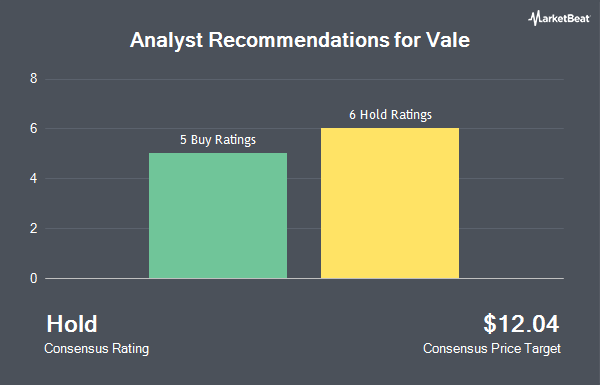

Vale S.A. (NYSE:VALE - Get Free Report) has received a consensus recommendation of "Moderate Buy" from the eleven research firms that are presently covering the stock, Marketbeat Ratings reports. One analyst has rated the stock with a sell recommendation, three have given a hold recommendation and seven have given a buy recommendation to the company. The average 12-month price objective among brokers that have issued a report on the stock in the last year is $16.17.

Several analysts recently weighed in on the stock. JPMorgan Chase & Co. reduced their target price on shares of Vale from $16.50 to $15.00 and set an "overweight" rating on the stock in a report on Monday, September 23rd. UBS Group cut their price objective on shares of Vale from $15.00 to $14.50 and set a "buy" rating on the stock in a report on Friday, July 5th. BNP Paribas raised shares of Vale from an "underperform" rating to a "neutral" rating in a report on Friday, June 21st. Wolfe Research cut shares of Vale from a "peer perform" rating to an "underperform" rating in a report on Wednesday. Finally, Morgan Stanley cut their price objective on shares of Vale from $16.00 to $15.50 and set an "overweight" rating on the stock in a report on Thursday, September 19th.

Check Out Our Latest Stock Analysis on VALE

Hedge Funds Weigh In On Vale

A number of hedge funds have recently modified their holdings of VALE. Versant Capital Management Inc purchased a new position in Vale in the 1st quarter valued at $26,000. Pacifica Partners Inc. purchased a new position in Vale in the 2nd quarter valued at $27,000. Richardson Financial Services Inc. purchased a new position in Vale in the 4th quarter valued at $31,000. Lowe Wealth Advisors LLC purchased a new position in Vale in the 2nd quarter valued at $45,000. Finally, Founders Capital Management grew its position in Vale by 111.1% in the 1st quarter. Founders Capital Management now owns 3,800 shares of the basic materials company's stock valued at $46,000 after buying an additional 2,000 shares during the last quarter. 21.85% of the stock is currently owned by hedge funds and other institutional investors.

Vale Stock Up 0.8 %

NYSE:VALE traded up $0.09 during mid-day trading on Friday, hitting $11.08. The stock had a trading volume of 22,288,403 shares, compared to its average volume of 27,204,660. The stock has a 50-day simple moving average of $10.65 and a two-hundred day simple moving average of $11.39. The company has a market capitalization of $49.67 billion, a PE ratio of 6.12, a PEG ratio of 0.30 and a beta of 0.93. Vale has a twelve month low of $9.66 and a twelve month high of $16.08. The company has a current ratio of 1.08, a quick ratio of 0.73 and a debt-to-equity ratio of 0.43.

Vale (NYSE:VALE - Get Free Report) last issued its earnings results on Thursday, July 25th. The basic materials company reported $0.43 earnings per share for the quarter, beating the consensus estimate of $0.38 by $0.05. The firm had revenue of $9.92 billion for the quarter, compared to analysts' expectations of $9.97 billion. Vale had a net margin of 23.07% and a return on equity of 22.23%. On average, equities research analysts anticipate that Vale will post 2.06 EPS for the current year.

Vale Increases Dividend

The firm also recently announced a semi-annual dividend, which was paid on Wednesday, September 11th. Stockholders of record on Monday, August 5th were given a dividend of $0.3698 per share. The ex-dividend date was Monday, August 5th. This is a positive change from Vale's previous semi-annual dividend of $0.32. This represents a dividend yield of 12.1%. Vale's dividend payout ratio (DPR) is 64.09%.

Vale Company Profile

(

Get Free ReportVale SA, together with its subsidiaries, produces and sells iron ore and iron ore pellets for use as raw materials in steelmaking in Brazil and internationally. The company operates through Iron Solutions and Energy Transition Materials segments. The Iron Solutions segment produces and extracts iron ore and pellets, manganese, and other ferrous products; and provides related logistic services.

See Also

Before you consider Vale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vale wasn't on the list.

While Vale currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.