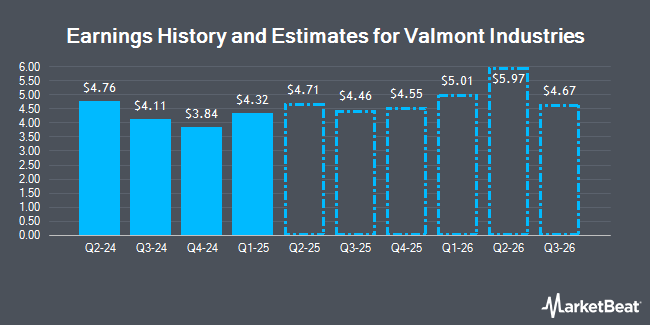

Valmont Industries, Inc. (NYSE:VMI - Free Report) - Equities researchers at DA Davidson reduced their Q4 2024 earnings per share estimates for shares of Valmont Industries in a note issued to investors on Thursday, October 24th. DA Davidson analyst B. Thielman now expects that the industrial products company will post earnings of $3.59 per share for the quarter, down from their previous forecast of $3.65. DA Davidson has a "Buy" rating and a $380.00 price target on the stock. The consensus estimate for Valmont Industries' current full-year earnings is $16.78 per share. DA Davidson also issued estimates for Valmont Industries' FY2025 earnings at $18.69 EPS.

Valmont Industries (NYSE:VMI - Get Free Report) last announced its quarterly earnings data on Tuesday, October 22nd. The industrial products company reported $4.11 earnings per share for the quarter, beating analysts' consensus estimates of $4.00 by $0.11. The business had revenue of $1.02 billion for the quarter, compared to analyst estimates of $1.02 billion. Valmont Industries had a return on equity of 23.63% and a net margin of 7.38%. The company's revenue was down 2.9% on a year-over-year basis. During the same period in the prior year, the company earned $4.12 earnings per share.

Several other research analysts also recently weighed in on the company. Stifel Nicolaus upped their target price on Valmont Industries from $350.00 to $360.00 and gave the stock a "buy" rating in a research note on Thursday. StockNews.com upgraded shares of Valmont Industries from a "buy" rating to a "strong-buy" rating in a research report on Monday, August 12th. One equities research analyst has rated the stock with a hold rating, two have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the stock has a consensus rating of "Buy" and an average price target of $370.00.

View Our Latest Analysis on VMI

Valmont Industries Stock Performance

Shares of VMI traded down $3.48 during mid-day trading on Friday, reaching $317.15. The company had a trading volume of 194,048 shares, compared to its average volume of 157,436. The company has a quick ratio of 1.63, a current ratio of 2.53 and a debt-to-equity ratio of 0.69. The stock has a 50 day moving average of $287.45 and a two-hundred day moving average of $268.48. Valmont Industries has a 52-week low of $188.63 and a 52-week high of $330.97. The stock has a market capitalization of $6.40 billion, a P/E ratio of 41.29 and a beta of 1.02.

Valmont Industries Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Friday, September 27th were given a dividend of $0.60 per share. The ex-dividend date of this dividend was Friday, September 27th. This represents a $2.40 dividend on an annualized basis and a yield of 0.76%. Valmont Industries's payout ratio is presently 31.62%.

Insider Buying and Selling at Valmont Industries

In other Valmont Industries news, CFO Timothy P. Francis sold 2,300 shares of the company's stock in a transaction on Tuesday, July 30th. The stock was sold at an average price of $298.49, for a total value of $686,527.00. Following the completion of the sale, the chief financial officer now directly owns 9,471 shares in the company, valued at $2,826,998.79. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. In other Valmont Industries news, CFO Timothy P. Francis sold 2,300 shares of Valmont Industries stock in a transaction on Tuesday, July 30th. The stock was sold at an average price of $298.49, for a total value of $686,527.00. Following the sale, the chief financial officer now owns 9,471 shares in the company, valued at $2,826,998.79. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Theodor Werner Freye sold 1,600 shares of the stock in a transaction dated Wednesday, July 31st. The stock was sold at an average price of $300.12, for a total transaction of $480,192.00. Following the transaction, the director now directly owns 3,685 shares of the company's stock, valued at approximately $1,105,942.20. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 2.00% of the stock is owned by insiders.

Institutional Investors Weigh In On Valmont Industries

Several institutional investors and hedge funds have recently modified their holdings of the company. Congress Wealth Management LLC DE lifted its holdings in Valmont Industries by 11.7% during the 1st quarter. Congress Wealth Management LLC DE now owns 27,673 shares of the industrial products company's stock worth $6,317,000 after buying an additional 2,909 shares in the last quarter. Vaughan Nelson Investment Management L.P. boosted its holdings in Valmont Industries by 69.0% in the first quarter. Vaughan Nelson Investment Management L.P. now owns 161,605 shares of the industrial products company's stock valued at $36,891,000 after purchasing an additional 65,970 shares during the period. State of Michigan Retirement System grew its stake in Valmont Industries by 2.0% during the 1st quarter. State of Michigan Retirement System now owns 5,088 shares of the industrial products company's stock worth $1,161,000 after purchasing an additional 100 shares in the last quarter. Norden Group LLC increased its holdings in Valmont Industries by 1,353.5% during the 1st quarter. Norden Group LLC now owns 23,620 shares of the industrial products company's stock worth $5,394,000 after purchasing an additional 21,995 shares during the period. Finally, Principal Financial Group Inc. raised its position in Valmont Industries by 2.5% in the 1st quarter. Principal Financial Group Inc. now owns 79,208 shares of the industrial products company's stock valued at $18,082,000 after purchasing an additional 1,933 shares in the last quarter. Hedge funds and other institutional investors own 87.84% of the company's stock.

Valmont Industries Company Profile

(

Get Free Report)

Valmont Industries, Inc operates as manufacturer of products and services for infrastructure and agriculture markets in the United States, Australia, Brazil, and internationally. It operates through two segments, Infrastructure and Agriculture. The company manufactures and distributes steel, pre-stressed concrete, composite structures for electrical transmission, substation, and distribution applications; and designs, engineers, and manufactures metal, steel, wood, aluminum, and composite poles and structures for lighting and transportation applications.

Recommended Stories

Before you consider Valmont Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Valmont Industries wasn't on the list.

While Valmont Industries currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report