Valaris (NYSE:VAL - Get Free Report) had its price objective cut by equities researchers at Barclays from $61.00 to $59.00 in a report issued on Tuesday, Benzinga reports. The firm currently has an "overweight" rating on the stock. Barclays's target price suggests a potential upside of 19.70% from the stock's current price.

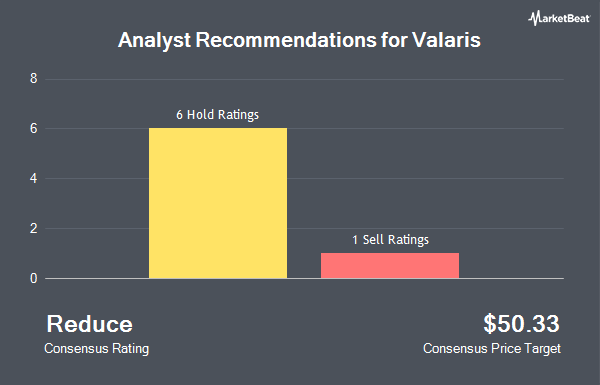

VAL has been the topic of a number of other research reports. Benchmark lowered Valaris from a "buy" rating to a "hold" rating in a research note on Tuesday, October 15th. Susquehanna reduced their target price on Valaris from $61.00 to $55.00 and set a "neutral" rating on the stock in a report on Friday. Citigroup reduced their target price on Valaris from $95.00 to $71.00 and set a "buy" rating on the stock in a report on Thursday, September 12th. Finally, Pickering Energy Partners lowered shares of Valaris from an "outperform" rating to a "neutral" rating in a research note on Tuesday, July 16th. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and four have assigned a buy rating to the company. According to MarketBeat, Valaris currently has a consensus rating of "Hold" and a consensus price target of $80.00.

View Our Latest Stock Analysis on Valaris

Valaris Price Performance

Valaris stock traded down $0.42 during trading hours on Tuesday, hitting $49.29. 1,025,348 shares of the stock were exchanged, compared to its average volume of 1,050,592. The stock has a market capitalization of $3.51 billion, a P/E ratio of 3.39 and a beta of 1.17. The company has a debt-to-equity ratio of 0.51, a quick ratio of 1.61 and a current ratio of 1.61. Valaris has a 12 month low of $48.04 and a 12 month high of $84.20. The business's 50-day moving average is $54.26 and its two-hundred day moving average is $65.66.

Insiders Place Their Bets

In other news, COO Gilles Luca sold 30,000 shares of the firm's stock in a transaction that occurred on Monday, September 9th. The stock was sold at an average price of $56.86, for a total value of $1,705,800.00. Following the completion of the sale, the chief operating officer now directly owns 108,342 shares of the company's stock, valued at $6,160,326.12. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. In other news, SVP Matthew Lyne sold 26,000 shares of the stock in a transaction that occurred on Monday, September 30th. The stock was sold at an average price of $55.77, for a total transaction of $1,450,020.00. Following the transaction, the senior vice president now owns 24,388 shares in the company, valued at approximately $1,360,118.76. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, COO Gilles Luca sold 30,000 shares of Valaris stock in a transaction that occurred on Monday, September 9th. The stock was sold at an average price of $56.86, for a total value of $1,705,800.00. Following the sale, the chief operating officer now directly owns 108,342 shares of the company's stock, valued at approximately $6,160,326.12. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 71,403 shares of company stock valued at $4,028,246 over the last 90 days. 0.12% of the stock is currently owned by insiders.

Institutional Investors Weigh In On Valaris

Institutional investors have recently modified their holdings of the business. Lingotto Investment Management LLP lifted its holdings in shares of Valaris by 1.2% in the second quarter. Lingotto Investment Management LLP now owns 3,040,610 shares of the company's stock worth $226,525,000 after acquiring an additional 36,870 shares during the last quarter. Marshall Wace LLP lifted its position in shares of Valaris by 5.9% during the 2nd quarter. Marshall Wace LLP now owns 1,882,846 shares of the company's stock valued at $140,272,000 after acquiring an additional 105,330 shares during the period. Condire Management LP lifted its position in shares of Valaris by 14.7% during the 1st quarter. Condire Management LP now owns 1,452,097 shares of the company's stock valued at $109,285,000 after acquiring an additional 186,076 shares during the period. Dimensional Fund Advisors LP increased its stake in Valaris by 23.4% during the 2nd quarter. Dimensional Fund Advisors LP now owns 1,188,973 shares of the company's stock valued at $88,573,000 after purchasing an additional 225,283 shares in the last quarter. Finally, Waverton Investment Management Ltd increased its stake in Valaris by 20.4% during the 3rd quarter. Waverton Investment Management Ltd now owns 670,885 shares of the company's stock valued at $37,412,000 after purchasing an additional 113,509 shares in the last quarter. Institutional investors own 96.74% of the company's stock.

About Valaris

(

Get Free Report)

Valaris Limited, together with its subsidiaries, provides offshore contract drilling services Gulf of Mexico, South America, North Sea, the Middle East, Africa, and the Asia Pacific. The company operates through four segments: Floaters, Jackups, ARO, and Other. It owns an offshore drilling rig fleet, which include drillships, dynamically positioned semisubmersible rigs, moored semisubmersible rig, and jackup rigs.

Featured Articles

Before you consider Valaris, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Valaris wasn't on the list.

While Valaris currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.