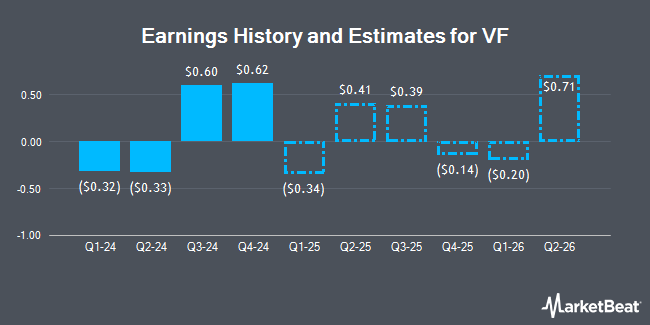

VF Corporation (NYSE:VFC - Free Report) - Seaport Res Ptn dropped their FY2025 earnings estimates for VF in a report released on Monday, October 28th. Seaport Res Ptn analyst M. Kummetz now expects that the textile maker will earn $0.52 per share for the year, down from their previous estimate of $0.58. The consensus estimate for VF's current full-year earnings is $0.60 per share. Seaport Res Ptn also issued estimates for VF's FY2026 earnings at $0.73 EPS and FY2027 earnings at $0.94 EPS.

A number of other research firms also recently issued reports on VFC. TD Cowen increased their price objective on VF from $16.00 to $19.00 and gave the stock a "hold" rating in a report on Tuesday. Robert W. Baird upped their price objective on shares of VF from $17.00 to $20.00 and gave the stock a "neutral" rating in a report on Tuesday. Evercore ISI lifted their target price on shares of VF from $14.00 to $16.00 and gave the company an "in-line" rating in a report on Wednesday, August 7th. Barclays raised their price objective on VF from $22.00 to $25.00 and gave the company an "overweight" rating in a research report on Tuesday. Finally, Wells Fargo & Company downgraded VF from an "equal weight" rating to an "underweight" rating and dropped their target price for the stock from $16.00 to $15.00 in a report on Monday, October 14th. Three analysts have rated the stock with a sell rating, fourteen have assigned a hold rating and three have assigned a buy rating to the company. According to MarketBeat, VF currently has an average rating of "Hold" and a consensus price target of $18.18.

View Our Latest Analysis on VF

VF Stock Up 2.9 %

Shares of NYSE:VFC traded up $0.62 during trading on Wednesday, hitting $22.25. The stock had a trading volume of 20,947,906 shares, compared to its average volume of 8,363,075. The company has a market capitalization of $8.66 billion, a PE ratio of -7.62, a PEG ratio of 3.27 and a beta of 1.53. The company has a quick ratio of 0.51, a current ratio of 0.99 and a debt-to-equity ratio of 2.84. The firm's fifty day moving average is $18.62 and its 200 day moving average is $15.64. VF has a 12 month low of $11.00 and a 12 month high of $23.09.

VF (NYSE:VFC - Get Free Report) last announced its quarterly earnings results on Monday, October 28th. The textile maker reported $0.60 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.41 by $0.19. VF had a negative net margin of 11.39% and a positive return on equity of 11.75%. The company had revenue of $2.76 billion for the quarter, compared to analysts' expectations of $2.72 billion. During the same quarter in the previous year, the company earned $0.63 earnings per share. VF's quarterly revenue was down 5.6% on a year-over-year basis.

VF Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Tuesday, December 10th will be issued a dividend of $0.09 per share. The ex-dividend date of this dividend is Tuesday, December 10th. This represents a $0.36 annualized dividend and a dividend yield of 1.62%. VF's payout ratio is -11.92%.

Insider Transactions at VF

In other news, Director Richard Carucci purchased 15,000 shares of the business's stock in a transaction on Thursday, August 22nd. The stock was acquired at an average cost of $16.70 per share, for a total transaction of $250,500.00. Following the purchase, the director now directly owns 230,178 shares in the company, valued at $3,843,972.60. This trade represents a 0.00 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 0.70% of the company's stock.

Institutional Trading of VF

Hedge funds and other institutional investors have recently modified their holdings of the company. M&G Plc raised its position in shares of VF by 10.0% during the second quarter. M&G Plc now owns 14,729,396 shares of the textile maker's stock valued at $206,212,000 after buying an additional 1,344,849 shares during the last quarter. Pacer Advisors Inc. boosted its holdings in shares of VF by 28.0% during the 2nd quarter. Pacer Advisors Inc. now owns 11,822,885 shares of the textile maker's stock valued at $159,609,000 after purchasing an additional 2,589,852 shares during the last quarter. Dimensional Fund Advisors LP grew its position in shares of VF by 2.8% during the second quarter. Dimensional Fund Advisors LP now owns 4,125,417 shares of the textile maker's stock valued at $55,694,000 after purchasing an additional 113,128 shares in the last quarter. Deprince Race & Zollo Inc. increased its holdings in shares of VF by 28.3% in the second quarter. Deprince Race & Zollo Inc. now owns 3,057,884 shares of the textile maker's stock worth $41,281,000 after purchasing an additional 673,979 shares during the last quarter. Finally, Bank of New York Mellon Corp boosted its stake in VF by 23.6% during the second quarter. Bank of New York Mellon Corp now owns 2,481,600 shares of the textile maker's stock valued at $33,502,000 after buying an additional 473,373 shares during the last quarter. 86.84% of the stock is owned by hedge funds and other institutional investors.

About VF

(

Get Free Report)

V.F. Corporation, together with its subsidiaries, engages in the design, procurement, marketing, and distribution of branded lifestyle apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific. It operates through three segments: Outdoor, Active, and Work.

See Also

Before you consider VF, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VF wasn't on the list.

While VF currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.