Allspring Global Investments Holdings LLC lifted its position in shares of Vale S.A. (NYSE:VALE - Free Report) by 49.2% during the third quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 3,642,469 shares of the basic materials company's stock after purchasing an additional 1,200,786 shares during the period. Allspring Global Investments Holdings LLC owned about 0.08% of Vale worth $42,544,000 at the end of the most recent reporting period.

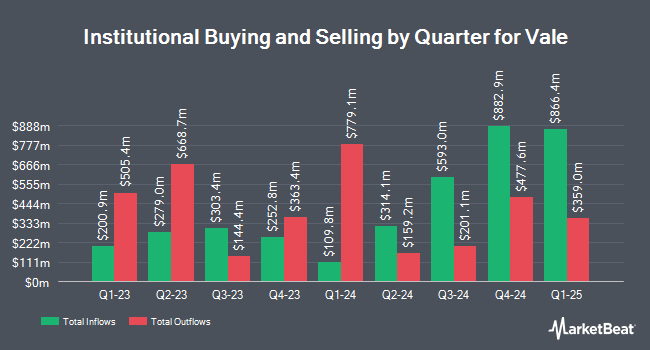

Other institutional investors also recently added to or reduced their stakes in the company. B. Riley Wealth Advisors Inc. acquired a new position in Vale in the 4th quarter valued at $174,000. Park Avenue Securities LLC boosted its holdings in Vale by 6.8% in the 1st quarter. Park Avenue Securities LLC now owns 59,302 shares of the basic materials company's stock valued at $723,000 after purchasing an additional 3,783 shares in the last quarter. Ballentine Partners LLC increased its position in Vale by 44.3% during the 1st quarter. Ballentine Partners LLC now owns 22,954 shares of the basic materials company's stock worth $280,000 after purchasing an additional 7,052 shares during the period. Global Assets Advisory LLC purchased a new position in shares of Vale during the 1st quarter worth approximately $373,000. Finally, Sound Income Strategies LLC lifted its holdings in shares of Vale by 133.7% in the 1st quarter. Sound Income Strategies LLC now owns 6,629 shares of the basic materials company's stock valued at $81,000 after buying an additional 3,792 shares during the period. Institutional investors and hedge funds own 21.85% of the company's stock.

Vale Trading Down 2.0 %

Shares of VALE stock traded down $0.21 on Wednesday, reaching $10.41. 20,589,402 shares of the stock were exchanged, compared to its average volume of 27,179,242. The company has a quick ratio of 0.73, a current ratio of 1.08 and a debt-to-equity ratio of 0.43. The stock has a market cap of $46.67 billion, a P/E ratio of 5.87, a price-to-earnings-growth ratio of 0.30 and a beta of 0.93. The firm has a 50 day moving average of $10.73 and a two-hundred day moving average of $11.32. Vale S.A. has a 1-year low of $9.66 and a 1-year high of $16.08.

Vale (NYSE:VALE - Get Free Report) last announced its quarterly earnings results on Thursday, July 25th. The basic materials company reported $0.43 EPS for the quarter, topping the consensus estimate of $0.38 by $0.05. Vale had a return on equity of 22.23% and a net margin of 23.07%. The company had revenue of $9.92 billion during the quarter, compared to analyst estimates of $9.97 billion. On average, research analysts anticipate that Vale S.A. will post 2.06 EPS for the current year.

Vale Increases Dividend

The firm also recently disclosed a semi-annual dividend, which was paid on Wednesday, September 11th. Shareholders of record on Monday, August 5th were paid a dividend of $0.3698 per share. This is an increase from Vale's previous semi-annual dividend of $0.32. This represents a yield of 12.1%. The ex-dividend date of this dividend was Monday, August 5th. Vale's payout ratio is currently 64.09%.

Analyst Upgrades and Downgrades

Several research firms have issued reports on VALE. UBS Group cut their price objective on Vale from $15.00 to $14.50 and set a "buy" rating for the company in a research report on Friday, July 5th. StockNews.com started coverage on shares of Vale in a research note on Friday, October 18th. They issued a "buy" rating for the company. Scotiabank lowered their target price on shares of Vale from $17.00 to $16.00 and set a "sector perform" rating on the stock in a research report on Tuesday, October 15th. Wolfe Research lowered Vale from a "peer perform" rating to an "underperform" rating in a research note on Wednesday, October 9th. Finally, JPMorgan Chase & Co. reduced their price objective on Vale from $16.50 to $15.00 and set an "overweight" rating for the company in a report on Monday, September 23rd. One research analyst has rated the stock with a sell rating, four have issued a hold rating and eight have issued a buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $16.15.

Read Our Latest Report on VALE

Vale Profile

(

Free Report)

Vale SA, together with its subsidiaries, produces and sells iron ore and iron ore pellets for use as raw materials in steelmaking in Brazil and internationally. The company operates through Iron Solutions and Energy Transition Materials segments. The Iron Solutions segment produces and extracts iron ore and pellets, manganese, and other ferrous products; and provides related logistic services.

Featured Articles

Before you consider Vale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vale wasn't on the list.

While Vale currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.