud mitigation, dispute management, data analytics, campaign management, a suite of digital solutions, and contact center services.

See Also

Before you consider Visa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Visa wasn't on the list.

While Visa currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report